What led to correction in Indian IT stocks in 2022?

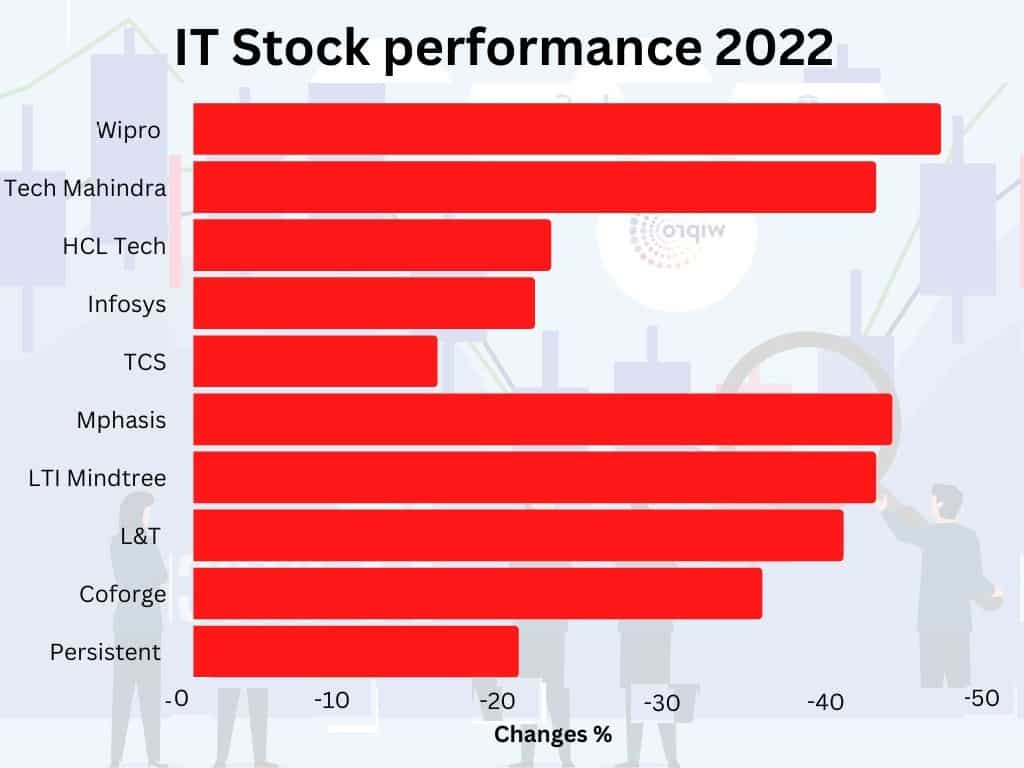

Among the heavyweights, Wipro posted the weakest performance as it tumbled around 46 per cent, followed by Tech Mahindra down 42 per cent on the NSE. Likewise, Infosys cracked around 21 per cent, HCL Tech declined over 22 per cent, and TCS tumbled over 15 per cent.

Indian IT Stocks To Buy Multiple global headwinds dragged the Information Technology (IT) stocks to register one of the weak performances this year. After hitting a life high in December 2021, the Nifty IT Index slumped nearly 27 per cent year to date as of December 20, 2022.

Similarly, S&P BSE Information and Technology witnessed a crack of 24.95 per cent Year To Date (YTD). Among the heavyweights, Wipro posted the weakest performance as it tumbled around 46 per cent, followed by Tech Mahindra down 42 per cent on the NSE. Likewise, Infosys cracked around 21 per cent, HCL Tech declined over 22 per cent, and TCS tumbled over 15 per cent.

Amongst Tier II IT stocks, Mphasis declined over 43 per cent, followed by LTI Mindtree dropped over 42 per cent, while L&T Technology Services around 40 per cent, Coforge cracked around 35 per cent, and Persistent system declined over 20 per cent

Click here to get more updates on Stock Market I Zee Business Live

Multiple factors dragged the IT index:

1. Downtrend of US and European markets, rising interest rates and recession.

Nirvi Ashar, Research Analyst, Religare Broking Limited, said that economic factors such as rising inflation slowdown, increasing interest rate and fears of slowdown in the US and Europe added to the worries and led to decline in the overall IT sector.

Apurva Sheth, Head of Market Perspectives, Samco Securities, said that IT companies get a significant share of their revenues from the US and Europe and these markets have been facing a downward trend and are on the verge of recession which is dampening the demand.

According to Pritam Deuskar, founder, Wealthyvia.com, said that the US and European markets contribute 86 per cent of the Indian IT revenue and are sensitive towards these markets.

2. High Attrition Rate, increase in employee cost, and higher wages

According to Pritam Deuskar attrition rates, which is the percentage of employees leaving a company in a specific period, are still very high and may peak next quarter. Increased employee costs will also create some pressure.

He added that global inflation, central bank policies and higher wages are affecting new deals' addition rates.

Nirvi Ashar said that attrition and employee costs increased which impacted the IT companies’ margins.

3. Acquisition and settlement

Pritam Deuskar said that there were 300 acquisitions in IT in 2021, usually, it is a settling period post-acquisition and costs to incur.

Click here to get more updates on Stock Market I Zee Business Live

Which stocks dragged the index the most

According to Apurva Sheth, Wipro has seen a severe beating at the D-street. The stock has witnessed this magnitude of de-rating simply because it has failed to live up to expectations. Wipro has failed to impress in its quarterly numbers as well.

According to Nirvi Ashar, most IT stocks– Tech Mahindra, Wipro, Tata Elxsi, Mphasis, and Coforge got a corrected 45-50 percent because of concern with regards to the high cost of employees and high attrition as well as expensive valuation.

Looking at the global picture, Pritam Deuskar said that CNX IT itself has corrected from 39500 to 26000 in 2022. Stocks having European exposure or less migration to digital compared to peers are on higher pressure.

HDFC Securities bullish on THIS PSU stock - Check price target

Outlook

1. Artificial Intelligence (AI), and digital exposure will gain traction

Such phases are temporary from a long-term point of view. If we see closely, cost pressures are high on industries that are a client of IT. Hence automation and digital are still going to be a theme going forward,” said Pritam Deuskar.

2. Next 3-6 months look challenging

According to Nirvi Ashar, the next 3-6 months may be challenging because demand is there but customers and clients are delaying their spending. Also, the attrition level is showing some sign of respite and still may take 1-2 quarters for cooling down.

She added, so, from a long-term perspective, we remain bullish for IT stocks given revival in demand and improvement in deal pipeline and orderbook for cloud and digital and normalising of employee cost and attrition levels.

3. Less European exposed companies to do better

“The deal wins going ahead are likely to witness some slowdown. The USA CPI inflation is still hovering at 7.1 per cent far from its 2 per cent target. This is likely to cause more stress in the western economy. Having said this, the companies with less exposure to Europe and higher exposure to non-discretionary spending are expected to do better going ahead, “ said Apurva Sheth.

4. Accenture Quarterly earnings and its impact on IT services

Global IT firm Accenture (ACN) released its Q1FY23 (Sept-Nov) quarter report on December 19, even though the company recorded strong growth in Q1 it has maintained its FY23 Year on Year (YoY) Constant Currency (CC) revenue guidance.

According to ICICI Securities, Accenture’s managed services revenue growth has correlation with Indian IT revenue growth and it will affect Indian IT stocks.

“We expect Indian IT services growth also to moderate due to macro demand headwinds,” said Aditi Patil, Senior Equity Research Associate, ICICI Securities.

ICICI Securities believes from Q3FY23 management commentary of Indian IT services will start to weaken and impact on revenue growth will be visible in Q1 and Q2 of FY24.

Experts bullish on IT stocks

Samco Securities recommends to buy IT stocks for the medium to long term as these have undergone a significant correction from their tops and are currently providing excellent buying opportunity from medium to long term perspective.

Religare Broking Ltd is bullish on large-cap IT companies such as Infosys, HCL Tech and TCS which are available at reasonable valuation and are showing stability.

Kotak Securities expects growth rates of 5-8 per cent in FY2024E, down from 11-16 per cent in FY2023E for Tier 1 IT stocks. A deeper recession has implications on multiples and is not fully priced in.

Click here to get more updates on Stock Market I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

07:15 AM IST

Citi cuts TCS target price by Rs 75, maintains 'sell'; Tata group IT stock declines

Citi cuts TCS target price by Rs 75, maintains 'sell'; Tata group IT stock declines NIfty IT index zooms to all-time high; Persistent Systems, Coforge and Tech Mahindra hit new 52-week high

NIfty IT index zooms to all-time high; Persistent Systems, Coforge and Tech Mahindra hit new 52-week high Wipro shares trade ex-bonus; here is what it means for investors

Wipro shares trade ex-bonus; here is what it means for investors Indian IT stocks outperform amid dollar strength and Trump’s policies

Indian IT stocks outperform amid dollar strength and Trump’s policies Wipro wins 4-year partnership extension with Italy's Marelli

Wipro wins 4-year partnership extension with Italy's Marelli