UBS expects volatility to persist on D-Street in near term, pegs Nifty at 25,200 by March 2025

Share market news: After a strong run up of Indian equities, some profit taking in the near term cannot be ruled out as economic and geopolitical risks remain elevated.

)

Share market news: With domestic benchmark indices Sensex and Nifty having scaled a series of unprecedented heights on the back of strong macroeconomic triggers, healthy corporate earnings, and steady buying by domestic institutional investors (DII), UBS expects some profit-taking on Dalal Street in the near term citing geopolitical and economic risks remain elevated. The foreign brokerage, however, believes that the downside risks are manageable amid a supportive domestic macro- and micro-environment.

“After a strong run-up of Indian equities, some profit-taking in the near term cannot be ruled out as economic and geopolitical risks remain elevated. Nevertheless, India remains in a sweet spot, in our view, and we recommend investors to use any corrections as buying opportunities given the long-term structural growth opportunities that exist.

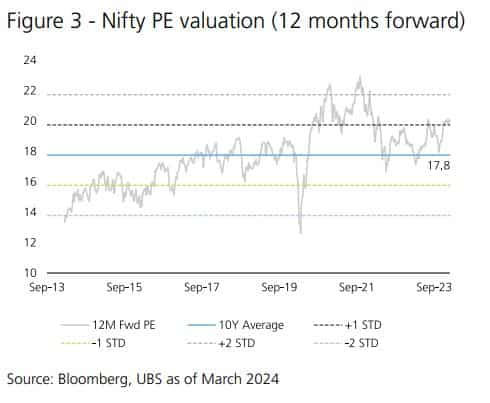

The 50-scrip Nifty50 index has risen 3.1 per cent so far in 2024, trading at a 12-month forward price-to-earnings multiple of 20.5 times, one standard deviation above its 10-year average, they highlighted.

ALSO READ: D-Street Wrap | Bulls take indices to record closing highs in holiday-shortened week; PSU bank, metal shares shine

Here are some of the key things that the brokerage highlighted in its report:

‘Indian economy in a sweet spot,’ says UBS

India is likely to remain one of the fastest-growing global economies, though its GDP growth is expected to moderate due to global and local factors, according to the brokerage.

"From 7.6 per cent year-on-year (YoY) growth in FY24E, we expect real GDP growth to moderate to 7 per cent and 6.8 per cent in FY25 and FY26 respectively," UBS said.

What should investors do? Buy the dip, says UBS

UBS recommends investors use any steep market corrections as buying opportunities given the long-term structural growth opportunities. “We prefer domestic economy linked sectors as they should benefit from India's superior economic growth,” the analysts wrote.

High valuation sustainable

The premium valuation is justified by cyclical and structural tailwinds, and further supported by political stability. Valuations are also supported by falling equity risk premiums as interest rates fall, according to brokerage.

Nifty at 25,200 by Mar '25

UBS in its report said that the Nifty index may touch 25,200 by March 2025 based on March 2026 EPS estimates of Rs 1,226 and a 12-month forward target PE multiple of 20.6 times.

ALSO READ: Axis Securities pegs Nifty target at 23,000 by Dec 2024

Preferred sectors

The brokerage prefers sectors that have high domestic exposure, like autos, industrials, utilities, real estate, consumer durables and healthcare. It has a ‘neutral’ stance on the financials, FMCG, IT, oil and gas, and chemicals space, and has least preference to metals and telecom stocks.

Risks

UBS sees unfavorable election outcomes, a delay in rate cut cycle, and geopolitical tensions in the Middle East (surge in oil prices) as key risks for investing on Dalal Street.

How UBS views the money market

The brokerage believes the rupee could remain resilient, supported by a stable external deficit and rising forex reserves.

“We expect the INR to strengthen against the USD, supported by an improving trade balance, healthy forex reserves, stable oil prices and anticipation of FPI inflows in debt (supported by index inclusion) and equities (on reversal of interest rate cycle),” the analysts added.

The brokerage expects the bond yields to remain rangebound in the near term. “Given the flatness of the yield curve, medium-to-long-duration bonds appear attractive as the elevated levels offer good carry with duration over the next 12 months,” UBS said.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

06:18 PM IST

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points

FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500

FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500 FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627

FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627