Paytm shares cross Rs 700 level after four months; is this an opportunity?

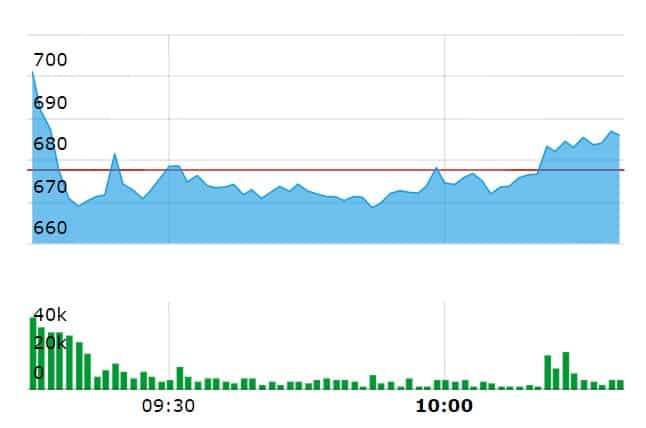

Paytm share price today: The stock of Paytm parent One97 Communications crossed the Rs 700 apiece mark for the first time in nearly four months after a positive start on Thursday, continuing to rise for the fourth session in a row. Here's what experts suggest you do with the stock now.

Paytm share price today: The stock of digital payments firm Paytm's parent, One97 Communications, crossed the Rs 700 apiece mark for the first time in nearly four months on Thursday, continuing to rise for the fourth back-to-back session.

The Paytm stock rose by as much as Rs 28.1 or 4.1 per cent to Rs 705.7 apiece — surpassing the Rs 700 level for the first time since October 13, 2022.

Should investors buy, hold or sell Paytm shares?

Editor's take

Last week, Zee Business Managing Editor Anil Singhvi reiterated his view that existing shareholders of Paytm may continue to hold the stock. The recent spike confirms its all-time low in November as the bottom for now.

According to Singhvi, the investors entering the stock now are getting the right valuation.

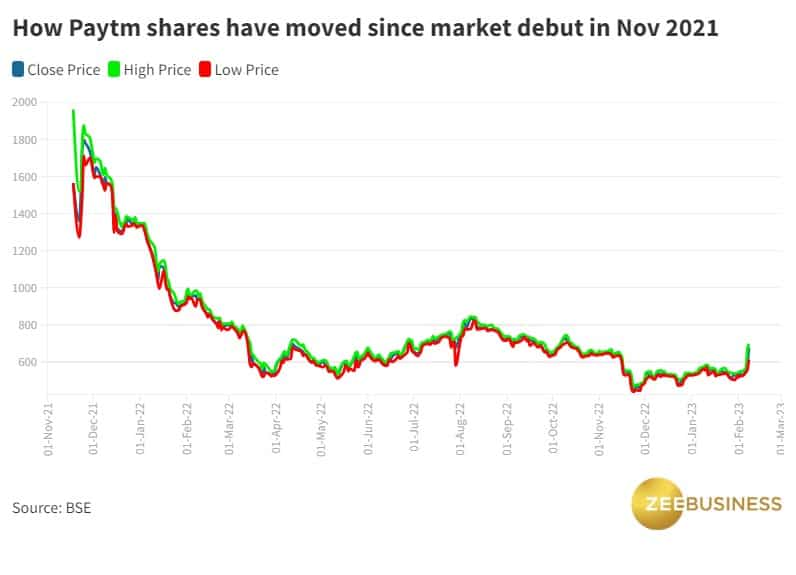

Paytm shares hit an all-time low of Rs 439.6 apiece on November 24. Earlier, Singvi had held the view that investors owing stocks of new-age firms such as Paytm should refrain from exiting at "just about any price".

Brokerage calls

Macquarie upgraded Paytm to 'outperform' from 'underperform' this week and nearly doubled its target price to Rs 800 from Rs 450.

| Brokerage | Rating | Target price |

| Macquarie | Outperform | Rs 800 |

| CLSA | Buy | Rs 750 |

| Morgan Stanley | Equal-weight | Rs 695 |

| Goldman Sachs | Buy | Rs 1,150 |

| Citi | Buy | Rs 1,061 |

Time to buy the dip in Paytm?

"Paytm shares seem to be in a good technical setup after ages. Succinctly put, further upside seems to be on the cards making, it a 'buy on declines' stock finally," Hemen Kapadia of KRChoksey told Zeebiz.com.

Paytm Q3 results

Last week, Paytm reported a quarterly net loss of Rs 392 crore for the quarter ended December 2022 as against a net loss of Rs 778.4 crore for the corresponding period a year ago.

The near-halving of the new age company's quarterly net loss and a slew of positive signals by brokerages sent Paytm shares soaring. As of Wednesday, the Paytm stock was up by Rs 152.7 or 29.6 per cent in three back-to-back sessions.

Paytm management commentary: What Vijay Shekhar Sharma said

Paytm Founder and CEO Vijay Shekhar Sharma said: “I wrote to you on April 6, 2022, and set a target for EBITDA before ESOP cost breakeven by the September 2023 quarter... I am very happy to share that our company has achieved this milestone of EBITDA before ESOP cost profitability in the December 2022 quarter itself."

Vijay Shekhar Sharma highlighted that Paytm reached the milestrone three quarters ahead of its guidance.

"There seems to be a renewed focus by the management and turning Ebitda positive much before his own outlook has had a major positive impact on sentiment," added Kapadia of KRChoksey.

IPO issue price still a long distance away

Despite intermittent spikes, Paytm shares have failed to revisit the price range of its IPO.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

11:20 AM IST

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN

Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers

Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29 Paytm shares surge 12% after NPCI nod for onboarding new UPI users

Paytm shares surge 12% after NPCI nod for onboarding new UPI users