Zee Business Stock, Trading Guide: 10 things to know before market opens on 16 November 2022

Indian indices traded lackluster for most of the session however a sharp surge in the last half an hour pushed the index to the day’s high.

Zee Business Stock and Trading Guide: The Indian markets gained nearly half a percent in a volatile trading session, in continuation of the prevailing trend. Indian indices traded lackluster for most of the session however a sharp surge in the last half an hour pushed the index to the day’s high.

Nifty finally settled at 18,403.40; up by 0.4 per cent and Sensex closed at 61,873, up by 0.4 per cent. Most of the sectoral indices traded in tandem with the benchmark and ended with modest gains however the underperformance continued the broader front.

Here is a list of things to watch out for on 16 November 2022

What should investors do?

Participants are maintaining a cautious stance around the record high which is reflecting in the market move. However, selective buying in the index majors on a rotational basis is helping the index to hold gains and gradually inch higher as well.

We thus maintain our view to continue to follow the up trend until Nifty holds 17,800 and look for buying opportunities on dips.

- Ajit Mishra, VP - Research, Religare Broking Ltd

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.4 per cent higher at 18,403.4. Key Pivot points (Fibonacci) support for the index is placed at 18225.2, 18280.93 and 18315.37, while resistance is placed at 18426.83, 18461.27, and 18517.0.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.7 per cent higher at 42,372. Key Pivot points (Fibonacci) support for the index is placed at 42159.27, 42071.83, and 41930.3, while resistance is placed 42442.33, 42529.77, and 42671.3.

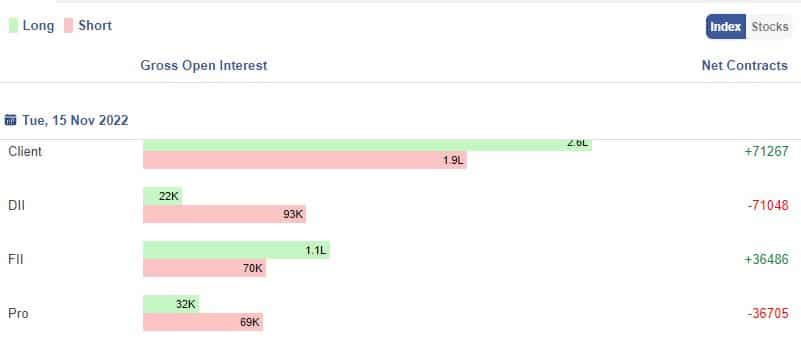

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

IndiGo commences operations of the first cargo flight between Delhi & Mumbai

Piramal Capital and Housing Finance withdraw the application made against Reliance Power under Section 7 of the Insolvency and Bankruptcy Code, 2016.

ReNew Power signs a framework agreement with the Egyptian Government to establish a Green Hydrogen plant in the Suez Canal Economic Zone.

BEL signs an MoU with Defence PSU Hindustan Shipyard Limited (HSL); companies to jointly develop, and upgrade products/systems for domestic & Export markets.

SBI said the government has nominated Vivek Joshi to its board following the cessation of the previous director.

Airtel starts offering 5G services in Gurugram.

Indosolar Ltd board has approved the setting up of one-gigawatt solar manufacturing facility.

Hero Electric enters into a 'preferred partner relationship' with NIDEC Japan.

Corporate Action

Bhagiradha Chemicals & Industries – Ex-date of Interim Dividend 10% at Rs 1 per share

Computer Age Management Services – Ex-date of Interim Dividend 85% at Rs 8.5 per share

Motherson Sumi Wiring – Ex-date of Bonus Issue 2:5

Pressure Sensitive Systems – Ex-date of stock split from Rs 10 to Rs 1

Qgo Finance – Ex-date of Interim Dividend 1% at Rs 0.1 per share

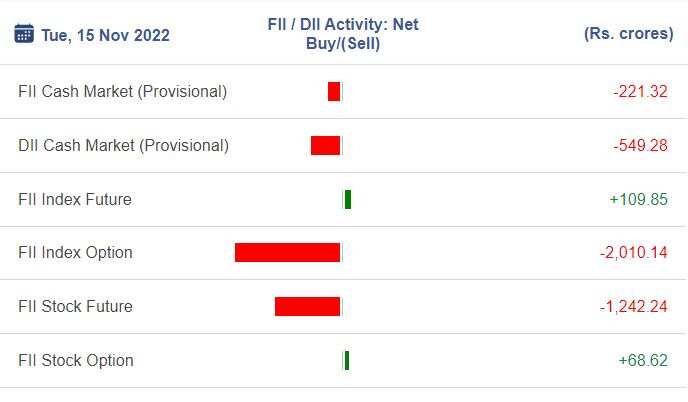

FII Activity on Tuesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 221.32 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 549.28 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Fusion Micro Finance: Massachusetts Institute Of Technology bought 5,52,281 equity shares in the company at the weighted average price Rs 339.28 per share on the NSE, the bulk deals data showed.

FSN E Commerce Ventures: Segantii India Mauritius sold 33,73,243 equity shares in the company at the weighted average price Rs 199.24 per share on the NSE, the bulk deals data showed.

Hi-Tech Pipes Limited: Mahesh Dinkar Vaze sold 89,000 equity shares in the company at the weighted average price Rs 630.48 per share on the NSE, the bulk deals data showed.

Best Agrolife Limited: Vimal Kumar bought 1,47,481 equity shares in the company at the weighted average price Rs 1609.25 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

BHEL, Delta Corp, GNFC, PNB and Sun TV are placed under the F&O ban for Wednesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

11:44 PM IST

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday

Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today