Top Stocks To Buy With Anil Singhvi: Know why Sandeep Jain is bullish on Shakti Pumps stocks – check share target price here

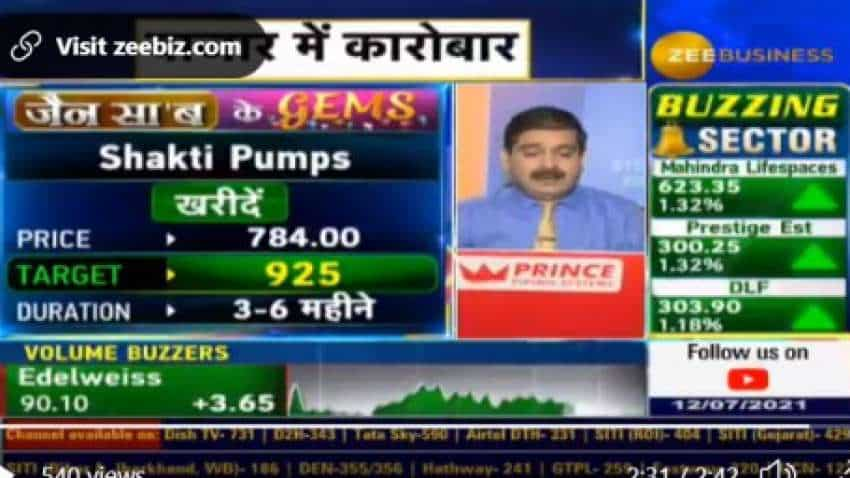

In a conversation with Zee Business Managing Editor and market guru Anil Singhvi, the market analyst Sandeep Jain recommended to Buy Shakti Pumps for bumper returns during a special show 'Jain Saab Ke Gems'.

In a conversation with Zee Business Managing Editor and market guru Anil Singhvi, the market analyst Sandeep Jain recommended to Buy Shakti Pumps for bumper returns during a special show 'Jain Saab Ke Gems'.

Jain being bullish on this whole sector had recommended KBS Pumps, Rotos Pumps, Kirloskar Pumps earlier for bumper gains.

See Zee Business Live TV Streaming Below:

He points out, the central government's initiatives and schemes have pro-actively helped this sector to be in focus, especially in engineered pumps, industrial pumps, and solar pumps, which have been in more demand lately.

While speaking about the fundamentals of the company, the market analyst mentions, the promoters have experience of over three-four decades, and it has a presence in both international and domestic markets.

जैन सा'ब के GEMS

3-6 महीने के निवेश के लिए बेहतरीन शेयर

आज Shakti Pumps पर क्यों बुलिश हुए संदीप जैन?

शेयर के लिए क्या हैं पॉजिटिव ट्रिगर्स? जानें यहां#StockMarket #Investment @AnilSinghvi_ @SandeepKrJainTS pic.twitter.com/ONF4STwNSP

— Zee Business (@ZeeBusiness) July 12, 2021

The company has over 550 distributors network and 15000 retailers network in the domestic market, says Jain, he further adds it has multiple marketing branches with a presence in 20 states, and they are doing business in 118 countries, specifically in the Middle East, US, Africa, and among other continents.

Jain also says, due to government schemes such as Kusum, this company has received many orders, and hence the last four-five quarters of Shakti Pumps have been splendid. Moreover, even the company's credit ratings upgraded since March from stable to positive, he added.

The market guru states, the company's return in capital employed (ROCE) is at 25-26 per cent, return in equity (ROE) is around 25 per cent, last three years profit CAGR is at 29 per cent, and five years profit CAGR stood at 134 per cent, and sales at 28-29 per cent growth, as well as OMPC, is improving by 15-16 per cent.

Except last quarter, due to some delay in implementation, the company reported losses as compared to Rs 30 crore PAT YoY, Jain says. Further adding that otherwise last three-four quarters have been spectacular in terms of earnings.

The market analyst says, the stock could be bought at the current level for a target of Rs 925 per share. The counter is trading over 1 per cent higher to Rs 778 per share at around 11:20 am today.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

12:51 PM IST

Shakti Pumps Q1 net profit jumps to Rs 93 crore

Shakti Pumps Q1 net profit jumps to Rs 93 crore  Shakti Pumps Q4 PAT surges to Rs 90 crore; order book touches Rs 2,400 crore

Shakti Pumps Q4 PAT surges to Rs 90 crore; order book touches Rs 2,400 crore Shakti Pumps Q3 results: Net profit jumps fourfold to over Rs 45 crore

Shakti Pumps Q3 results: Net profit jumps fourfold to over Rs 45 crore  Shakti Pump stock hits an all-time high after Rs 1,603 crore order boost

Shakti Pump stock hits an all-time high after Rs 1,603 crore order boost Shakti Pumps wins Rs 150-crore order under PM-KUSUM scheme

Shakti Pumps wins Rs 150-crore order under PM-KUSUM scheme