Sector Spotlight: Hindalco, Tata Steel, National Aluminium are stocks to buy, says analyst

Nifty Metal index is likely to test level of 7,200 and once it is breached an upside up to 7,500 will open, technical expert Niesh Jain says. He sees a strong support at 6,600 and recommends a buy on decline strategy

Metal sector was under spotlight on Monday as Indian stock markets began 2023 on a positive note. Metal sector gauge Nifty Metal ended at 6,886.65, up 163.25 points or 2.43 per cent and was the best performing sector today. In the 15-share index, 14 ended in the green with Steel Authority of India (SAIL), Hindustan Copper and MOIL finishing as top gainers.

The said stocks were up 7.62 per cent, 6.66 per cent and 5.87 per cent respectively. The loser was Adani Enterprises.

Technical Analyst Nilesh Jain is bullish on metal sector and recommended three stocks to buy for January series.

He said that Nifty Metal index is likely to test level of 7,200 and once it is breached an upside up to 7,500 will open. He sees a strong support at 6,600 and recommends a buy on decline strategy. The stock has emerged from a multi-month rounding bottom pattern breakout. The index hit its lifetime high today.

Jain is Assistant Vice President - Lead Derivative and Technical Research at Centrum Broking.

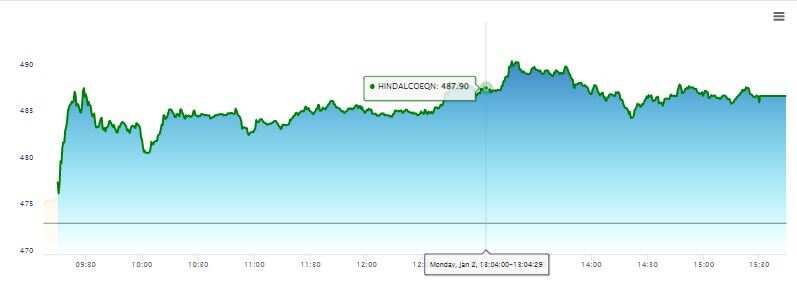

Buy: Hindalco Industries | CMP: Target: Rs 550 | Stop Loss: 450 | Upside: 13%

Hindalco shares ended at Rs 486.50 on the NSE and were up 13.15 or 2.78 per cent from the Friday closing price. Jain recommends buy on decline and at current levels. He gives targets of Rs 530 and Rs 550.

Meanwhile, brokerage firm Jefferies has raised the target on Hindalco Industries from Rs 390 to Rs 600 while upgrading its view from ‘Hold’ to ‘Buy’. The stock was recommended at a price of Rs 473.

The stock has given 2.4 per cent returns over a period of 1 year and has underperformed the Nifty50 index by 2.4 per cent which has returned 4.9 per cent during this time.

Momentum indicators RSI and MFI are at 63.1 and 61.7 respectively. A number below 30 is considered oversold and above 70 seen as overbought.

Buy: Tata Steel | CMP: 119.10 | Target: Rs 130 | Stop Loss: 114 | Upside: 9%

Tata Steel shares ended at Rs 119.10, up by Rs 6.45 or 5.73 per cent. This stock is poised for an upside from current levels, the Centrum analyst said.

Jefferies has also revised its target upwards on Tata Steel from Rs 95 to Rs 150 with a buy recommendation from hold.

Tata Steel shares have outperformed the broader market Nifty50 by 2.4 per cent giving returns of 7.3 per cent.

Momentum indicators RSI and MFI are at 66.2 and 68.5 respectively.

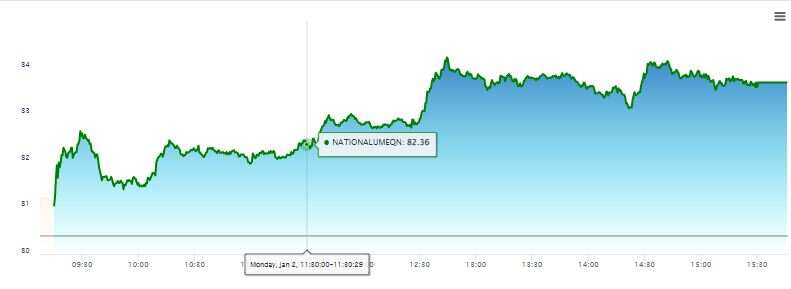

Buy: National Aluminium | CMP: 83.60 | Target: Rs 90 | Stop Loss: 79 | Upside: 8%

Another stock picked by him was National Aluminium Company. It has been a sector underperformer, he said. The current chart structure suggests a positive outlook, he added. Buying is recommended for a price target of Rs 90. This is with a positional term view. The stock ended at Rs 83.60, down by Rs 3.20 or 3.98 per cent.

National Aluminium shares have underperformed the broader market Nifty50 by over 22 per cent giving negative returns of 17.1 per cent.

Momentum indicators RSI and MFI are at 66.2 and 68.5 respectively.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

08:02 PM IST

Tata Steel engages with miners NMDC, OMC to secure future iron ore needs By Abhishek Sonkar

Tata Steel engages with miners NMDC, OMC to secure future iron ore needs By Abhishek Sonkar Tata Steel reports Rs 759 crore net profit in Q2

Tata Steel reports Rs 759 crore net profit in Q2 Tata Steel Q2FY25 preview: Weak pricing, high costs to weigh on earnings

Tata Steel Q2FY25 preview: Weak pricing, high costs to weigh on earnings Tata Steel UK signs contract for electric furnace in green steelmaking drive By Aditi Khanna

Tata Steel UK signs contract for electric furnace in green steelmaking drive By Aditi Khanna Tata Steel, L&T Finance & More: Brokerage recommends buying these 7 stocks for up to 3 months for huge profit| Check targets, stop losses

Tata Steel, L&T Finance & More: Brokerage recommends buying these 7 stocks for up to 3 months for huge profit| Check targets, stop losses