Sector Spotlight: Buy SBI, ICICI Bank for gains as banking, financial sector stocks poised for gains, says analyst

ICICI Bank: Buy| LTP: Rs 886.50 | Target: 920 | Stop Loss: Rs 525| Upside 5% | The second largest private bank in terms of market capitalisation will announce its quarterly results on 22 October 2022

Domestic stock markets ended Monday in deep green with benchmark indices closing in the green. While the BSE Sensex closed at 58,410.98 and was up by over 491 points or 0.85 per cent from the Friday closing price, the Nifty50 index settled at 17311.80, up by 126 points or 0.73 points. In the 30-stock Sensex, 23 shares gained while remaining 7 were the losers. As for the 50-share Nifty50, 37 advanced and 13 declined.

Out of the 15 sectoral indices on NSE, 3 were losers at the closing time while the rest were in the green in the closing time. Banking and financial services stocks were among the top gainers with Nifty PSU Bank index hogging the limelight. It was up nearly 3.5 per cent. The next top performer was Nifty Bank which was up by 1.56 per cent and settled at 39,920.45. Nifty Financial Services was higher by 1.15 per cent. Another non-banking sector which gained traction was Nifty Oil & Gas (0.65 per cent).

Nifty Bank is poised for an upside and could test levels between 45000 and 48000, technical analyst Nilesh Jain opines. He said that this banking sector is now under the spotlight. He sees support at 39500.

All 12-stocks closed positively in the Nifty Bank. The biggest gainers were Bank of Baroda (BoB), Punjab National Bank (PNB) and State Bank of India (SBI) which gained by nearly 5 per cent 3.5 per cent and 3 per cent at the day’s closing.

Jain, who is Assistant Vice President - Lead Derivative and Technical Research at Centrum Broking recommended two stocks for gains. He picked SBI and ICICI Bank for gain over a short term period. He said that both the stocks are likely to ride the momentum in the sector.

SBI: Buy| LTP: Rs 543.20 | Target: Rs 570| Stop Loss: Rs 525| Upside 5%

The stock was up by 3 per cent or Rs 16 on Monday and traded with large volumes (1,34,85,349 shares). The stock is poised for a 5 per cent upside and suitable for investors or traders who wants to make quick gains. The stock has moved both ways obver the last 10 trading sessions during this month, giving opportunities to make entries or book profits. Jain said that the stock can be bought at current levels or on declines.

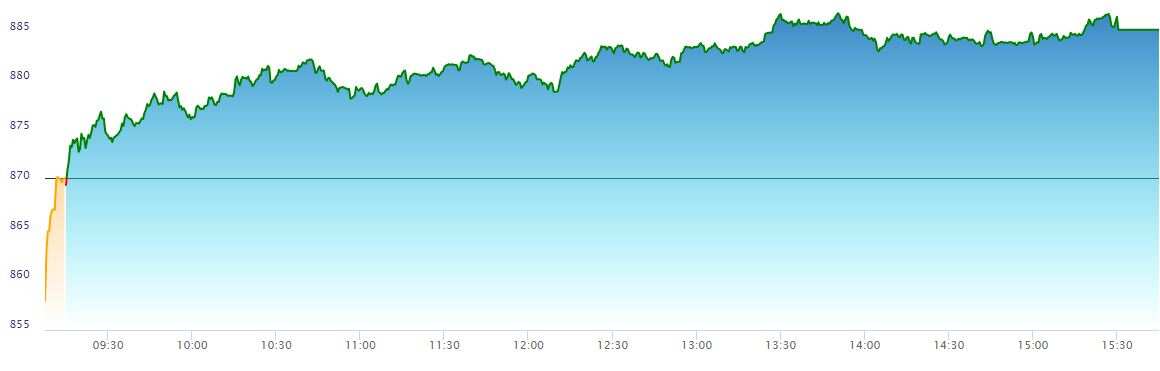

ICICI Bank: Buy| LTP: Rs 886.50 | Target: 920 | Stop Loss: Rs 525| Upside 5%

Another stock that will likley to have traction this week will be ICICI Bank. The second largest private bank in terms of market capitalisation will announce its quarterly results on 22 October 2022. The stock today gained nearly 2 per cent on the NSE. Jain said that the stock can be bought at current levels or on declines. The stock has moved both ways during this month.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

Latest FD Rates: Know what SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on 1-year, 3-year and 5-year fixed deposits

09:53 PM IST

Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag

Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag

Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag  GIFT Nifty down 40 points; markets to remain cautious ahead of Fed decision

GIFT Nifty down 40 points; markets to remain cautious ahead of Fed decision Vedanta declares Rs 8.5 per share interim dividend

Vedanta declares Rs 8.5 per share interim dividend  Final Trade: Sensex drops 384 pts; Nifty slips below 24,700; Titan BPCL top losers

Final Trade: Sensex drops 384 pts; Nifty slips below 24,700; Titan BPCL top losers