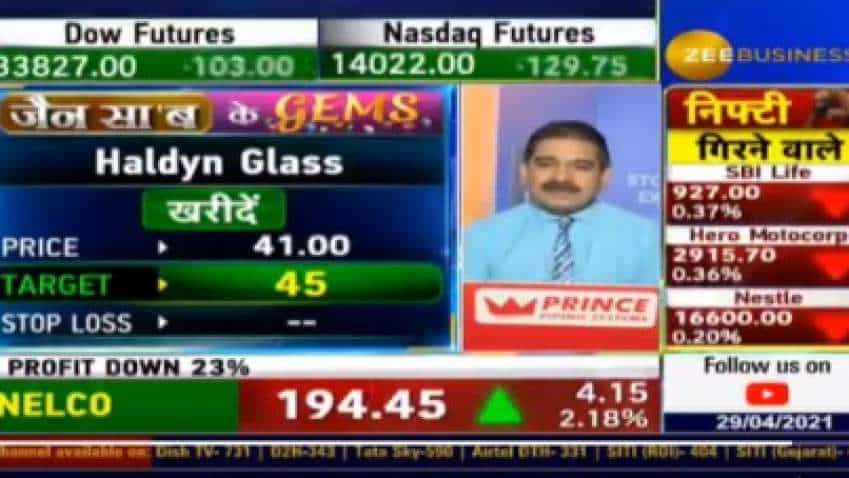

Stocks to buy with Anil Singhvi: Sandeep Jain recommends Haldyn Glass shares for bumper returns

In conversation with Zee Business Managing Editor Anil Singhvi, market expert Sandeep Jain picked this 'gem' from glass industry – Haldyn Glass stocks. Jain said Haldyn Glass shares have spectacular fundamentals with promising growth in the near future.

Picking the 'most lucrative' stock from mid-cap space, Jain said this Gujarat based company has been in the business of glass kit manufacturing. It makes small vials for the pharmaceutical company as well as also cater to the industry, such as food and beverages, liquor, and beer industries, said the market expert.

See Zee Business Live TV Streaming Below:

Haldyn Glass was incorporated in 1991 and its promoters have over five decades of experience in this business, which gives huge confidence says the market expert. The company is catering to the industries which have received great demand in the recent past such as pharma space, he adds.

"The company manufactures injectable materials, glass bottles ranging from 1 ml to 2500 ml capacity, the market expert said. Being an old and experienced company, it has strong clienteles, good rating and almost zero-debt company," said Tradeswift’s Director Jain.

जैन सा'ब के GEMS: दमदार फंडामेंटल वाले बेहतरीन शेयर

संदीप जैन ने आज किस स्टॉक को चुना आपके मुनाफे के लिए?@AnilSinghvi_ @SandeepKrJainTS pic.twitter.com/A0oakNMj1s

— Zee Business (@ZeeBusiness) April 29, 2021

The company’s book value is around Rs 29-30 per share as compared to the current market price of 37-38 per share. It also gives a dividend yield of Rs 1.5-2 per share, points out Jain.

He further says, the December-ended quarter of the company has been the most profitable one, as it reported the highest profit of Rs 5.5 crore as compared to 3 crores in the December-ended quarter in 2019.

The last three years have been very good in terms of share price and growth of the company except for the lockdown period, says the analyst. He expects the target of the company to grow around Rs 40-45 per share in the coming days. The stock had already shown a level of Rs 50-55 apiece in 2018.

Adding to Jain’s input, Market Guru Singhvi says, the target set for this stock by the Tradeswift’s Director is less as compared to the demand it’s been and will be going to receive ahead.

Singhvi adds, this company would be fruitful as the demand for the covid vaccine will increase, as Haldyn Glass in in the business of making the vaccine containers. He says, the company to grow its business and eventually the stock price, going forward. He sets target of not less than Rs 60 per share.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

12:54 PM IST

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today