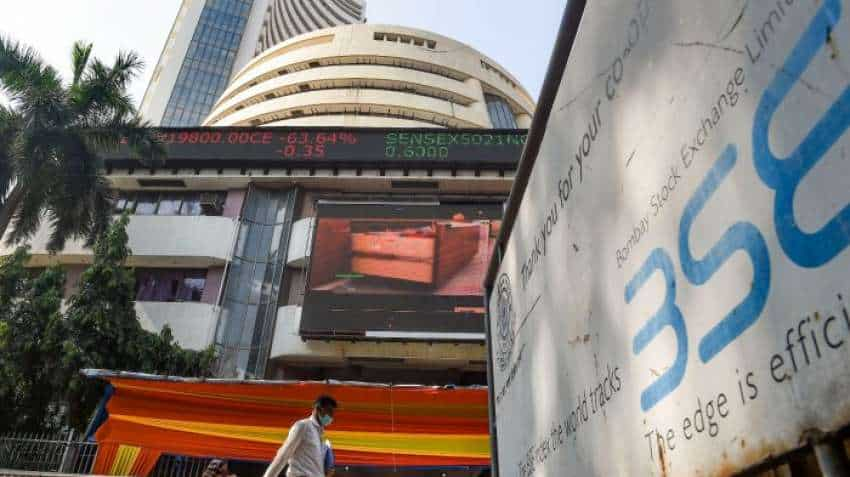

Q4 results, US Fed interest, LIC IPO, macro data among others to drive market in holiday-shortened next week: Experts

Santosh Meena, Head of Research, Swastika Investmart Ltd said, "The market is likely to kick off this week on a sombre note after a sharp fall in the US market then the focus will shift to the outcome of the US FOMC meeting, which is crucial amid record inflation and growth worries.”

The US Fed interest rate decision, ongoing Q4 earnings, Life Insurance Corporation IPO and domestic macroeconomic data announcements among others are the key triggers that are supposed to drive the market in a holiday-shortened next week, analysts believe.

The equity markets will remain closed on Tuesday, May 3, 2022, on account of for Id-Ul-Fitr (Ramzan Id).

Santosh Meena, Head of Research, Swastika Investmart Ltd said, "The market is likely to kick off this week on a sombre note after a sharp fall in the US market then the focus will shift to the outcome of the US FOMC meeting, which is crucial amid record inflation and growth worries.”

The FOMC meeting is scheduled for Wednesday and the Indian market may react to the same on Thursday.

Besides, the market analyst added that the global cues will dominate the domestic markets, apart from the FOMC meeting, there will be a release of BOE interest decisions, US payroll numbers, and worldwide PMI numbers.

This week is going to be a truncated one as the market will remain shut on Tuesday on account of Ramzan Eid, Meena said in his quote. The movement in commodity prices, dollar index and FIIs' behaviour will remain other key factors, he added.

On the domestic front, we will have monthly auto sales numbers whereas there will be lots of Q4 earnings, including Reliance, Britannia, HDFC Ltd, Adani Enterprises, Heromoto Corp, Tata Steel, Titan, Kotak Mahindra Bank and Tata Power, according to the analyst.

Along with other key triggers, Ajit Mishra, VP Research, Religare Broking said, “Participants will first react to auto sales numbers.”

"On the macro front, markets will be eyeing manufacturing PMI and services PMI data on May 2 and May 5, respectively. The much-awaited IPO of insurance behemoth, LIC, is opening for subscription on May 4. On the global front, the US Fed meeting outcome will be in focus," he added.

The country's largest life insurer LIC on Wednesday set the price band at Rs 902-949 per share for its Rs 21,000 crore initial public offering (IPO), which will open for subscription on May 4.

Yesha Shah, Head of Equity Research, Samco Securities, said, "Globally, the FOMC meeting will be in the limelight. As market participants attempt to read between the lines of Fed's policy actions, any surprises can result in panic reactions in global markets".

"Back home, the largest IPO, LIC, is poised to go public. Considering the mammoth issue size, the IPO is expected to test investors' appetite and the liquidity routed towards the IPO can mildly influence secondary markets."

Shah further added that the monthly auto sales numbers are likely to attract the attention of investors seeking to anticipate future patterns in auto stocks.

"All these events coupled with the current earnings season can make markets choppy this week," Shah said.

Markets would also track the investment pattern of foreign institutional investors, movement in Brent crude and the rupee.

"Going ahead, volatility is likely to continue as the focus will shift to central bank policy meetings at both the US Federal Reserve and the Bank of England. Apart from this, a slew of economic data releases, monthly auto sales data and ongoing earnings season will keep investors busy.

"The mother of all IPO - LIC will also hit Dalal Street on 4th May 2022, which could pull out liquidity from the market and exert some selling pressure," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd.

With Inputs from PTI

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

12:52 PM IST

Profit booking hits D-Street: Why BSE Sensex, Nifty50 gave up key levels on Thursday? Check factors behind fall

Profit booking hits D-Street: Why BSE Sensex, Nifty50 gave up key levels on Thursday? Check factors behind fall US Fed meeting, global cues, and foreign flows among others will dictate Indian markets next week – know technical outlook

US Fed meeting, global cues, and foreign flows among others will dictate Indian markets next week – know technical outlook