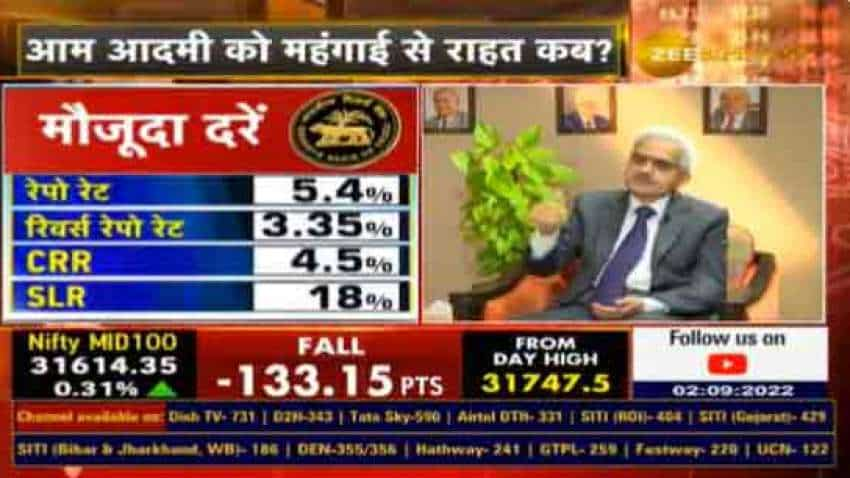

RBI Governor ZEE BIZ EXCLUSIVE INTERVIEW: What Shaktikanta Das said about time lag between lending and deposit rates, increase in EMIs

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, on Friday said that it is important to strike a balance between lending and deposit rates.

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, on Friday said that it is important to strike a balance between lending and deposit rates. The RBI Governor was responding to a question posed by zee Business Managing Editor Anil Singhvi in an exclusive interview on Friday.

Zee Business Managing Editor said it has often been noticed that whenever lending rates are hiked, EMIs rise immediately too, however, deposit rates do not increase in the same proportion.

To which, Das said the external benchmarking introduced by the RBI ensures that there is a minimum gap between the two rates. Even deposit rates are also increasing, he said. "The rates at which banks offer loans are linked to lending rates. They work in tandem and increase or decrease in proportion to the lending rate or the rate at which banks offer loans," said the RBI Governor.

We are reducing the gap between the increase in these rates through our liquidity management policy, which gradually pulls out excess liquidity in circulation.

RBI गवर्नर शक्तिकांता दास का #EXCLUSIVE हिंदी इंटरव्यू

लेंडिंग और डिपॉजिट ब्याज दरों के बीच तालमेल पर क्या बोलें RBI गवर्नर?

डिपॉजिट ब्याज दरों में कब होगी बढ़ोतरी?

देखिए अनिल सिंघवी के साथ...

देखिए पूरा इंटरव्यूhttps://t.co/L4gNUuTpyH@RBI @DasShaktikanta @AnilSinghvi_ pic.twitter.com/WOHKhDI310

— Zee Business (@ZeeBusiness) September 2, 2022

"This further puts pressure on banks to raise funds, which they do by increasing deposit rates. This has been happening and deposit rates will continue to rise in almost the same proportion to the lending rate hike," he added.

Earlier, speaking on inflation, he said inflation has peaked out in India. In current scenario, global factors are playing out more on inflation in India.

"It is a global phenomenon. Inflation has globalised. In India, it has peaked and will come down gradually over the time," he said.

On growth and inflation, the RBI Governor said tackling inflation is the priority of the top bank. At the same time, we will try to ensure it does not affect growth much, he said.

Shaktikanta Das said as far as India's growth is concerned, I am very confident.

"We will keep monitoring it and take the necessary action as and when required," he said.

He said slowing world economy will also impact the country, however, so far, we are progressing well on this front.

On guidance, he said it is easy to give guidance when you cut interest rates, but the situation is changing rapidly and hence it will be difficult to say anything on this topic.

He said we are performing well on the agriculture sector front, while India's position on forex reserve is also strong.

Speaking on the devaluation of rupee, he said the Indian currency has fallen less in comparison to other currencies, while bank's capital adequacy ratio has also improved

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

07:03 PM IST

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today