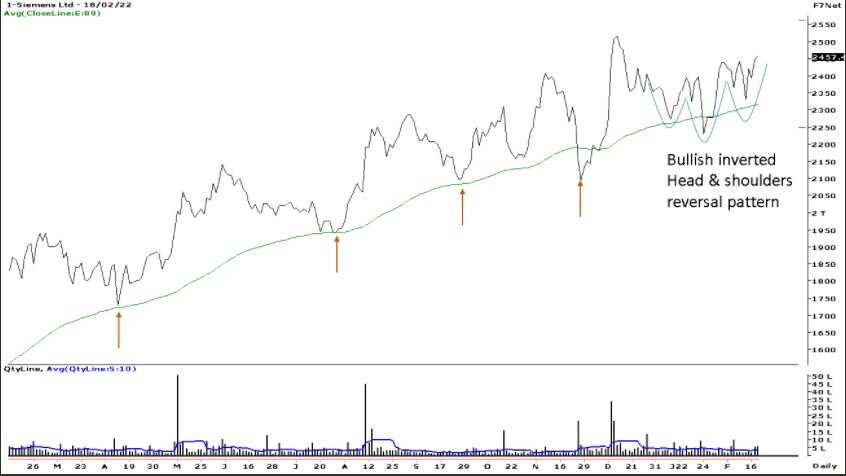

Technical Check: Siemens forms bullish Inverted Head & Shoulder pattern; could hit fresh 52-week high

Siemens Ltd rose over 30 per cent last year compared to over 14 per cent rise seen in the Nifty50 but the good news is that the uptrend is still intact, and investors can hold positions for targets closer to Rs 2700 in the next 3-6 months

Siemens Ltd rose over 30 per cent last year compared to over 14 per cent rise seen in the Nifty50 but the good news is that the uptrend is still intact, and investors can hold positions for targets closer to Rs 2700 in the next 3-6 months.

The heavy equipment maker with a market capitalization of more than Rs 87,000 cr hit a fresh 52-week high of Rs 2577 on 13 December, but since then the trend sideways.

Siemens Limited offers products, integrated solutions for industrial applications for manufacturing industries, drives for process industries, intelligent infrastructure and buildings, efficient and clean power generation from fossil fuels and oil & gas applications.

The company receives ~77% of its revenues from its business within India while the rest 32% revenues come from business outside India.

The recent action seems to suggest that the stock is getting support at lower levels. Siemens rose more than 2 per cent in a week and nearly 6 per cent in last month. If the trend sustains the stock could well surpass 2577 and hit fresh highs in the next 3-6 months, suggest experts.

The stock has formed an Inverted Head and Shoulder pattern on the daily charts. The stock has been finding support near the 89-Days EMA (in green line). It breached the resistance level last week which has opened room for further upside.

An inverted Head and Shoulder pattern is formed when the price falls to a trough and then rises, in the second wave, the price fall below the previous trough and then rises. And, finally, the price falls but not as much as the second trough.

A breakout happens when the price starts rising after hitting the trough and breakout on the upside above the resistance level.

“Stock is in a long-term uptrend forming a higher top and higher bottom on daily chart i.e., each new high after an up move is higher than previous high and each new low after a decline is higher than previous low,” Ashish Chaturmohta, Director, Equity Research, Sanctum Wealth, said.

“The 89-day exponential moving (green line) is acting support on dips and stock is trending higher. Though recently price had dipped below the average it has bounced above the average maintaining rising uptrend structure,” he said.

On the daily chart, the price has formed over the last few weeks stock has formed bullish inverted head and shoulders patterns. Chaturmohta said that the stock can be bought at current levels and on dips 2400 levels with a stop loss of 2330 for the target of 2700 and 2840 levels.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:54 AM IST

Indian stock market witness biggest fall in 4 years amid vote counting day

Indian stock market witness biggest fall in 4 years amid vote counting day  Nifty, Sensex drop nearly 2%; 5 key factors behind stock market fall today

Nifty, Sensex drop nearly 2%; 5 key factors behind stock market fall today  Anil Singhvi's strategy on 26 Sept: Support zone on Nifty is 17300-17350 and Bank Nifty is 39050-39125

Anil Singhvi's strategy on 26 Sept: Support zone on Nifty is 17300-17350 and Bank Nifty is 39050-39125 Sebi levies Rs 23 lakh fine on 3 entities for violating open offer norms

Sebi levies Rs 23 lakh fine on 3 entities for violating open offer norms Anil Singhvi's Strategy 23 Sept: Support zone on Nifty is 17425-17525, Bank Nifty is 40200-40375

Anil Singhvi's Strategy 23 Sept: Support zone on Nifty is 17425-17525, Bank Nifty is 40200-40375