Top Gainers, Losers: Tata Group firm defies market’s negative trend, ends as top Nifty, Sensex gainer - Check target

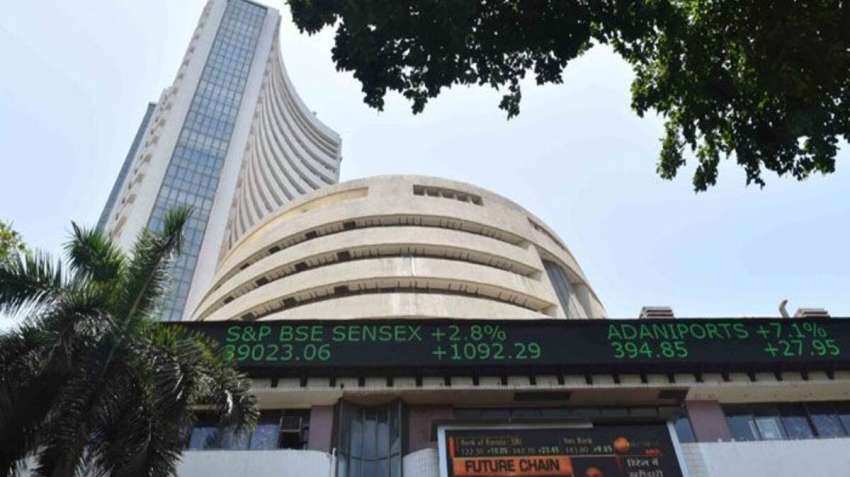

Top Gainers, Losers: The BSE Sensex tanked 631.83 points or 1.04 per cent to settle at 60,115.48. The Nifty50 declined 187.05 points or 1.03 per cent to end at 17,914.15.

Top Gainers, Losers: Indian equity benchmarks Sensex and Nifty50 closed one per cent lower on Tuesday amid weakness across global markets. Selling pressure in the financial and IT spaces weighed on headline indices, with losses in heavyweights such as Reliance Industries, HDFC Bank, Infosys and TCS.

The Sensex ended 631.8 points lower at 60,115.5 and the Nifty50 settled at 17,914.2, down 187.1 points from its previous close.

As many as 22 stocks in the Sensex basket closed lower. Bharti Airtel, SBI, HDFC Bank, UltraTech Cement, Bajaj Finance, HDFC, NTPC, ITC, Reliance Industries, and Tech Mahindra were the top laggards. Tata Motors, PowerGrid, Tata Steel, Hindustan Unilever, and Mahindra & Mahindra were the top gainers.

The TCS stock finished with a loss of one per cent at Rs 3,286.2 apiece on BSE, a day after India's largest IT services company reported a mixed set of quarterly results.

Here's a list of some of the biggest gainers and losers of the day, and what analysts suggest investors should do with them:

Tata Motors

Tata Motors emerged the top gainer on both main gauges after the auto major posted a robust quarterly business update.

The stock gained by Rs 23.7 or 6.1 per cent -- bucking the negative market trend -- to finish at Rs 413.1 apiece on BSE.

Image Source: Stockedge

Motilal Oswal has a 'buy' call on the stock with a target price of Rs 520, which implies a potential upside of 25.9 per cent from Tuesday's closing price.

While the company's India commercial vehicle business will see a cyclical recovery, its India passenger vehicle business is in a structural recovery mode, according to Motilal Oswal. The brokerage also said that JLR, a subsidiary of Tata Motors, is also witnessing a cyclical recovery, supported by a favourable product mix, though supply-side issues will defer the recovery process.

The stock trades at a consolidated earnings per share (EPS) multiple of 17.1 times the earnings estimate for the year ending March 2024 and a price-to-book multiple of three times, according to Motilal Oswal.

Apollo Hospitals

Apollo Hospitals shares ended higher by Rs 64.2 or 1.5 per cent at Rs 4,468 apiece on BSE. The stock was among the top three gainers in the Nifty50 universe.

Image Source: Stockedge

ICICI Securities has a 'buy' call on the stock with a target price of Rs 5,230 apiece -- implying 17 per cent upside potential.

After a strong performance in the July-September period, the hospital segment is expected to witness a sequentially flattish quarter for Apollo Hospitals amid lower possible elective surgeries owing to Dussehra and Diwali festivals, according to Siddhant Khandekar, Research Analyst at ICICI Securities.

Bharti Airtel

Bharti Airtel shares declined by Rs 26.5 or 3.2 per cent to finish at Rs 792.9 apiece on BSE and were among the top laggards on benchmark indices Sensex and Nifty50.

Image Source: Stockedge

According to Neeraj Chadawar of Axis Securities, Bharti Airtel may see a sequential improvement in its earnings with an increase in the India and Africa wireless revenue, and a strong service mix along with growth in average revenue per user (ARPU) may help the telecom company improve its margin.

India's non-wireless revenue is expected to remain robust for Bharti Airtel, especially broadband and enterprise, according to Bhupendra Tiwary of ICICI Securities.

The brokerage has a 'buy' on the stock with a target price of Rs 960 apiece — implying 21 per cent upside potential.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:24 PM IST

Top Gainers & Losers: Motor stocks vroom on D-street, UPL ends marginally lower

Top Gainers & Losers: Motor stocks vroom on D-street, UPL ends marginally lower Top Gainers & Losers: UPL, IndusInd Bank hold on to the green in volatile market; Tech Mahindra falls most among blue-chip stocks

Top Gainers & Losers: UPL, IndusInd Bank hold on to the green in volatile market; Tech Mahindra falls most among blue-chip stocks Top Gainers & Losers: IndusInd Bank, M&M rise most; Bajaj Finance slips

Top Gainers & Losers: IndusInd Bank, M&M rise most; Bajaj Finance slips  Top Gainers, Losers: Auto majors Tata Motors, Maruti help markets end in green – Check analysts' recommendation

Top Gainers, Losers: Auto majors Tata Motors, Maruti help markets end in green – Check analysts' recommendation Top Gainers, Losers: Auto and IT heavyweights aid D-Street to snap 3-day fall – Check target price

Top Gainers, Losers: Auto and IT heavyweights aid D-Street to snap 3-day fall – Check target price