Zee Business Stock, Trading Guide: 10 things to know before market opens on 28 December 2022

Most sectors participated in the move wherein metal outshined the others as it gained over 4 per cent. Besides, further recovery in the broader indices eased the pressure.

Zee Business Stock, Trading Guide: The Indian markets gained over half a percent in a range bound session, tracking firm global cues. The benchmarks surrendered all the gains in no time however buying in select index majors pushed the index to the day’s high again as the day progressed.

Consequently, the NSE Nifty and BSE Sensex settled at 18,123 and 60,927.43 levels, respectively, each up by 0.6 per cent. Most sectors participated in the move wherein metal outshined the others as it gained over 4 per cent. Besides, further recovery in the broader indices eased the pressure.

Here is a list of things to watch out for on 28 December 2022

What should investors do?

The recovery in the global indices, especially in the US, is offering the respite in absence of any major domestic trigger.

The recent buoyancy in the banking pack combined with a recovery in the select index majors is encouraging however Nifty has multiple hurdles to cross before resuming the uptrend. We thus reiterate our view to focus on stock-specific opportunities and maintaining positions on both sides.

- By Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.65 per cent higher at 18,132.30. Key Pivot points (Fibonacci) support for the index is placed at 18013.52, 17970.62, and 17901.17, while resistance is placed at 18152.41, 18195.32, and 18264.77.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.54 per cent higher at 42,859.50. Key Pivot points (Fibonacci) support for the index is placed at 42523.29, 42397.48, and 42193.84, while resistance is placed at 42930.58, 43056.39, and 43260.03.

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source - Stockedge

Stocks in News

RBI approves re-appointment of Baskar Babu Ramachandran as MD & CEO of Suryoday SFB for 3 years effective January 23, 2023

Government appoints Ajit Kumar Saxena as Chairman-cum-Managing Director on the board of MOIL

Indowind Energy to allot 3.58 cr shares worth Rs 43 cr under rights issue

IEX forms subsidiary to explore business opportunities in carbon market

RVNL receives LoA worth Rs 1,544.60 crore for implementation of UTF Harbor Project in Maldives

Business News

SEBI grants final approval for introducing Social Stock Exchange (SSE) as a separate segment on BSE

Schedule commercial banks recover Rs 47,421 crore via IBC route in 2021-22: RBI

IT ministry appointed as nodal ministry for online gaming in India

Consider discount on policy renewal for those with 3 doses of COVID-19 vaccine: Irdai to insurers

Quality of domestic coal increased considerably: Government

India plans $2 billion incentive for green hydrogen industry

38% of delayed real estate projects in Maharashtra launched after MahaRERA’s creation

Ola, Uber & 3 other digital platforms score nil in rating of fair work conditions for gig workers: Fairwork India & Oxford University.

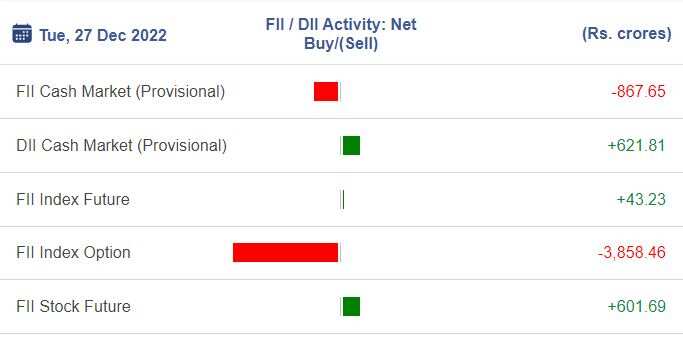

FII Activity on Tuesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 867.65 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 621.81 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source – Stockedge

Bulk Deals:

Atal Realtech Limited: Bhavesh Kirti Mathuria bought 1,00,800 equity shares in the company at the weighted average price Rs 77.86 per share on the NSE, the bulk deals data showed.

SP Refractories Limited: Aryaman Capital Markets Limited sold 48,000 equity shares in the company at the weighted average price Rs 85 per share on the NSE, the bulk deals data showed.

S. P. Apparels Limited: Ashish Ramesh Kacholia sold 1,64,427 equity shares in the company at the weighted average price Rs 307.1 per share on the NSE, the bulk deals data showed.

Network People Srv Tech: Rajeev Trading & Holdings Private Limited bought 40,000 equity shares in the company at the weighted average price Rs 125.88 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Balrampur Chini, Indiabulls Housing Finance and PNB are placed under the F&O ban for Wednesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

10:21 PM IST