Week ahead: Top 10 factors that are likely to dictate market trends in coming week

The Indian markets closed the holiday-shortened week on a positive note. The Nifty50, and the S&P BSE Sensex closed with gains of over 1 per cent each in the Diwali week.

The Indian markets closed the holiday-shortened week on a positive note. The Nifty50, and the S&P BSE Sensex closed with gains of over 1 per cent each in the Diwali week.

The Bulls took control of the D-Street on the Muhurat Trading session pushing the S&P BSE Sensex above 60,000, while the Nifty50 also closed above 17900 levels.

Experts advise investors to remain cautious in the coming week as 18000-18200 levels are likely to act as stiff resistance, while 17450-17550 are likely to act as crucial support for the markets.

The index formed an ‘Inside Bar’ formation on its weekly close post the breakdown below its 5 WEMA after 13 weeks of trending above the same is a sign of consolidation to weakness.

See Zee Business Live TV Streaming Below:

“Weekly trend strength indicators RSI & ADX are showing signs of exhaustion; RSI divergence exhibits up move if any to be fragile with resistance firm at 18030, followed by 18500,” Sacchitanand Uttekar, DVP–Technical (Equity), Tradebulls Securities, said.

Uttekar recommends short-term traders adhere to long-short opportunities until clear bullish reversal pattern signs occur. A breach below 17810 would result in a sharp decline towards 17660-17600 zone and hence its ideal to remain cautious throughout the week.

We have collated a list of trends that will dictate the markets action in the coming week:

US Fed Impact Continues:

The Indian markets reacted opened for an hour on Thursday for the Muhurat Trading to digest the impact of US Fed decision. The positive impact could well continue on Monday as well.

The US central bank announced a reduction of asset purchases, but at the same time, it said that the Fed would be "patient" in deciding when to raise its benchmark overnight interest rate from the near-zero level, said a Reuters report.

The Wall Street's main indexes hit a record high in a broad-based rally on Friday.

Paytm IPO:

Paytm’s IPO, the much-awaited one, is likely to be the biggest in the country's corporate history, breaking Coal India’s fundraising of Rs 15000 cr.

The initial public offer (IPO) subscription, which will open on November 8 and close on November 10, at the price band of Rs 2,080-2,150 a piece, implies that the firm's valuation stands at Rs 1.44 lakh crore-Rs 1.48 lakh crore.

Paytm plans to raise Rs 18,300 crore from the IPO, which comprises Rs 8,300 crore from issuance of fresh equity and Rs 10,000 crore from offer for sale (OFS).

Also Read: Paytm's Rs 18,300-cr IPO: Top 10 things to know from Red Herring Prospectus

https://www.zeebiz.com/market-news/news-paytms-rs-18300-cr-ipo-10-things...

Primary Market:

Apart from Paytm IPO, 2 more IPOs will hit the D-Street – Sapphire Food, and Latent View. Sapphire Foods India, which operates KFC and Pizza Hut outlets; and Latent View Analytics -- are set to launch their initial share-sales to collectively mop up about Rs 21,000 crore.

The three-day IPOs of Paytm, Sapphire Foods India and Latent View Analytics are scheduled to open on November 8, November 9 and November 10, respectively.

So far in 2021, as many as 46 companies have floated their IPOs to raise Rs 80,102 crore and market experts believe that the year should close with the Rs 1-lakh crore primary market fundraising.

Also Read: IPO rush continues; Paytm, Sapphire Foods, & Latent View Analytics public issues to open next week

Micro Data:

The market will also react to Industrial Production data for September on November 12, as well as inflation for the month of October. India's industrial production rose 11.9 per cent in August, according to official data released in October. The manufacturing sector's output surged 9.7 per cent in August 2021.

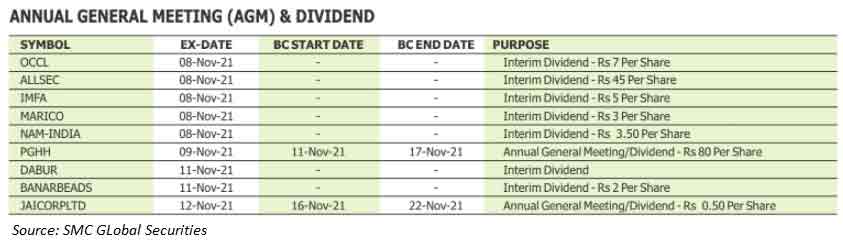

Corporate Action:

September Quarter Results:

More than 1600 companies on the BSE will declare their results for the quarter ended September in the period 8-12 November that include names like Britannia Industries, V-Mart, Aurobindo Pharma, Power Grid, M&M, Pidilite Industries, Zomato, Berger Paints, Tata Steel, Godrej Consumer, ONGC, Hero MotoCorp, Hindalco, and Grasim Industries etc. among others.

Eye on Crude Oil:

Crude prices rose more than 2% on Friday after OPEC+ producers rebuffed a US call to pump more oil, sticking to their plan of hiking output gradually even as demand nears pre-pandemic levels, said a Reuters report.

The Organization of the Petroleum Exporting Countries and allies including Russia, collectively known as OPEC+, agreed on Thursday to stick to their plan to raise oil output by 400,000 barrels per day (bpd) from December, despite calls from US President Joe Biden for extra output to cool rising prices, it said.

Technical Factors:

The Nifty50 closed the Muhurat Trading session on a positive note. The index reclaimed 17900 levels while the S&P BSE Sensex rallied by nearly 300 points to close above 60,000.

The benchmark indices witnessed profit booking in the week gone by amid weak global market cues and stretched valuations. The index has been consistently trading below 20-day SMA and on intraday charts it has also formed a lower top formation near 18000, which is broadly negative for the market.

“As long as it’s trading above 17,750 the uptrend texture is intact. We are of the view that 17750 would act as a key support level for the day traders, and above the same we can expect one more intraday upmove up to 17900-17975 levels,” Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd, said.

“On the flip side, trading below 17750 could possibly trigger one more round of correction wave up to 17700-17660,” he said.

COVID Cases:

COVID cases have begun to rise which might pose a threat to the equity rally. India logged 12,729 new coronavirus infections taking the country's total tally of COVID-19 cases to 3,43,33,754, while the active cases increased to 1,48,922, according to the Union Health Ministry data updated on 5 November.

The daily rise in new coronavirus infections has been below 20,000 for 28 straight days and less than 50,000 daily new cases have been reported for 131 consecutive days now, said a PTI report.

Nifty Bank:

The Nifty Bank closed with gains of nearly 200 points on the Muhurat Trading day. For the week, the index is up over 1 percent.

“Bank Nifty is trying to respect its 20-DMA on a closing basis however 40500-41000 is a critical supply zone at any pullback,” Santosh Meena, Head of Research, Swastika Investmart Ltd, said.

“If it manages to sustain above 41000 level then it may again start to show strong bullish momentum. On the downside, 39000 is immediate support while 38500 will remain sacrosanct support,” he said.

(Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:25 AM IST

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts  Indian markets will remain under pressure amid global rate cuts: Report

Indian markets will remain under pressure amid global rate cuts: Report FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows

FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts

Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts  FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%

FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%