Technical Check: This Rakesh Jhunjhunwala-owned stock rose over 100% in 2021; momentum likely to remain intact

Indiabulls Real Estate Ltd, which is also the part of Rakesh Jhunjhunwala portfolio, rallied more than 130 per cent so far in the year 2021, compared to over 29 per cent rally seen in the Nifty50 in the same period.

Indiabulls Real Estate Ltd, which is also the part of Rakesh Jhunjhunwala portfolio, rallied more than 130 per cent so far in the year 2021, compared to over 29 per cent rally seen in the Nifty50 in the same period.

See Zee Business Live TV Streaming Below:

The big bull owns 1.1 per cent stake in Indiabulls Real Estate valued at nearly Rs 100 crore, as of data collated from Trendlyne for the September quarter.

Indiabulls Real Estate, with a market capitalization of more than Rs 8,600 crore, hits a fresh 52-week high of Rs 195.50 on November 9, but witnessed some selling pressure at higher levels, but the momentum remains intact, suggested experts.

The stock fell from Rs 186 on 18 October to hit support near Rs 148 to surpass the recent peak of 186 levels. Technical experts see the momentum to continue in the near future and prices could well surpass 200-220 levels in the next 6-9 months.

The company has a presence in residential real estate development from the affordable to premium and Uber-luxury space. It mainly focuses on the construction and development of residential, commercial and SEZ projects across the Indian metro cities.

In terms of shareholding, foreign institutional investors raised their holding from 16.58 per cent to 19.43 per cent in the September quarter, according to data from Trendlyne. MFs also raised holding from 1.5 per cent to 3.5 per cent in Q2.

Technically, the stock is trading above 30,50,100 and 200-DMA. Most if the technical indicators confirm a bullish bias.

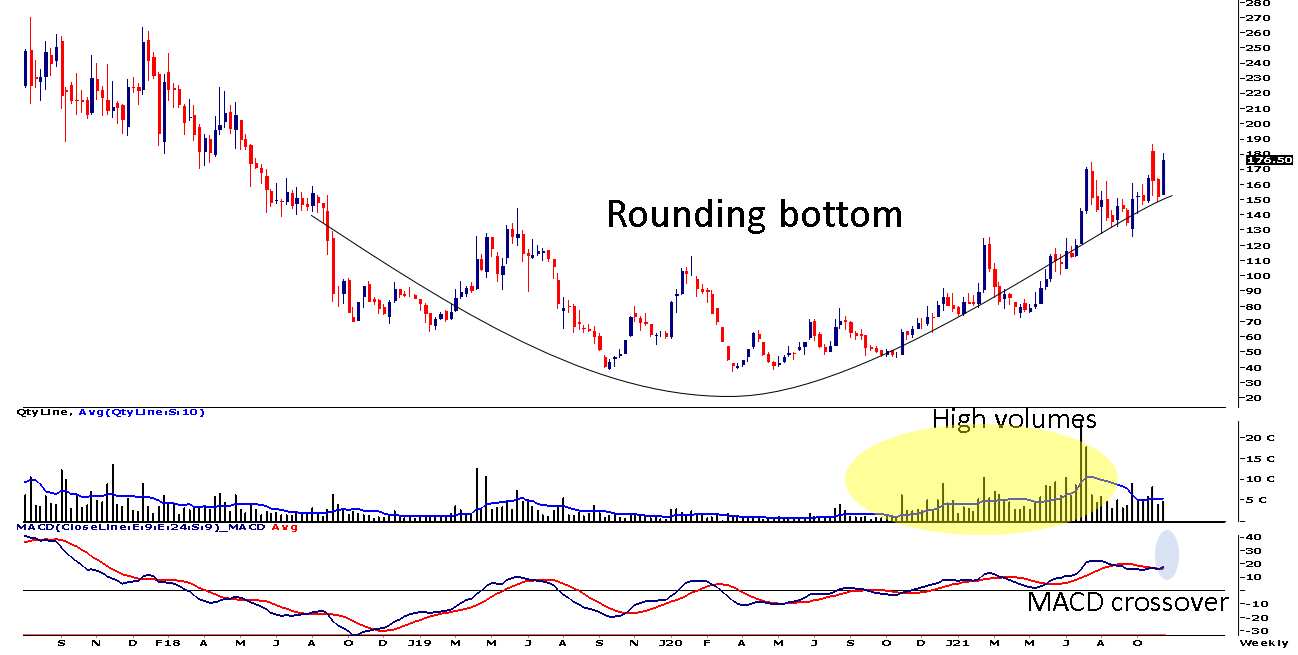

“Stock price has formed major rounding bottom pattern on weekly chart over the last 2 months. Since the up move started a year ago, stock has witnessed high volumes indicating buying participation,” Ashish Chaturmohta, Director Research, Sanctum Wealth, said.

“While the decline in the month of August-September was on below-average volumes. Now after the last 3 months of consolidation stock is showing a breakout. The Moving average convergence divergence (MACD) line has given a positive crossover with its average on weekly chart resumption of the uptrend,” he said.

Chaturmohta is of the view that the stock can be bought at current levels and dips to 172 with stop loss of 160 for the target of 220 in the coming 6-9 months.

(Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

02:18 PM IST

Indiabulls Real Estate Q4 Results: IBREL loss widens to Rs 1,038 crore in FY24

Indiabulls Real Estate Q4 Results: IBREL loss widens to Rs 1,038 crore in FY24  Indiabulls Real Estate Q1 sale bookings down 75% to Rs 74 crore

Indiabulls Real Estate Q1 sale bookings down 75% to Rs 74 crore Indiabulls Real Estate cracks 20%; here is why

Indiabulls Real Estate cracks 20%; here is why Q4 Results 2022: Indiabulls Real Estate, Oil India, Arvind Fashions and Realty firm Puravankara declare March quarter results - key highlights

Q4 Results 2022: Indiabulls Real Estate, Oil India, Arvind Fashions and Realty firm Puravankara declare March quarter results - key highlights Indiabulls Real Estate raises Rs 865 crore via issue of shares to institutional investors

Indiabulls Real Estate raises Rs 865 crore via issue of shares to institutional investors