Top Gainers & Losers: Bharti Airtel drops after JPMorgan downgrade, Sun Pharma gains – Here's what analysts suggest

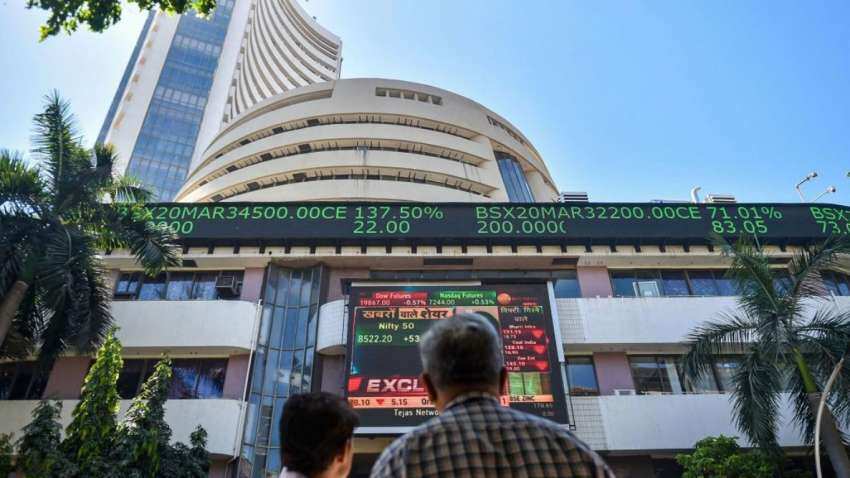

Extending losses to a second straight session, the Sensex lost 10 points to end at 60,105.5 and the Nifty50 settled at 17,895.7, down 18.5 points from its previous close.

Top Gainers & Losers: Indian equity benchmarks Sensex and Nifty50 ended a choppy session flat with a negative bias on Wednesday amid sustained foreign fund outflows and a weak trend in heavyweights such as Reliance Industries and Bharti Airtel.

Extending losses to a second straight session, the Sensex lost 10 points to end at 60,105.5 and the Nifty50 settled at 17,895.7, down 18.5 points from its previous close.

Bharti Airtel, Cipla, Divi's, Apollo Hospitals, Hindustan Unilever, ONGC, and Coal India -- ending between 1.7 per cent and 3.5 per cent lower -- were the worst hit among the 32 laggards in the Nfity50 basket. On the flipside, Hindalco, BPCL, Sun Pharma, UltraTech, HDFC Bank, and TCS -- rising between 1.3 per cent and 2.8 per cent -- were the top gainers.

As of Tuesday, FIIs have net sold Indian shares worth Rs 16,594.3 crore in 13 back-to-back sessions, according to provisional exchange data. DIIs, however, have made net purchases to the tune of Rs 14,748.4 crore during this period, in some respite for the bulls.

Here are some of the blue-chip stocks that saw big moves on January 11:

Hindalco

Hindalco shares were the top gainer in the Nifty50 pack, closing with a gain of Rs 13.3 or 2.8 per cent at Rs 490.8 apiece on NSE.

JM Financial reiterated a 'buy' rating on the stock with a target price of Rs 530 per share. The long-term outlook for Hindalco continues to remain buoyant amid the improving trajectory for its India aluminum business given the correction in thermal coal prices, according to the brokerage.

Axis Securities expects the Aditya Birla Group company to report muted earnings for the October-December period. The brokerage expects Hindalco's revenue to decline 6.5 per cent sequentially on account of lower shipments at Novelis along with a fall in aluminum prices on LME.

Sun Pharma

Sun Pharma was the top gainer in the 30-scrip Sensex universe, finishing higher by Rs 16.7 or 1.7 per cent at Rs 1,028.3 apiece on BSE.

Sun Pharma’s improved earning visibility with traction in the US and India, and specialty revenue with product launches and strengthening balance sheet make it one of the preferred bets in the pharmaceutical space, according to Sharekhan analysts.

Sun Pharma trades at 23.6 times its estimated earnings per share for FY24 and 19.8 times the estimate for the following year, respectively, which is reasonable, according to the brokerage, which has a 'buy' rating on the stock with a target price of Rs 1,300 apiece.

Bharti Airtel

Bharti Airtel shares were the top laggard on both Sensex and Nifty50, finishing with a cut of Rs 27.5 or 3.5 per cent at Rs 765.4 apiece on BSE.

The stock succumbed to selling pressure after a downgrade to 'underweight' from 'overweight' by JPMorgan. The brokerage reduced its target price for Bharti Airtel by Rs 150 to Rs 710 apiece, saying 2023 should be defined by competitive 5G rollouts.

Jefferies maintained a 'hold' rating for the telecom stock but brought down its target by Rs 5 to Rs 850 apiece.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

04:48 PM IST

Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers— Top 10 stocks that buzzed the most today

Gainers and Losers— Top 10 stocks that buzzed the most today Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today