Traders Watchlist: Top 12 data points to know before the share market opening bell on Monday

The Indian markets on Thursday closed session with a record closing high, as Sensex ended over 61300-mark and Nifty above 18300-level for the first time ever in history.

The Indian markets on Thursday closed session with a record closing high, as Sensex ended over 61300-mark and Nifty above 18300-level for the first time ever in the history.

Sectorally, selling pressure was visible in auto indices while buying interest was seen in FMCG, IT, metal, media, pharma, banking, and financial stocks.

See Zee Business Live TV Streaming Below:

“The week gone by was dominated by the bulls right from the beginning till the end. The weekly chart shows that the index has broken out from an Inside bar pattern; which was formed in the penultimate week.,” Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas said.

He added, “On the way up, Nifty crossed the crucial psychological mark of 18000 & is now set to test 19000 on the upside from short term perspective. The daily chart is showing runaway gap, which underscores the underlying strength.”

“The same is visible from the momentum indicators as well. Hence the index is expected to stay on the upward trajectory with the short term target at 19000. On the other hand, the recent gap area of 18248 – 18197 will provide cushion in the case of any minor degree dip,” Ratnaparkhi said.

Here is a list of 12 data points that will help you in making a profitable trade:

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.97 percent lower at 18,338. Key Pivot points (Fibonacci) support for the index is placed at 18273, 18249, as well as 18210 while resistance is placed at 18351, 18375, and 18414.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 1.8 per cent lower at 39,340. Key Pivot points (Fibonacci) support for the index is placed at 38861, 38695, as well as 38427 while resistance is placed at 39397, 39563, and 39831.

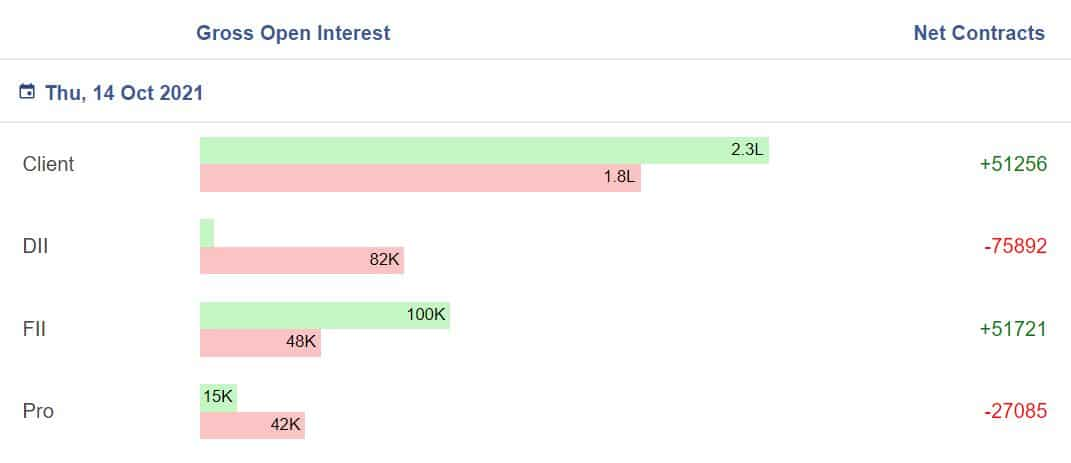

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

On the Option front, Maximum Put OI is at 18000 followed by 17500 strike while maximum Call OI is at 18500 followed by 19000 strike. Minor call writing is seen 18800 then 18600 strike while meaningful Put writing is seen at 18000 than 18300 strike.

“Option data suggests an immediate trading range in between 18000 to 18500 zones.,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

25 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more of long positions.

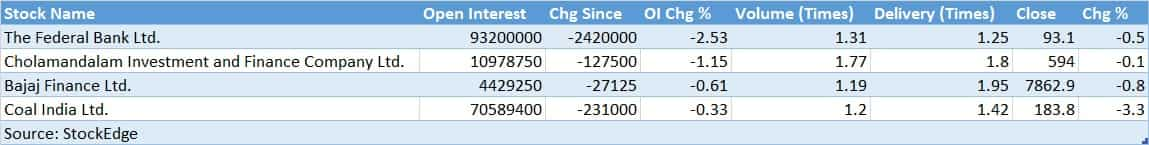

04 stock witnessing Long Cover:

If the price decreases and open interest decreases, then participants are long covering their contracts.

20 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

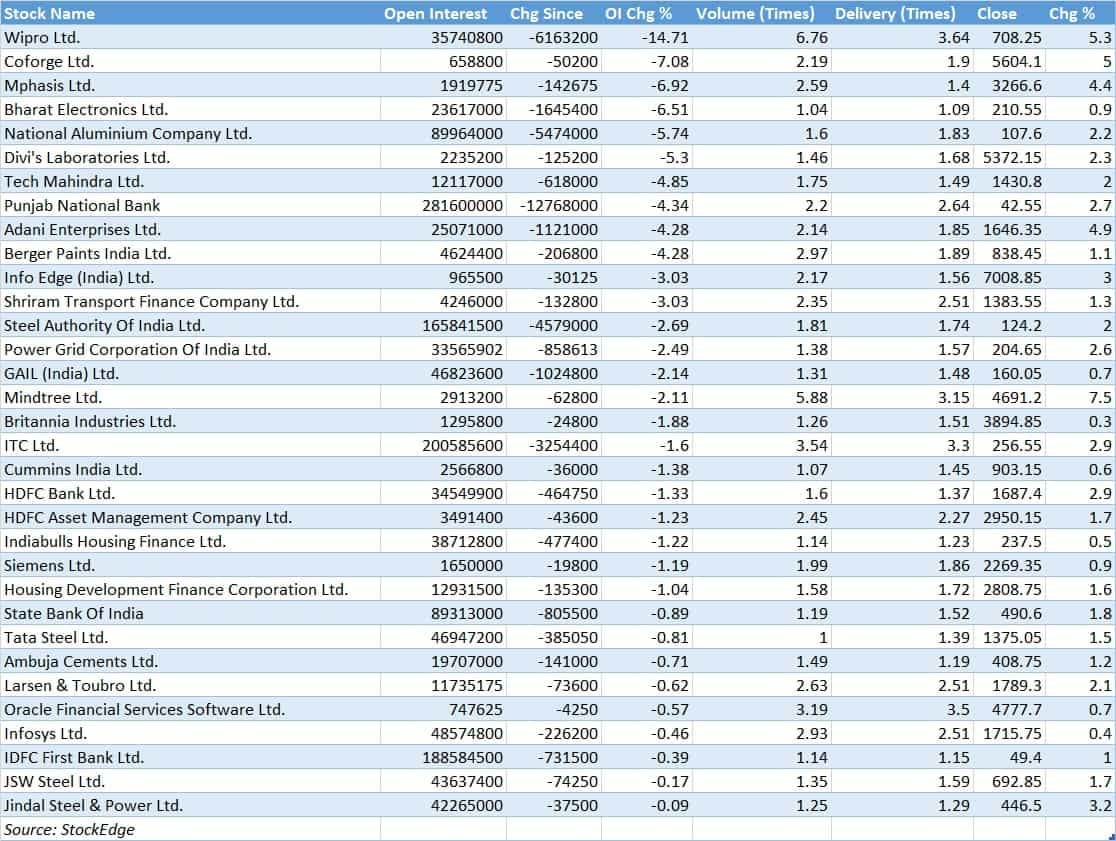

33 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net buyers for Rs 1681.6 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 1750.59 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

United Drilling Tools Ltd: Ashish Kacholia bought 4,00,000 lakh equity shares in the company at the weighted average price Rs 357.5 per share on the NSE, the bulk deals data showed.

Vijaya Diagnostic: CLSA Global Markets PTE LTD sold 5,11,761 equity shares in the company at the weighted average price Rs 379.73 per share on the NSE, the bulk deals data showed.

Walchandnagar Ind. Ltd: Vistra ITCL India Limited sold 4,00,000 equity shares in the company at the weighted average price Rs 54.49 per share on the NSE, the bulk deals data showed.

Debock Sale Marketing Ltd: Nanalal Bhanji Dudhaiya has apparently bought 42,000 lakh shares in the company at the weighted average price Rs 66.7 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Six stocks – Bank of Baroda, BHEL, Indiabulls Housing Finance, Idea, IRCTC, & Sun TV - are under the F&O ban. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 1777-day FD vs HDFC Bank 55-month FD: What will be maturity amounts for general and senior citizens on Rs 6 lakh and Rs 12 lakh investments?

SBI Guaranteed Return Scheme: Know what State Bank of India is offering to senior citizens and others on 1-yr, 3-yr and 5-yr fixed deposits

50:30:20 Investment Strategy: Can you build Rs 3.9 crore retirement corpus with salary of Rs 30,000?

Know Your Gratuity: Rs 41,000 as last-drawn basic salary and 6 years and 8 months of service; what will be gratuity?

Power of Compounding: How many years will it take to reach Rs 3 crore corpus if your monthly SIP is Rs 4,000, Rs 5,000, or Rs 6,000

Sukanya Samriddhi Yojana vs PPF: Rs 1 lakh/year investment for 15 years; which can create larger corpus on maturity?

06:54 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28