Paytm share in oversold territory, 7 in 9 oscillators turn bearish: What technical charts say about stock

Paytms stock's RSI has fallen below 20 to 16.8 according to data sourced from Trendlyne. The level below 20 is considered as strongly oversold

Paytm share: Shares of Paytm's parent company — One 97 Communications — hit yet another 52-week low on Wednesday as selling in this stock remains unabated. One 97 Communications shares' RSI (Relative Strength Index) suggests that the stock is trading in an oversold territory.

The RSI has fallen below 20 to 16.8 according to data sourced from Trendlyne. The level below 20 is considered as strongly oversold.

Another indicator, MFI or Money Flow Index has ebbed to 4.7, significantly lower from a benchmark of 20 and indicates a massive selling in the counter.

Out of 9 oscillators, 7 are trading below, the data suggests.

RSI and MFI below 20 also imply that the stock may rebound.

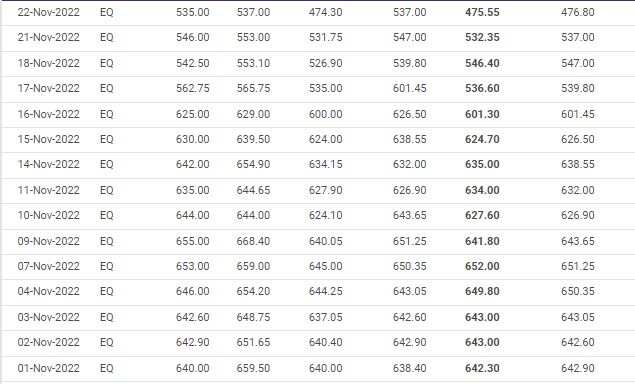

The stock’s fall has been more pronounced. In one week, the stock has fallen 26 per cent or by Rs 165. In three months, the stock has fallen by Rs 314 or 40 per cent and in one year, the decline has been to the tune of 66 per cent or nearly Rs 900.

One 97 Communications stock was listed on 18 November and since its listing the stock has lost over Rs 1 trillion in market capitalisation. The m-cap was over Rs 1.38 trillion at the time of the launch of the IPO which fell to Rs 1.01 trillion on the day of the listing as the stock was listed at a discount.

The market cap has since fallen 70 per cent.

The public issue was launched with much fanfare at an issue price of Rs 2,150.

After LIC, Paytm IPO was the second biggest issue in the country's corporate history.

The company had posted a loss of Rs 481 crore in the same period a year ago, Paytm said in its regulatory filing.

Paytm's consolidated revenue from operations increased by about 76 per cent to Rs 1,914 crore during the reported quarter from Rs 1,086.4 crore in the September 2021 quarter.

Paytm said that its revenue from payment services to consumers increased by 55 per cent to Rs 549 crore on year-on-year (YoY) basis while payment services to merchants went up by 56 per cent to Rs 624 crore YoY.

The average monthly transacting users (MTU) grew 39 per cent YoY to 7.97 crore while the merchant base has increased to 2.95 crore, the company said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

02:43 PM IST

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN

Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers

Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29 Paytm shares surge 12% after NPCI nod for onboarding new UPI users

Paytm shares surge 12% after NPCI nod for onboarding new UPI users