Sensex, Nifty to resume trading on Friday amid local, global triggers – here are 10 things to watch out for

Domestic equity markets will resume trading on Friday taking cues from Wall Street closing on Thursday; Q3 results, rupee movement against dollar and development around Budget 2023 may also play a decisive role in the way frontline indices trade

Indian stock markets will resume trading on Friday amid a host of local and global factors. Equity and commodity markets were closed for trading on Thursday on account of 74th Republic Day. Zee Business has collated 10 factors that are likely to impact movement when trading starts tomorrow.

Both, NSE and BSE will migrate to T+1 settlement cycle from tomorrow.

Wednesday Market Recap: On Wednesday, selling pressure in index heavyweights HDFC Bank, Reliance Industries and ICICI Bank led to a market crash. S&P BSE Sensex and Nifty50 ended the January series on a negative note. While Sensex settled at 60,205.06, down by 773.69 points or 1.27 per cent while the broader market Nifty finished 226.35 points or 1.25 per cent lower at 17,891.95. Banking gauge Nifty Bank closed at 41,647.90, down by over 1,000 points or 2.54 per cent.

In the 50-stock Nifty, 35 stocks declined against gains seen in the remaining 15 stocks. Bajaj Auto, Hindustan Unilever, Hindalco Industries, Maruti Suzuki and Britannia Industries were the top gainers while top gainers were Adani Ports, State Bank of India (SBI), Indusind Bank, HDFC Bank and HDFC.

Triggers for Friday, 27 January, 2023

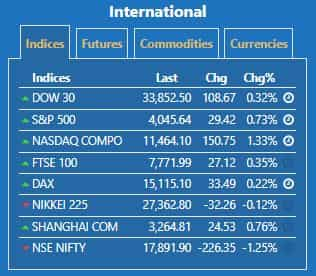

1) US Markets: When domestic equity markets resume trading tomorrow, they are likely to take cues from global markets. Friday morning trade in Dow Futures and Singapore-based SGX Nifty futures are likely to prepare ground for movement of Indian benchmark indices Sensex and Nifty50. SGX Nifty futures set the tone for momentum in Nifty. All three benchmark indices were trading positive. Dow 30 was trading at 33,852.50, up 108.67 points or 0.32 per cent while S&P 500 were up 29 points or 0.73 per cent at 4,045.64. Nasdaq Composite was trading at 11,464.10, higher by 150.75 points or 1.33 per cent.

US economy slowed in December quarter but still grew at 2.9 per cent; Wall Street gains

At the time of filing the story, Dow Futures were trading with marginal gains of 29.20 points or 0.09 per cent at 33,773. SGX Nifty was trading at 17,988, up by 34.5 points or 0.19 per cent.

Investors must also keep a track on Thursday closing of benchmark indices trading on Wall Street.

2) Rupee Vs Dollar: Movement of rupee against the US Dollar remains a key determinant of how domestic markets perform tomorrow. On Wednesday, Rupee slips 1 paisa to settle at 81.64 (provisional) against US dollar, PTI reported. The rupee remained boxed in a range of 81.48/81.75 for the day as Adani FPO was fully subscribed and national banks bought dollar for possibly oil companies, Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said. Dollar Index remains below 102 against the basket of six major currencies, Bhansali said. Asian currencies were also trading within a range, said. Rupee is expected to be in a range of 81.20 to 81.90 on Friday with oil bids and inflows being the deciding factor, he further said.

3) Q3 Results: Expect stock specific action in Cipla, TVS Motor Company, Jyothi Labs, Blue Dart Express, Indian Bank, Ceat, Uco Bank, Macrotech Developers and Strides Pharma who announced their December quarter earnings on Wednesday. Today, IGL and IndiGrid declared their quarterly earnings.

Several listed companies will report their Q3 results on Friday. In the Nifty50 pack, Bajaj Finance will announce results. Others include, Aarti Drugs, Vedanta Limited, Godfrey Philips, CMS Info Systems and others.

4) Stocks in News: Japan's Suzuki Motor Corporation on Thursday said it will introduce six battery electric vehicles in India by FY2030 as part of its growth strategy and achieve carbon neutrality by 2070 as per the target set by the government. In the growth strategy for FY2030 shared on BSE by its Indian arm Maruti Suzuki India, Suzuki Motor Corporation (SMC) said in India, it will provide not only battery EVs but also carbon-neutral internal combustion engine vehicles using CNG, biogas and ethanol mixed fuels. Meanwhile, Mahindra & Mahindra opens booking for E-SUV XUV 400; Route Mobile declares interim dividend of Rs 6. Vodafone Idea board to discuss Rs 1,600 crore debenture issue for ATC on January 31

5) Stocks in Ban on 27 January, 2023: No stocks are in ban.

6) FII /DII Action: Foreign institutional investors were net sellers of Indian equities at Rs 2,393.94 crore while domestic institutional investors were net buyers at Rs 1,378.49 crore.

7) Bulk Deals: Over a dozen companies witnessed bulk deal action on NSE on Wednesday. Among them were Kohinoor Foods, Aarti Surfactants, Bright Solar, Nureca, South Indian Bank and others. Investors in these stocks must keep an eye on them.

8) Anil Singhvi Strategy on Nifty, Bank Nifty: Friday marks the beginning of February series and markets are slightly in an oversold territory, Zee Business Managing Editor said. Nifty will find support at 17,750-17,850. If Nifty slips further, an opening will be triggered to levels between 17,200 and 17,300. Resistance is seen at 18,000. As for Bank Nifty, more weakness will emerge if the banking gauge slips below 41,500. It will regain strength over 42,000.

#BazaarAajAurKal में देखिए आज के शेयर बाजार का लेखा-जोखा और कल के बाजार का अनुमान @rainaswati | @AnilSinghvi_ https://t.co/UZoHUqo9RP

— Zee Business (@ZeeBusiness) January 25, 2023

9) Commodities: February Gold futures ended at Rs 57,005 per 10 gram and were up by Rs 36 or 0.06 per cent. March Silver futures settled at Rs 68,745 per kg, up by Rs 203 or 0.30 per cent. February Oil futures closed at Rs 6,542, down by Rs 20 or 0.30 per cent.

10) Budget 2023: Last but not the least, street will be tracking developments around Union Budget 2023. Finance Minister Nirmala Sithraman will be reading her budget speech on 1 February, Wednesday. Budget Session of Parliament begins on 31 January, Tuesday.

Expert Take

"Nifty was trending in the range for the whole January series from 18,200 to 17,800 levels. On the monthly expiry day, Nifty slumped in a terrifying session and ended way below psychological 18,000 mark to close the series at 17,892. The level of 17,800, which is the 50% retracement support of recent up move is still intact and acting as an anchor point for the index.

The benchmark Index in January expiry has made a couple of attempts to breach 17,800 – 17,780 levels but was not successful as prices were continuously finding support near that zone.

Nifty on the weekly chart is placed between a broader high-low range of 18,200 -17,800 levels from the past 5 weeks. Furthermore, the price is also trapped between the 9 & 21 EMA bands which suggest a break on either side will decide further directional move in the index." -- Rohan Patil, Technical Analyst at SAMCO Securities

"The Nifty opened on a negative note on January 25 & tumbled down sharply as the day progressed. It breached the key daily moving averages on the way down. The larger structure, however, shows that the index is still in the range, which it has been witnessing for last one month. It recently tested the upper end of the range & thereon it has tumbled down towards the lower end i.e. 17800-17760. This zone has been acting as a strong support & is likely to provide support this time as well. Thus unless the level of 17760 breaks, the Nifty can witness recovery within the short term range." -- Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Want to use market crash as a buying opportunity? Analysts suggest buying Bharti Airtel, HDFC Life and 3 more shares for up to 39% gains

Top 7 Large and Mid Cap Mutual Funds With up to 21% SIP Returns in 10 Years: Rs 11,111 monthly SIP investment in No. 1 fund has sprung to Rs 40,45,114; know about others

Power of Compounding: How soon will monthly SIP of Rs 8,000, Rs 12,000, and Rs 15,000 reach Rs 6 crore corpus target?

10:05 PM IST

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points

FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500

FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500 FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627

FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627