PTC India Financial shares tank 17% after directors resign on corporate governance issues

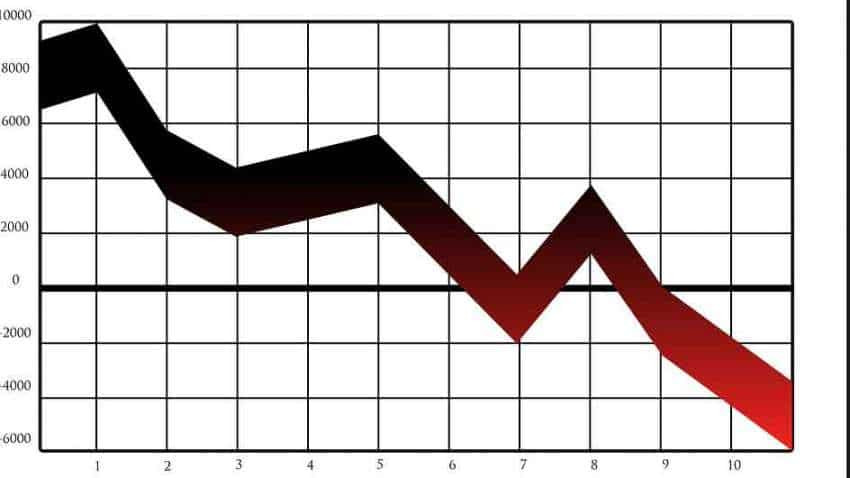

Shares of PTC India Financial services fell as much as 16.6% on Thursday, a day after the non-banking financial company said three independent directors had resigned, citing lapses in corporate governance.

Shares of PTC India Financial services fell as much as 16.6% on Thursday, a day after the non-banking financial company said three independent directors had resigned, citing lapses in corporate governance.

This comes after the financial services share surged nearly 12 per cent to fresh 52-week high of Rs 25.90 per share on the BSE on January.

See Zee Business Live TV Streaming Below:

At 9.55 am, shares of PTC Indian Financial Servies were trading lower by 13% or Rs 3.40 to Rs 22.25 apiece on the BSE.

The company said on Wednesday evening that it had received resignation letters dated Jan. 19 from independent directors Kamlesh Shivji Vikamsey, Thomas Mathew and Santosh Nayar.

In his resignation letter, Mathew said independent directors had flagged multiple times serious lapses in corporate governance and compliance.

I have placed on record many times - specially over the last few months my deep displeasure about the lack of appropriate information being made available to the board, Mathew wrote.

Some of the issues pointed out included the appointment of a whole-time director, non-disclosure of a forensic audit report regarding a loan account, and unilateral changes in loan conditions without board approvals.

PFS has been promoted by PTC India Ltd (PTC) as a company incorporated under the Companies Act 1956 and registered with RBI as a NBFC. It is a systemically important non-deposit taking NBFC classified as “Infrastructure Finance Company (IFC)” by RBI and is listed on the Bombay Stock Exchange Limited and the National Stock Exchange of India Limited. PFS, being an IFC, is engaged in the business of making investments in, and providing financing solutions to companies with projects in the power sector and related areas across the entire energy value chain. The business model and commitment of PFS is to partner in infrastructure development and support the Power Sector by catering to the financial requirements of the sector.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:58 AM IST

PTC India net up 16% to Rs 234 crore in July-September

PTC India net up 16% to Rs 234 crore in July-September PTC India appoints 3 former IAS officers as independent directors

PTC India appoints 3 former IAS officers as independent directors PTC India share dividend 2022: Final dividend of Rs 5.80 approved

PTC India share dividend 2022: Final dividend of Rs 5.80 approved  NHPC signs pact with PTC India for sale of power to be generated in Nepal – Details

NHPC signs pact with PTC India for sale of power to be generated in Nepal – Details  SJVN inks pact with PTC India to develop products for supplying renewable energy

SJVN inks pact with PTC India to develop products for supplying renewable energy