Zee Business Stock, Trading Guide: 10 things to know before market opens on 18 November 2022

The decline was widespread wherein auto, media and IT lost over a percent each. The broader indices too remained under pressure and lost nearly half a percent each on Thursday.

Zee Business Stock and Trading Guide: The Indian Markets remained range bound and lost nearly half a percent amid mixed cues. The Nifty index traded dull in a narrow range for most of the session however decline in the last half an hour pushed the index in the red.

Nifty and Sensex settled at 18,343.9 and 61,750, each down around 0.4 per cent. The decline was widespread wherein auto, media and IT lost over a percent each. The broader indices too remained under pressure and lost nearly half a percent each on Thursday.

Here is a list of things to watch out for on 18 November 2022

What should investors do?

The recent market structure is pointing towards the possibility of some profit-taking or consolidation ahead. However, we expect Nifty to hold the 17800-18100 zone.

The prevailing underperformance on the broader front is already hurting sentiment and it might deteriorate further during the corrective phase. We thus reiterate our view to remain selective and focus on position sizing.

- Ajit Mishra, VP - Research, Religare Broking Ltd

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.36 per cent higher at 18,343. Key Pivot points (Fibonacci) support for the index is placed at 18318.14, 18293.43 and 18253.43, while resistance is placed at 18398.13, 18422.84, and 18462.83.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.18 per cent higher at 42,458. Key Pivot points (Fibonacci) support for the index is placed at 42384.64, 42324.17, and 42226.3, while resistance is placed 42580.37, 42640.84, and 42738.7.

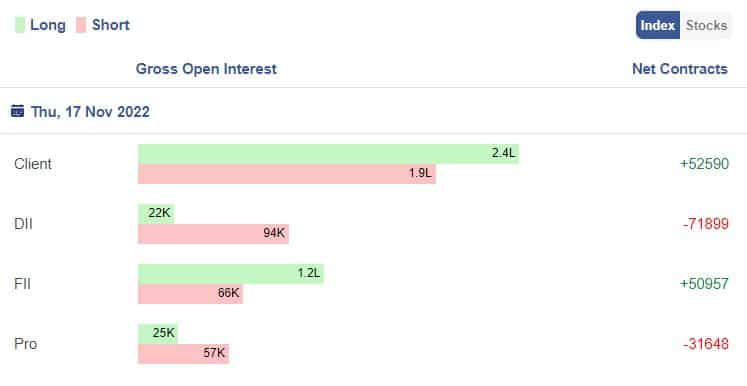

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

CSB Bank: The Reserve Bank of India approves Bhama Krishnamurthy's appointment as part-time Chairperson

Vedanta board meeting on November 22 to consider third Interim Dividend for FY23.

Fortis Healthcare: SEBI asks IHH to get Delhi HC order to proceed with Open Offer

BEL signs MoU with AWEI to address needs of domestic and export markets

Ultratech Cement starts operations at the company's third Birla White Wall Care Putty plant at Nathdwara, Rajasthan with a capacity of 4 lakh mt per annum, at a total cost of Rs 187 cr

Corporate Action

Astral Limited: Ex-date interim dividend 120% at Rs 1.25 per share

Emami: Ex-date interim dividend 400% at Rs 4 per share

ESAB India: Ex-date interim dividend 300% at Rs 30 per share

HAL: Ex-date interim dividend 200% at Rs 20 per share

Info Edge: Ex-date interim dividend 100% at Rs 10 per share

La Opala RG: Ex-date interim dividend 100% at Rs 2 per share

MSTC: Ex-date interim dividend 55% at Rs 5 per share

FII Activity on Thursday:

Foreign portfolio investors (FPIs) remained net buyers for Rs 618.37 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 449.22 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

One 97 Communications Ltd: SVF India Holdings (Cayman) Limited sold 2,93,50,000 equity shares in the company at the weighted average price Rs 555.67 per share on the NSE, the bulk deals data showed.

Hi-Tech Pipes Limited: Mahesh Dinkar Vaze sold 1,35,000 equity shares in the company at the weighted average price Rs 596.61 per share on the NSE, the bulk deals data showed.

CMS Info Systems Limited: Purvi Prabhatchandra Jain sold 56,067 equity shares in the company at the weighted average price Rs 235.22 per share on the NSE, the bulk deals data showed.

Amiable Logistics (I) Ltd: Prakashbhai Mahendrabhai Dave bought 17,600 equity shares in the company at the weighted average price Rs 143.2 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Balrampur Chini, BHEL, Delta Corp, GNFC, Sun TV and Indiabulls Housing Finance are placed under the F&O ban for Friday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

11:51 PM IST

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday

Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today