Sensex ends 330 points down, Monday blues for Nifty too as metals, IT take hit

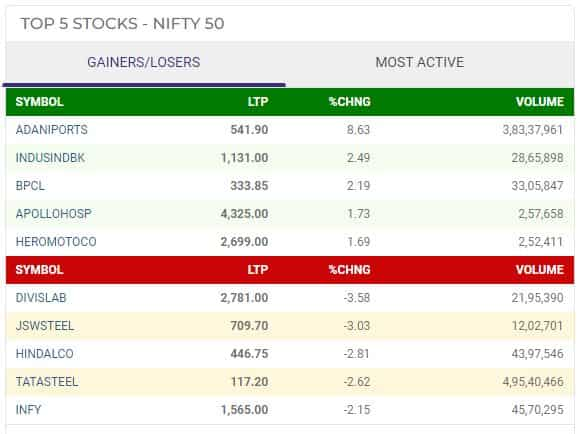

In the 50-stock Nifty50, 16 stocks advanced. The top gainers were Adani Ports, Indusind Bank, BPCL, Apollo Hospitals and Hero MotoCorp while the top losers were Divi's Laboratories, JSW Steel,Hindalco Industries, Tata Steel and Infosys.

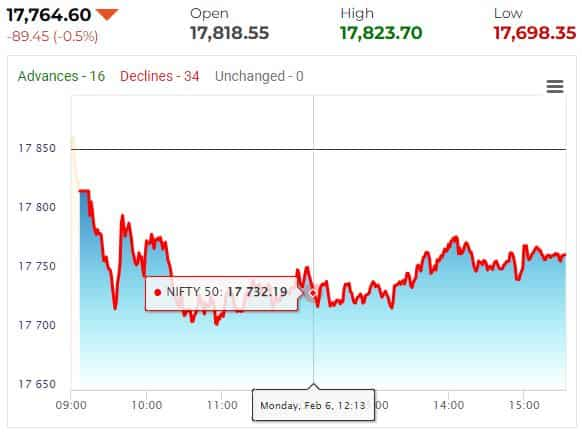

Indian frontline indices S&P BSE Sensex and NSE Nifty 50 traded lackluster on Monday and ended with declines. While Sensex close at 60,506.90, down by 334.98 points or 0.55 per cent, the broader market Nifty50 settled at 17,764.60, down by 90 points or 0.50 per cent. The banking gauge Nifty Bank finished at 41,374.65, lower by 125.05 points or -0.3 per cent.

The ebbing in market sentiments was on strong non-farm payroll data reported in the US. Almost 517,000 jobs were added in January far ahead of the street's expectations of 193,000 jobs. This has led to a renewed fear that Federal Reserve will unlikley contemplate on rate pause. Moreover, ISM services PMI unexpectedly surged to 55.2 in January sharply above estimates of 50.5, PTI reported. Unemployment rate declined to 3.4 per cent in January compared to forecast of 3.6 per cent.

In the 50-stock Nifty50, 16 stocks advanced. The top gainers were Adani Ports, Indusind Bank, BPCL, Apollo Hospitals and Hero MotoCorp while the top losers were Divi's Laboratories, JSW Steel, Hindalco Industries, Tata Steel and Infosys.

Infosys, Reliance Industries and ICICI Bank accounted for a mojor share of loss in the benchmark indices owing to the weight they carry.

Selling pressure was seen in most indices with profit booking more prominent in Nifty IT (-0.61 per cent), NIfty Metal (-2.20 per cent) and Nifty Financial Services (-0.41 per cent). The sectors which were on top were Nifty FMCG (+0.56 per cent), Nifty Media (+0.78 per cent) and Nifty Realty (+0.52 per cent).

India VIX, a a measure of volatility in Nifty was up 2.01 per cent at 14.69.

There was stock-specific action in broader markets. The Nifty Mid Cap 100 closed at 30,670.65, higher by 292.55 points or 0.96 per cent. In the 100-share index, 61 advanced. The top gainers were Vodafone Idea, Zydus Lifesciences, Mahindra & Mahindra Finance while the top losers were Adani Wilmar, LIC Housing Finance and Jindal Steel. In the Nifty Small Cap 100 index, 55 stocks gained, 44 declined while 1 remained unchanged. The index closed at 9,466.40, up by 50.85 points or 0.54 per cent.

Out of 3,791 stocks that traded on the BSE, advances were seen in 1,900 while declines in 1,695; 196 remained unchanged.

Rupee Vs Dollar

The rupee fell by 65 paise to close at 82.73 (provisional) against the US currency on Monday, weighed down by gains in the greenback in the overtseas markets and a muted trend in domestic equities. Sustained foreign fund outflows and firm crude oil prices further dented investor sentiments, forex traders said and PTI reported.

At the interbank foreign exchange market, the rupee opened at 82.35 against the greenback, and fell to an intra-day low of 82.76. It finally settled at 82.73 (provisional), down 65 paise over its previous close. In the previous session on Friday, the rupee settled at 82.08 against the US dollar.

The dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.24 per cent higher at 103.16, on robust economic data from the US, which raised expectations of a hawkish Federal Reserve.

"Dollar gained on robust economic data from the US raising expectations of hawkish Federal Reserve," Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas said. "We expect the rupee to trade with a negative bias as the rebound in Dollar may further weaken the domestic currency. Weak domestic equities and FII outflows may also put downside pressure on Rupee," Choudhary said.

Global oil benchmark Brent crude futures advanced 0.45 per cent to USD 80.30 per barrel.

"Rupee opened weaker by about 60 paise due to higher dollar index and lower Asian currencies. Oil and Gold remained on the down side as dollar index rose further to 103.20," Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said.

"Rupee looks a bit vulnerable as oil companies continue with their buying but have a feeling that USD should get sold off at this level as rupee has not gained at lower dollar index. Market now awaits for the MPC meeting which is currently underway and decision will be announced on 8th February. Range for tomorrow 82.30 to 82.90," Bhansali said.

Expert Take

"The Nifty opened on a negative note on February 06 & moved lower in the beginning of the session. However, the key hourly moving averages offered support on the downside & restricted further downside. Consequently, the index traded in a sideways manner as the day progressed & ultimately formed an Inside bar on the daily chart. Going ahead, 17700 & 17870 are key support & resistance respectively. The index has a potential to stretch towards the 18000 mark as long as it stays above 17700." -- Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:28 PM IST

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points

FIRST TRADE: Nifty falls below 24,000; Sensex down 720 points FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500

FIRST TRADE: Sensex falls over 150 points, Nifty below 24,500 FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627

FIRST TRADE: Equities open weak; Sensex down 38 points, Nifty at 24,627