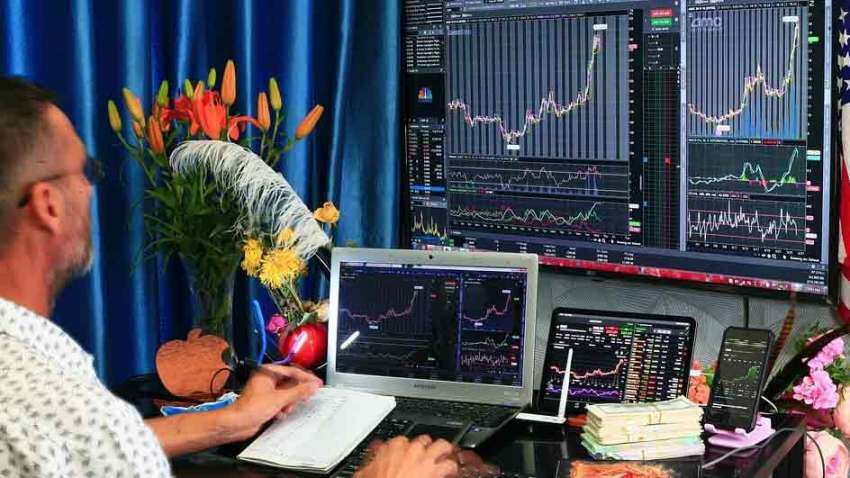

Wealth Guide: How to avoid costly trading mistakes in volatile market—Tips

The technological landscape is rapidly changing the trading sphere and with several trading options available, people are now finding the market both profitable and mystifying. Trading is less about making money/profit and more about investing money for the future. When you manage your money by analysing and decrypting the various factors that influence the market, you will have the ability to make your money work harder for you. This value-add is essential at a time when world economies are facing an impending state of stagnation.

Nevertheless, keeping in mind the various risks and rewards present in trading is crucial in avoiding costly trading mistakes.

1. Don’t predict, ponder

One of the main reason traders end up losing large sums of money in trading is that they predict more than they ponder. People try to prove their trading ideas by considering the trends and events that influence the market. But they don’t realise that just considering the market is not enough. Even a child reading the daily newspaper can be very considerate about events and the impending results on the market. It is important that you analyse the trends or events impacting the market. A prediction should be supported by hard facts and strong conclusive arguments, and you need to ponder and comprehend the factors affecting the market.

2. Don’t stick to a single asset, diversify

Investing in various assets at a single time, helps in reducing potential market risks. This approach is known as diversification. Over time, this practice aims to help in reducing the volatility of your portfolio. Diversification helps in reducing trading risks, something which is hard to avoid when you step into the market. If in the near future one or two of your stocks don’t perform well, other underlying assets could help cushion the impact on your portfolio.

Whether you trade instruments like stocks, crypto, commodities or forex, every market segment is prone to factors that are not within your control. Therefore, to mitigate the level of risk you take, you should consider diversifying your assets to strengthen your portfolio.

3. Leveraging within your capacity

The concept of deploying borrowed funds to boost an investment's return is known as leverage. Leverage is a helpful financial instrument when used correctly. It gives you greater market exposure on a limited number of assets. However, you should trade only what you can afford to lose, it’s never a good idea to take on too much risk on your plate.

Returns and risks go hand in hand. Lower returns may not give you huge profits but it provides a relatively safe position in the market, whereas higher possible returns also indicate a greater risk profile. Make an informed decision on the risks and leverage ratio you are willing and able to take on, do not let indecisiveness do it for you.

(By Marc Despallieres, Chief Strategy & Trading Officer at Vantage)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:27 PM IST

Wealth Guide: Planning to invest Real Estate? Expert decodes what all you need to understand

Wealth Guide: Planning to invest Real Estate? Expert decodes what all you need to understand Wealth Guide: Real Estate - Is It A Great Choice For Investment? Expert Suggests This

Wealth Guide: Real Estate - Is It A Great Choice For Investment? Expert Suggests This  Zee Business Top Picks 18th Sep'22: Top Stories This Evening - All you need to know

Zee Business Top Picks 18th Sep'22: Top Stories This Evening - All you need to know Zee Business Top Picks 14th Sep'22: Top Stories This Evening - All you need to know

Zee Business Top Picks 14th Sep'22: Top Stories This Evening - All you need to know Wealth Guide: Real Estate - Things you must know when choosing a builder

Wealth Guide: Real Estate - Things you must know when choosing a builder