Stock Market on Friday: Watch out for these 10 triggers that could impact movement in Sensex, Nifty

Anil Singhvi Strategy on Nifty, Bank Nifty: Zee Business Managing Editor said that Nifty50 will find support at 17,400-17,500 while resistance at 17,727-17,800. As for Bank Nifty, support is seen at 40,150-40,300 while resistance is seen at 41,000-41,200

Stock Markets on Friday, 2 February: Rout in Adani Group stocks created havoc on Dalal Street on Thursday, yet again. While S&P BSE Sensex appears less affected, it is NSE Nifty50 which is bearing the maximum brunt. On Thursday, broader Market Nifty settled at 17,610.40, down by nearly 6 points or 0.03 per cent pulled down by Adani Enterprises stock that fell a whopping 27 per cent.

Domestic markets traded today traded under the influence of Budget 2023 announcements and US Federal Reserve FOMC outcome – two back-to-back events that were held on Wednesday.

When markets reopen on Friday, benchmark indices Sensex and Nifty will take cues from a host of local and global triggers. Zee Business has collated 10 factors that could determine movement today.

1) US Markets: Frontline indices on Wall Street were trading mixed. While Dow 30 was down by 180.15 points or 0.53 per cent at 33,912.80, S&P 500 was trading at 4,158.45, up by 39.24 points or 0.95 per cent. Nasdaq Composite surged by 274 points or 2.33 points at 12,091.20. Dow Futures at the time of filing the story were trading at 33,924.50, lower by 168.50 points 0.49 per cent. Meanwhile, Singapore-based SGX Nifty, an early indicator of movement in Nifty50 was trading at 17,646, up by 7 points or 0.04 per cent.

Indian markets will take cues from the Thursday closing of benchmark indices on Wall Street and movement of Dow futures and SGX Nifty futures on Friday.

2) Rupee Vs Dollar: The rupee fell 40 paise to close below the 82 per US dollar mark on Thursday, weighed down by foreign fund outflows and corporate dollar demand. At the interbank foreign exchange market, the rupee opened at 81.81 against the greenback, and touched an intra-day high of 81.71 and a low of 82.20. It finally settled at 82.20 (provisional), down 40 paise over its previous close. On Wednesday, the rupee had appreciated 8 paise to close at 81.80 against the dollar after Finance Minister Nirmala Sitharaman presented the Union Budget for 2023-24. The dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.12 per cent lower at 101.10, after the US Fed hiked the interest rate along expected lines by 25 basis points to 4.50-4.75 per cent.

3) Q3 Results: Several listed companies announced their December quarter results on Thursday. Among them were Birla Soft, Redington, Tata Consumer Products, Dabur India, Bajaj Electricals, Titan and others.

Many companies will declare their quarterly earnings on Friday. Aarti Industries, Bank of Baroda, BCG, BRPL, Indigo, Intellect Design Arena, JK Tyre, Jubilant Pharmova, Birla Soft, Mahindra & Mahindra and others. In the Nifty50 pack ITC will announce its results.

4) Stocks in News: Expect stock specific action in companies based on news. Likhitha Infrastructure gets order worth Rs 1.3 billion; HDFC Life Insurance says it is analyzing impact of budget on insurance; Adani Enterprises; Engineers India, which has received the order from Ministry of Housing and Urban Affairs. Investors must watch out for Adani Group shares as well.

5) Bulk Deals: Half a dozen companies witnessed bulk deal action today. The companies are Akash Infra-Projects Ltd, GTL Limited, Marshall Machines Ltd, Mold-Tek Technologies Ltd, Sah Polymers Limited and Sapphire Foods.

6) FII / DII Action: Foreign institutional investors were net sellers of Indian equities at Rs 3065.35 crore while domestic institutional investors were net buyers at Rs 2371.36 crore.

7) Stocks in Ban: Securities in ban for trade on 3 February, 2023 are Adani Ports and Ambuja Cements.

8) Anil Singhvi Strategy on Nifty, Bank Nifty: Zee Business Managing Editor said that Nifty50 will find support at 17,400-17,500 while resistance at 17,727-17,800. As for Bank Nifty, support is seen at 40,150-40,300 while resistance is seen at 41,000-41,200.

#BazaarAajAurKal में देखिए आज के शेयर बाजार का लेखा-जोखा और कल के बाजार का अनुमान @rainaswati | @AnilSinghvi_ https://t.co/JIuO93DqYE

— Zee Business (@ZeeBusiness) February 2, 2023

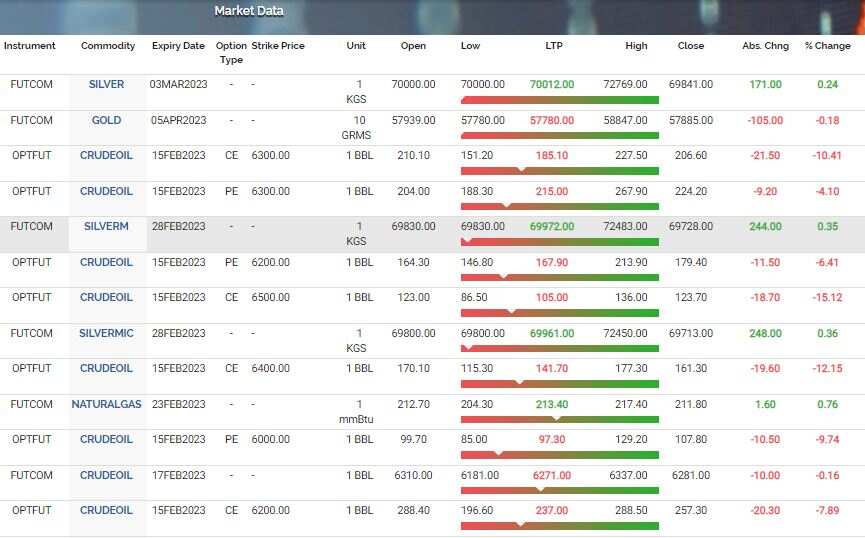

9) Commodity Markets: Dollar movement is key to how commodities trade on Friday. Bullion, crude oil and metals will take hints from the Dollar Index strength or weakness. Commodity expert Anuj Gupta of IIFL Securities recommends a buy in bullion, He sees Gold futures hitting levels of Rs 60,000 per 10 gram while Silver futures testing RS 74,000 per kg by March.

Expert Take

"The bears continued to be at the helm and the Nifty witnessed a gap-down opening on Thursday, February 2, 2023, where prices formed an intraday low at 17,445.95 in the first 5 mins candle. Prices protected their initial intraday low and traded sideways with above-average volatility throughout the day.

Prices on the daily chart are continuously showing an effort to close above their 200 EMA which is placed at 17,550 levels. From the past five days Nifty is hovering within the range of 17,900 – 17,400 levels. Any breakout or breakdown above or below the mentioned levels will trigger the next directional move in the benchmark index.

The immediate sentiment is likely to remain weak as long as Nifty remains below its 9 EMA which is placed at 17758 levels." -- Rohan Patil, Technical Analyst at SAMCO Securities

"The rout in Adani group stocks continued to play havoc as benchmark indices gyrated sharply intra-day before recouping lost ground on buying in IT and banking stocks. However, power, energy, oil & gas, and utility stocks were plundered as investors continued to exit in view of dampening sentiment. More than external factors, investors' sentiments have been hurt by the domestic mood. Technically, the Nifty hovered between 17450 to 17650 range and also formed an inside body candle on daily charts which indicates the continuation of a range bound activity in the near future. However, a pullback rally is possible if the index trades above 17500. Above the same, it could move up to 17700-17750. On the flip side, a fresh selloff is possible only after the dismissal of 17500 and below the same the index could retest the level of 17380-17350." -- Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd

"The Nifty witnessed swings in both the directions on February 02 & ultimately posted a minor negative close. Despite multiple attempts, the index couldn’t sustain in the positive territory. The hourly chart shows that the 20 HMA acted as a cap on the higher side, whereas the hourly lower Bollinger Band offered support to the index. Thus 17650 – 17450 is the tight range within the overall short term range of 17350-18000. The bulls can get some relief if the index crosses 17650-17700 area on the higher side." -- Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:40 PM IST

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points

FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500

FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500 FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627

FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627