Russia-Ukraine war would leave oil prices elevated for months, may spike India's inflation; China's supply to bear maximum brunt

Oil prices shot up to trade near 7-year high in the previous session as Ukraine Crisis deepened and chances of Russia striking became more probable after Russia on Tuesday recognized two separatists held region in Ukraine as independent.

Oil prices shot up to trade near 7-year high in the previous session as Ukraine Crisis deepened and chances of Russia striking became more probable after Russia on Tuesday recognized two separatists held region in Ukraine as independent. However, Oil prices took a breather on Wednesday after the United States, Britain and the European Union on Tuesday announced sanctions focused on Russian banks. Besides, the potential return of more Iranian crude to the market, with Tehran and world powers close to reviving a nuclear agreement, also kept a lid on prices.

Meanwhile, as Russia is yet to back down, a probable war is in offing and that can hurt global oil prices further. As per ICICI Securities, Oil prices would remain elevated (well above US$90/bbl) for several months, once the US imposes additional sanctions on Russia, including its ability to export oil & gas, following a possible Russian invasion of Ukraine.

See Zee Business Live TV Streaming Below:

Sanctions on Russia in case Moscow launches an all-out invasion of its neighbour, it will not affect India directly given its less dependence on the world's second largest producer and exporter of crude oil for oil and gas needs. "India buys very little oil and gas from Russia, so the near-term disruptions to the Indian economy will be minimal (apart from the higher oil-import bill)," highlights ICICI Securities.

How Russia-Ukraine war impacts India?

Russia accounts for 11% of global crude-oil exports. If sanctions take about 60% of this off global markets (with China, Belarus, and a few other customers possibly defying the sanctions), world crude-oil supply would decline by 3mmbd, and the Brent crude price would likely shoot above US$110/bbl, says te brokerage.

Though a possible war among the two nations does not hurt India directly, but it will see its impact in two ways:

1 Higher crude oil prices will keep CPI inflation higher for longer, pushing the RBI to raise rates more than the two hikes as expected in August-December’22 by the brokerage. Though it can be contained if the government decides to cut excise duties on petrol and diesel sharply to arrest fuel inflation.

2. Secondly, It will hurt India's trade route given the EU is the biggest market for India’s exports.

On the brighter side, supply disruptions to the EU would generate greater demand for steel, engineering goods, etc., of which India is an alternate supplier. "So, the factors that caused India’s exports to outperform the world in CY21 will continue to hold in CY22, allowing exports to remain robust," says the brokerage.

Which countries will take direct hit if things go south between the two nations?

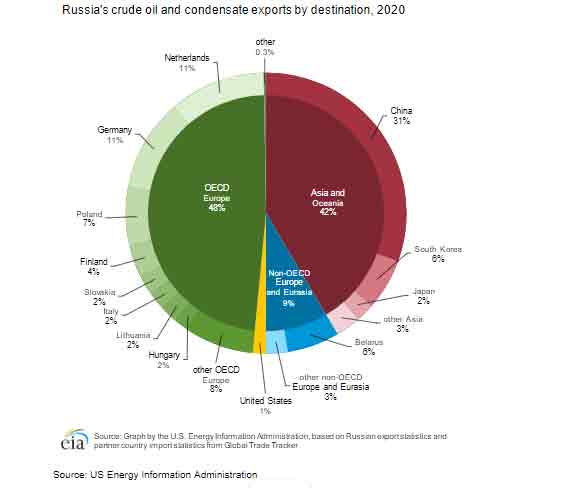

Russia exports about 5mmbd (million barrels per day) of crude oil, more than half of which goes to Europe and 42% to Asia. The largest single customer for Russia’s oil exports is China, which takes 31% of the total share, followed by Germany and the Netherlands (11% each), Poland (7%), Belarus and South Korea (6% each).

Sanctions on Russia to hit China hard

Any sanctions on Russia will hit China’s access to oil, but have little direct impact on India. "Countries defying sanctions would face reprisals from the western banking system –and this could prove very disruptive to China’s ability to participate in the global trading system unhindered. This would offer a potentially positive opportunity for India as an alternative supplier of manufactured exports, although the primary initial benefits would flow to ASEAN, Taiwan, Korea and Japan," underlines brokerage research.

"Oil price may hit triple digit anytime"

The Ukraine crisis has the oil market on its toes. The intensifying diplomatic stand-off and military escalation are raising fears of energy trade sanctions and disruptions. Given this nervousness, it seems that oil prices may be hitting triple digits anytime. However, if history is any guide, such a burst of geopolitical fears may be short-lived," says Norbert Rücker, Head of Economics & Next Generation Research, Julius Baer.

Meanwhile, speaking of gas reserves, Russia has the largest reserves of natural gas in the world (1688trn cubic feet, Tcf, as of the beginning of 2021), well ahead of Iran (1200Tcf), Qatar (843Tcf), the US (465Tcf) and Turkmenistan (400Tcf), but is the second-largest annual producer of natural gas after the US.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

12:46 PM IST

Russia extends countermeasures against Western oil price cap

Russia extends countermeasures against Western oil price cap ONGC, Oil India fall; Chennai Petroleum and MRPL trade with gains up to 3% as centre scraps windfall gains tax on crude

ONGC, Oil India fall; Chennai Petroleum and MRPL trade with gains up to 3% as centre scraps windfall gains tax on crude  Oil prices near flat as demand worries offset Middle East risk

Oil prices near flat as demand worries offset Middle East risk Saudi Arabia cuts February Arab Light crude price to Asia to 27-month low

Saudi Arabia cuts February Arab Light crude price to Asia to 27-month low Commodity Capsule | Crude oil prices range-bound, copper moves up | Watch video

Commodity Capsule | Crude oil prices range-bound, copper moves up | Watch video