Even as Sensex turns negative so far in 2022, index likely to test 66,600 by FY24; Stay Put says ICICIdirect

Indian market started off on a strong note but persistent selling by foreign investors as well as rising geopolitical concerns dented sentiment and pushed benchmark indices in red for the year 2022.

Indian market started off on a strong note but persistent selling by foreign investors as well as rising geopolitical concerns dented sentiment and pushed benchmark indices in red for the year 2022.

The S&P BSE Sensex fell 0.7 per cent, while the Nifty50 is down 0.4 per cent so far in the year 2022, data as on 18 February showed.

However, investors who have a long-term horizon can look at putting fresh money into equity markets now or on dips as the structural trend still remains to be on the upside.

See Zee Business Live TV Streaming Below:

The S&P BSE Sensex could well surpass its peak of 62245 and head towards 66,000 while Nifty50 could also surpass 18,600 and hit 20,000, said a report.

Most of the volatility is seen in Indian markets is largely on account of external events. The commentary from Budget 2022 as well as the Reserve Bank of India (RBI) highlighted that the government wants growth.

Once we find some stability. the focus will shift back to earnings. Global as well as Indian equity markets have been quite volatile in the recent past, primarily tracking inflation-led interest rate hike outlook by global central banks, geopolitical tensions, and rise in crude prices.

“Corporate earnings, a true barometer of the health of the market, on the other hand, have been quite resilient with growth momentum continuing unabated,” ICICIdirect said in a report.

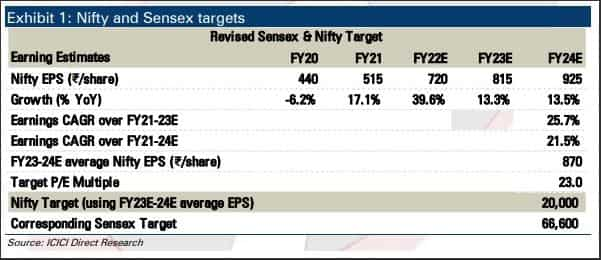

“FY23E estimates remain unchanged at Rs 815/share. Incorporating FY24E numbers, we expect Nifty earnings to grow at over 20% CAGR over FY21-24E,” it said.

Keeping our index targets intact ICICIdirect now value the Nifty at 20,000 i.e. 23x PE on FY23-24E average EPS of | 870/share, and about 66,600 for the S&P BSE Sensex.

What should investors do?

The December quarter earnings were strong and most of the micro and macro indicators suggest that economic growth is likely to remain strong – investors should not miss out on the opportunity to buy the dip.

ICICIdirect in the report said that the management commentary is optimistic and hopeful of a strong rebound, going forward. Other macroeconomic indicators viz. GST collection, e-way bill generation, advance tax collection, etc, also point to a better-than-expected economic rebound.

The shot in the arm is the capital expenditure outlay in Union Budget 2022-23 (Rs 7.5 lakh crore, up 35% YoY) that is expected to have a multiplier effect across the domestic economy.

At the Nifty index level, on QoQ basis, sales, PAT growth for Q3FY22 is pegged at 11%, 9% respectively, highlighted in the ICICIdirect note. On a YoY basis, growth is even more stupendous at 25%+ each tracking commodity price-led benefits in metals and oil & gas space.

“We believe that the present market volatility offers an opportunity to build a long-term portfolio of quality companies, which have lean b/s, are capital-efficient & have growth longevity,” it said. Bet on Capex linked capital goods, commercial vehicle space and PLI oriented domestic manufacturing play

Preferred Investment Destination:

Foreign portfolio investors (FPIs) have withdrawn a net Rs 18,856 crore from the Indian markets in February so far amid geopolitical tensions and chances of a rate hike by the US Federal Reserve. This is the fifth consecutive month of foreign fund outflows, PTI reported.

Also Read: FPIs pull out Rs 18,856 cr from Indian markets in February so far

But experts feel that outflows are temporary and flow will reverse as India is still the preferred investment destination amid strong macros and expectations of double-digit earnings growth, suggest experts.

“The market welcomed the bold CAPEX-oriented budget and reacted positively post the announcement. However, FPI outflow continues to impact near-term performance and exert pressure,” Mitul Shah, Head of Research – Institutional Desk at Reliance Securities, said.

“Going forward we expect this volatility would settle in the next 1-2 months and FPI inflow would begin in FY23. We expect Indian equities to outperform with double-digit returns. Our year-end 2022 target for Nifty is 20,000 at 22x FY24E earnings,” he said.

Shah expects the Nifty to enjoy premium valuation for the next 1-2 years on the back of higher earnings CAGR (before reaching a stable earnings pace of growth), as India becomes a preferred destination for global manufacturing, going ahead.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

10:58 AM IST

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts  Indian markets will remain under pressure amid global rate cuts: Report

Indian markets will remain under pressure amid global rate cuts: Report FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows

FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts

Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts  FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%

FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%