Nifty50, Sensex top gainers and losers: Axis Banks beats targets convincingly, Hold recommended; Buy UPL

Axis Bank Shares ended at Rs 903.80, up 9.44 per cent from the Thursday closing price and was the biggest gainer today

Indian stock markets ended the week on a winning note. It was the sixth straight gains for equity markets. The BSE Sensex ended at 59,307.15, up by 104.25 points or 0.18 per cent from the Thursday closing level. Meanwhile, the Nifty50 index closed at 17,590.00, higher by 26.05 points or 0.15 per cent. In the 30-share Sensex, 13 stocks gained while the remaining 17 ended on the losing side. In the 50-stock Nifty50, 21 stocks advanced while 29 declined.

Technical Analyst Nilesh Jain picks two stocks - one each from top gainers and losers on the NSE to give his strategy. He remains bullish on Axis Bank and UPL.

Nifty Top Gainers & Loser

Nifty50 Top Gainers:

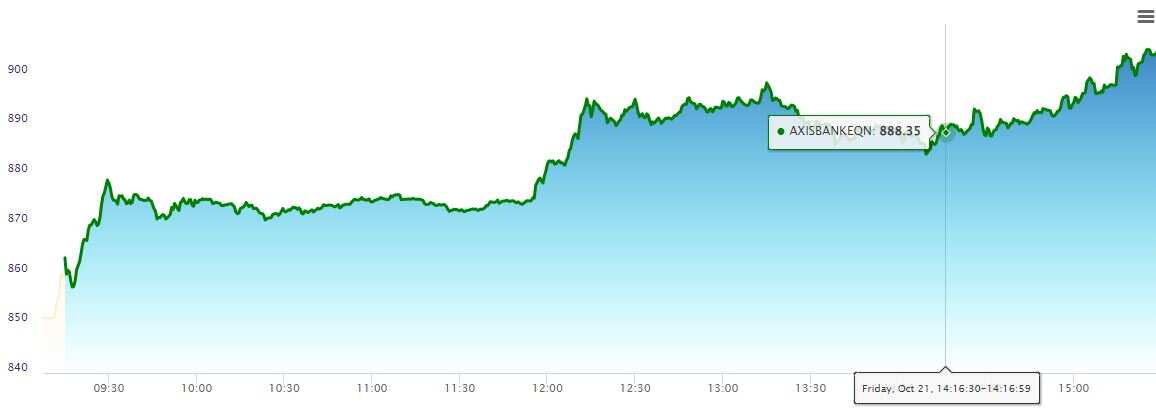

1) Axis Bank Shares ended at Rs 903.80, up 9.44 per cent from the Thursday closing price.

2) Kotak Bank Shares ended at Rs 1905.25, up 2.24 per cent from the Thursday closing price.

3) ICICI Bank ended at Rs 908.50, up 2.23 per cent from the Thursday closing price.

4) SBI Life ended at Rs 1247.60, up 2.02 per cent from the Thursday closing price.

5) Hindustan Unilever ended at Rs 2647.05, up 1.77 per cent from the Thursday closing price.

Nifty50 Top Losers:

1) Bajaj Finance Shares ended at Rs 7179.75, down 3.40 per cent on the NSE from the Thursday closing price.

2) Adani Ports Shares ended at Rs 799.95, down 3.45 per cent on the NSE from the Thursday closing price.

3) Bajaj Finserv shares ended at Rs 1683.85, down 2.43 per cent on the NSE from the Thursday closing price.

4) Divi’s Laboratories Shares ended at Rs 3568.05, down 2.30 per cent on the NSE from the Thursday closing price.

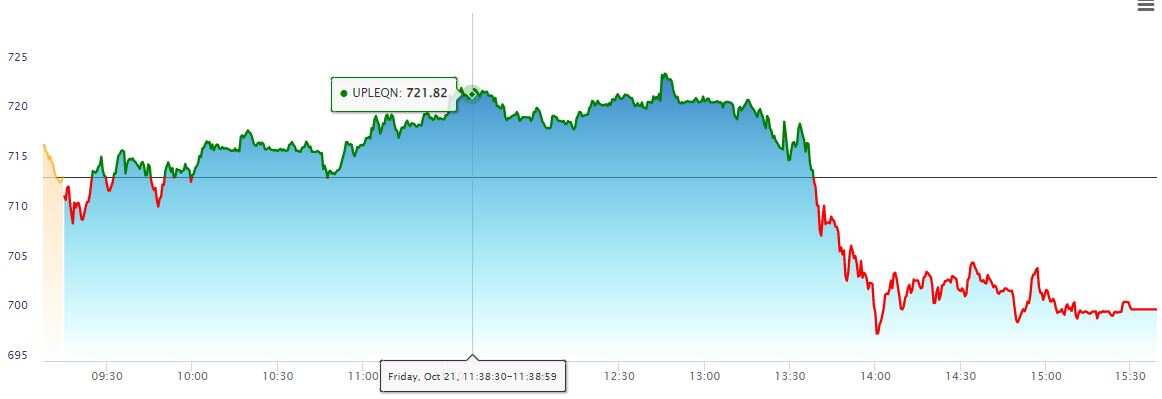

5) UPL Shares ended at Rs 700.85, down 1.77 per cent on the NSE from the Thursday closing price.

Axis Bank: Hold| LTP: Rs 904 | Target: Rs 950/1000 | Upside 10%

Axis Bank shares have been on a roll and have given good returns to investors. Jain recommended this stock at levels of Rs 785. His advise is to hold the stock for targets of Rs 950 in the near term and Rs 1000 in the positional term. Investors willing to take positions in this stock can buy on declines. The right levels to buy it is Rs 880, Jain said. Todat the stock was up over 9 per cent.

UP: Hold| LTP: Rs 701| Target: Rs 730 | Stop Loss: 670 | Upside 4%

This is another stock that was previously recommended by Jain. He remains bullish on this stock. Buying on decline was recommended and the stock is at right levels to make entry.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

05:22 PM IST

Sensex, Nifty50 top Gainers and losers: Buy HCL Tech for short term gains; Hold SBI for this target

Sensex, Nifty50 top Gainers and losers: Buy HCL Tech for short term gains; Hold SBI for this target Sensex, Nifty50 top losers and gainers: Buy Hero MotoCorp for shot terms gains; avoid Titan

Sensex, Nifty50 top losers and gainers: Buy Hero MotoCorp for shot terms gains; avoid Titan Sensex, Nifty50 top gainers and losers: Buy Hindalco for short term gains; Sell Divi’s Lab

Sensex, Nifty50 top gainers and losers: Buy Hindalco for short term gains; Sell Divi’s Lab Sensex, Nifty top gainers and losers: Buy SBI for near term gains, ‘Avoid’ recommendation on Tech Mahindra

Sensex, Nifty top gainers and losers: Buy SBI for near term gains, ‘Avoid’ recommendation on Tech Mahindra  Sensex, Nifty50 Top Gainers and Losers: BUY Tata Steel for near term gains and avoid Bajaj Finance, says analyst

Sensex, Nifty50 Top Gainers and Losers: BUY Tata Steel for near term gains and avoid Bajaj Finance, says analyst