Q4 results, corporate action to drive action in Tata Power, L&T Infotech, Mindtree and other 4 stocks on Monday, says analyst

The Nifty50 has closed below 200-DMA (Daily Moving Average) decisively, technically it is weak too, Jain said, advising investors to be very cautious while trading on a short-term basis.

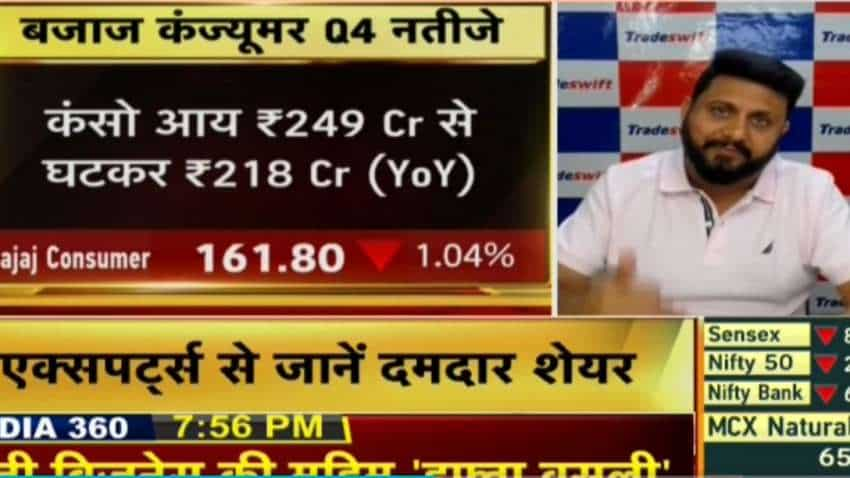

March quarter results and other corporate actions mainly to drive movement of certain stocks such as Tata Power, Bajaj Consumers, Sundaram Clayton, L&T Infotech, Mindtree among others during the Monday’s session, TradeSwift Director Sandeep Jain tells Zee Business.

According to Jain, the market has been most volatile and it may decline further amid multiple negative factors such as inflation pressure, raw material prices concern, geopolitical tensions, weak global markets, and an unpleasant rate hike from RBI among others.

The Nifty50 has closed below 200-DMA (Daily Moving Average) decisively, technically it is weak too, Jain said, advising investors to be very cautious while trading on a short-term basis.

The market analyst listed out stocks on the basis of news and Q4 results that are likely to show action on Monday, and suggests what to do with them.

Ashok Leyland: On the intraday call, Jain suggested to sell Ashok Leyland at a target between Rs 115-113 per share with a stop loss of Rs 123 per share. The stock on Friday closed at Rs 120 per share levels

Mastek: On the positional view, the market analyst picks Mastek as the best bet amid robust December quarter earnings. The stock has shown quite a good correction and sees a target of Rs 3020-3050 per share with a stop loss of Rs 2710 per share.

Tata Power: Seeing a lot of power in power stocks, the analyst is bullish on Tata Power shares, and on the back of robust Q4 earnings suggests fresh buying at the correct level and also urges existing investors to Hold the stock as the demand in this sector is good.

Sundaram Clayton: Analyst views Sundaram Clayton as a good company and has reported stable results year-on-year (YoY), while the overall valuations are good also the group has a good pedigree. He says auto ancillary stocks are doing good, with no downside risk so far.

Bajaj Consumer: Jain suggests to Hold this stock as the performance of this counter is priced-in, while with a good correction, the scrip is available on good downside levels. The stock may recover in future quarters as Q4 had been muted, Jain said.

LT Infotech – Mindtree: According to Jain the PE multiple of both the company shares are the same. He added, that the synergies will certainly be met, and this merger was expected after the acquisition of Mindtree by L&T.

The market analyst suggests to Hold both the stocks. LT Infotech is Jain’s favourite stock, as it is a strong company with a good pedigree.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

05:08 PM IST

Tata Power Renewables Energy commissions 431 MW solar project at Neemuch, Madhya Pradesh

Tata Power Renewables Energy commissions 431 MW solar project at Neemuch, Madhya Pradesh  Tata Power, ADB ink pact for USD 4.25-bn finance for key energy projects

Tata Power, ADB ink pact for USD 4.25-bn finance for key energy projects  Tata Power, Asian Development Bank ink pact for $4.3-billion finance

Tata Power, Asian Development Bank ink pact for $4.3-billion finance  Tata Power, Bhutan's Druk Green Power Corp to develop 5,000 MW clean energy projects

Tata Power, Bhutan's Druk Green Power Corp to develop 5,000 MW clean energy projects  Suzlon, Tata Power, IREDA: Government’s big move draws attention to these Stocks; check here

Suzlon, Tata Power, IREDA: Government’s big move draws attention to these Stocks; check here