Stock Market Outlook: 8 triggers for Sensex, Nifty that could impact movement on Tuesday

Anil Singhvi Strategy on Nifty, Bank Nifty: Nifty will find support at 18,075-18125 while resistance ay 18,275-18350. As for Bank Nifty, support is seen at 42,850-43,950 while resistance 43,400-43,600

Stock Market Outlook: Indian equity markets ended Monday on a positive note. Frontline indices S&P BSE Sensex settled at 61,167.79, up 327.05 points or 0.54 per cent while the broader market Nifty50 closed at 18,197.45, up 92.15 or 0.51 per cent. When markets reopen on Tuesday, they will be impacted by a host of local and global factors. We have collated 10 such triggers that investors must watch out for.

“Markets gained confidence in the afternoon trades after European indices advanced sharply in their early trades. Local traders lapped up metals, realty and banking shares, which had faced relentless selling in the last week's sell-off,” Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities said.

“The Nifty has been witnessing short term consolidation for the last few sessions. On the higher side, a rising trendline and the key daily moving averages are acting as resistances whereas the 20 week moving average & the 50 per cent retracement of the September December 2022 rally are providing support on the downside,” Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas.

Triggers to watch out for:

1) US Markets: US markets are closed on Monday, 2 January 2023 on account of New Year holiday. They will resume trading on Tuesday. Dow 30 closed at 33,147.20, down 73.55 points or 0.22 per cent on Friday while S&P 500 settled at 3,839.50, down 9.78 points or 0.25 per cent. Nasdaq Composite finished at 10,466.50, down 11.60 points or 0.11 per cent. Dow Futures were down 57 points or 0.17 per cent at 33,163.50.

Indian markets will take cues from Dow Futures and Singapore-based SGX Nifty futures on Tuesday. The latter is an early indicator of movement in Nifty50. Germany’s Dax was trading at 14,047.50, up 123.92 points or 0.89 per cent.

2) Rupee Vs Dollar: The rupee started the New Year on a muted note, declining 17 paise to close at 82.78 against the US dollar on Monday amid rising crude oil prices and sustained foreign fund outflows. Forex traders said the support from firm domestic equities and weak American currency was negated by the rising crude oil prices and selling by foreign funds, PTI reported. On the last trading day of 2022, the rupee had settled at 82.61.

The dollar index was still in a range and moved up to 103.60 since morning, Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said. Range for tomorrow for USDINR is expected to be within 82.40 to 83.20, he added.

3) Stocks in News: Auto stocks are likely to remain in action as top companies announce their December 2022 sales. Mahindra & Mahindra December passenger vehicles sales rise 61 per cent to 28,445 units while Hero MotoCorp December sales fell marginally to 394,179 units. In another news, Dabur completes 51 per cent acquisition of Badshah Masala. Expect movement in Hindustan Zinc, Craftsman Automation and others based on specific news.

4) FII / DII: Foreign institutional investors sold Indian equities worth Rs 212 crore while domestic institutional investors bought equities worth Rs 743.35 crore.

5) Stocks in Ban: There are no stocks in ban in the Futures & Options (F&O).

6) Anil Singhvi Strategy on Nifty, Bank Nifty: Nifty will find support at 18,075-18125 while resistance ay 18,275-18350. As for Bank Nifty, support is seen at 42,850-43,950 while resistance 43,400-43,600.

#BazaarAajAurKal में देखिए आज के शेयर बाजार का लेखा-जोखा और कल के बाजार का अनुमान @rainaswati | @AnilSinghvi_

https://t.co/ndq2Sh3ezn— Zee Business (@ZeeBusiness) January 2, 2023

7) Experts View:

Markets may face strong bouts of volatility as investors brace for earnings season and the upcoming Union Budget. Technically, the Nifty is consolidating between 18050 and 18250 levels. For the bulls 18250 would be the fresh breakout level to watch out for, and above the same it could move up to 18350-18400. On the flip side, below 18100, there is a strong possibility of a quick intraday correction. Below the same, the index could slip till 18050-18000, Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities said.

“The overall structure shows that the index can continue with the short term consolidation in the range of 17800-18400. Within this range, the Nifty is attempting a move towards 18400. The level of 18000 is acting as an intermediate support,” Ratnaparkhi said.

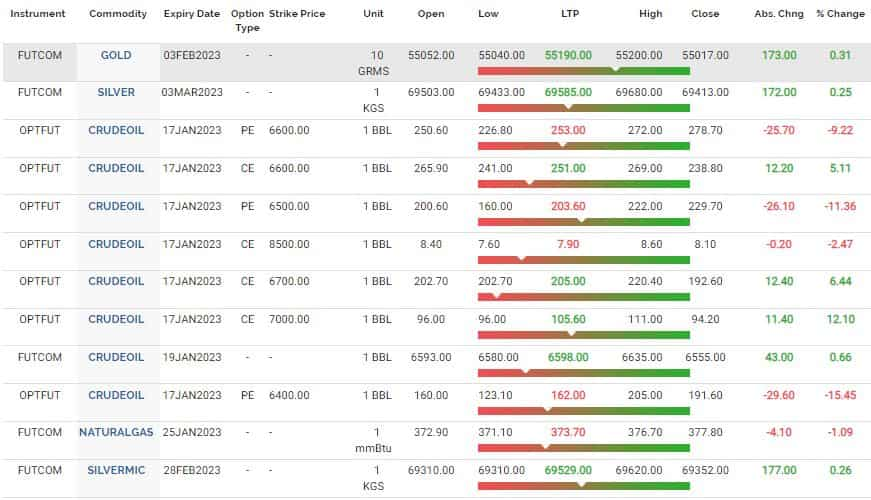

Commodity: Key commodities gold, silver and oil will track movement of the Dollar Index. MCX February Gold futures were trading at Rs 55176 per 10 gram, up Rs 159 or 0.29 per cent. March Silver futures Rs 69,585, up by Rs 172 or 0.25 per cent.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:24 PM IST

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points

FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500

FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500 FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627

FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627