Traders Guide: Here are the 10 things to know before market opens on Monday, January 23

The bias again shifted southward in the final sessions due to profit-taking in the global indices. Consequently, the benchmark indices, Nifty and Sensex, settled at 18,027.65 and 60,621.77 levels.

Traders Guide, NSE Nifty50, BSE Sensex: The Indian markets consolidated in a narrow range for the fourth successive week and ended marginally higher on Friday. The tone was subdued in the beginning however buying in select heavyweights in the middle helped the index to inch higher.

The bias again shifted southward in the final sessions due to profit-taking in the global indices. Consequently, the benchmark indices, Nifty and Sensex, settled at 18,027.65 and 60,621.77 levels.

Meanwhile, continued buying in the IT pack combined with a recovery in energy and banking majors aided the index to close in the green. The underperformance of broader indices continued for yet another week as they lost in the range of 0.7-1.10 per cent.

Here is a list of things to watch out for on 23 January 2022

What Should Investors Do On Monday?

Markets will first react to the important results like Reliance, ICICI Bank and Kotak Bank in early trade on Monday. Global cues are currently weighing on sentiment so a positive surprise on the earnings front might subside some pressure.

Meanwhile, we reiterate our view to continue with a stock-specific trading approach until we see improvement in participation and stability on the global front.

-Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Technical Outlook

Technically, Nifty is trading in a well-defined trading range of 17800-18250, but it is getting narrower, so we can expect a breakout or breakdown. The move is like what happened in 2022, when Nifty formed doji candles in the second and third weeks of January before exploding in the fourth week ahead of the budget.

On the upside, if Nifty manages to take out the 50-DMA of 18250, then we can expect a rally towards 18500 and 18650 levels. On the downside, a cluster of 20 and the 100-DMA of 18040–17940 is an immediate demand zone, while 17800 is a sacrosanct support level. If Nifty slips below the 17800 level, then 17625 and 17425 will be the next support levels.

Bank Nifty is also in a well-defined trading band of 41725–42725; it needs to take out this band for further direction. If it breaks out above 42725, it is likely to move towards the 43500 and 44000 levels. On the other hand, any major weakness will be seen only with a decisive move below the 41725 level.

- Santosh Meena, Head of Research, Swastika Investmart Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.44 per cent lower at 18,027.65. Key Pivot points (Fibonacci) support for the index is placed at 18013.74, 17983.25, and 17933.9, while resistance is placed at 18112.45, 18142.95, and 18192.3.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.42 per cent higher at 42,506.80. Key Pivot points (Fibonacci) support for the index is placed at 42396.3, 42315.33, and 42184.27, while resistance is placed at 42658.43, 42739.4, and 42870.46.

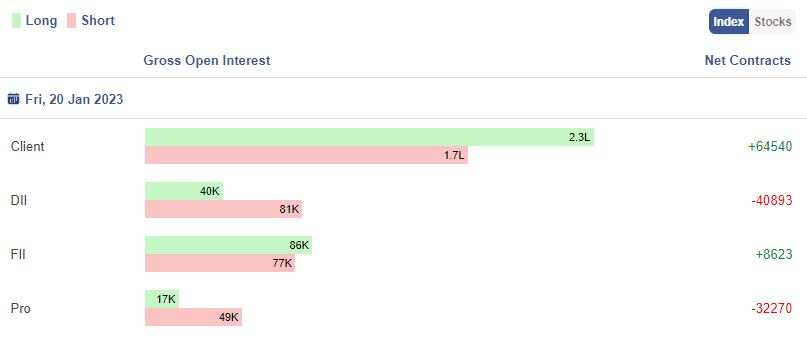

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source - Stockedge

Stocks in News & Q3 Earnings

McLeod Russel India: Board approves execution of exclusivity agreement with Carbon Resources to discuss, negotiate & evaluate a mechanism for a one-time settlement of debt owed by the Company to its identified lenders

SBI has entered into an agreement to purchase 40% stake in Commercial lndo Bank LLC (CIBL), Moscow held by Canara Bank.

63 Moons: Bombay High Court sets aside Yes Bank administrator’s order in AT1 bonds case against company.

Strides Pharma Science: Inspection by WHO at Puducherry facility completed. This facility caters to US, other regulated markets.

ICICI Bank reported a 34.5 per cent jump in its net profit at Rs 8,792 crore in December 2022 quarter on a consolidated basis, helped by an overall healthy performance.

Reliance Industries Ltd reported a 15 per cent drop in its net profit to Rs 15,792 crore for the third quarter, according to a company's stock exchange filing.

Also Read: Q3 Results 2023: IEX, Ramkrishna Forgings, JSW Energy announce December quarter results - HIGHLIGHTS

Reliance Industries retail arm reported a 6.24 per cent increase in its net profit to Rs 2,400 crore for the December 2022 quarter.

Reliance Industries telecom arm Jio posted a 28.3 per cent year-on-year rise in its net profit to Rs 4,638 crore for the December 2022 quarter amid a steady rise in subscriber base and realisations for the connectivity business.

Kotak Mahindra Bank reported a 31 per cent jump in its standalone profit at Rs 2,792 in the quarter ended December 2022 aided by improvement in net interest income.

UltraTech Cement reported a 37.9 per cent decline in its consolidated net profit to Rs 1,062.58 crore for the third quarter of FY2022-23.

SBI Life Insurance reported more than 16 per cent decline in net profit at Rs 304 crore in the third quarter ended December 2022.

IDFC First Bank on Saturday reported a two-fold jump in its net profit to Rs 605 crore for the quarter ending December 2022, driven by growth in operating income.

Punjab & Sind Bank on Saturday reported a 24 per cent jump in profit at Rs 373 crore for the quarter ended December 2022, aided by healthy growth in interest income and decline in bad loans.

Union Bank of India on Friday reported a two-fold jump in its December quarter net at Rs 2,245 crore, helped by a huge jump in recoveries from loans written-off earlier.

RBL Bank reported a 34 per cent growth in its December quarter net profit at Rs 209 crore and the bank's total revenue grew 11 per cent year-on-year to Rs 1,767 crore and net interest income was up 14 per cent to Rs 1,148 crore for the quarter ended December 2022.

Indian Energy Exchange (IEX) on Friday reported an over 4 per cent decline in its consolidated net profit to Rs 77.21 crore in the December quarter.

JSW Energy on Friday reported a 45 per cent decline in its consolidated net profit to Rs 180 crore for the December 2022 quarter.

Ramkrishna Forgings posted a 35 per cent rise in its December quarter consolidated net profit to Rs 61.04 crore, mainly on account of higher revenues.

LTIMindtree posted a consolidated net profit of Rs 1,000.7 crore for the December quarter, a 4.6 per cent decline over the year-ago period due to one-off impact of merger-related integration cost.

FII Activity on Friday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 2002.25 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 1509.95 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source – Stockedge

Bulk Deals:

Hi-Tech Pipes Limited: Kusum Aggarwal sold 66,000 equity shares in the company at the weighted average price Rs 937.16 per share on the NSE, the bulk deals data showed.

Chaman Metallics Limited: Hem Securities Limited PMS Account bought 2,01,000 equity shares in the company at the weighted average price Rs 55.71 per share on the NSE, the bulk deals data showed.

Generic Eng Cons Proj Ltd: Rasiklal P Sanghavi (Huf) bought 2,79,000 equity shares in the company at the weighted average price Rs 67 per share on the NSE, the bulk deals data showed.

Agri-Tech (India) Limited: Manish Verma bought 34,280 equity shares in the company at the weighted average price Rs 118.45 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Delta Corp, L&T Finance, and PVR are placed under the F&O ban for Monday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

With PTI Inputs

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

04:35 PM IST

Traders Guide: From stocks in news to Nifty outlook - 10 things to know before market opens on Monday, March 13

Traders Guide: From stocks in news to Nifty outlook - 10 things to know before market opens on Monday, March 13 Traders Guide: From stocks in news to Nifty outlook - 10 things to know before market opens on Monday, February 27

Traders Guide: From stocks in news to Nifty outlook - 10 things to know before market opens on Monday, February 27 Traders Guide: From stocks in news to Nifty's technical outlook - 10 things to know before market opens on Monday, February 20

Traders Guide: From stocks in news to Nifty's technical outlook - 10 things to know before market opens on Monday, February 20 Traders Guide: From stocks in news to Q3 earnings - 10 things to know before market opens on Monday, February 13

Traders Guide: From stocks in news to Q3 earnings - 10 things to know before market opens on Monday, February 13 Traders Guide: 10 things to know before market opens on Monday, February 6 – stocks in news, Q3 results, FII/DII data and more

Traders Guide: 10 things to know before market opens on Monday, February 6 – stocks in news, Q3 results, FII/DII data and more