Nifty, Sensex Gainers & Losers: Up to 21% upside expected in Divi’s Laboratories, Sun Pharma, IndusInd Bank - should you buy?

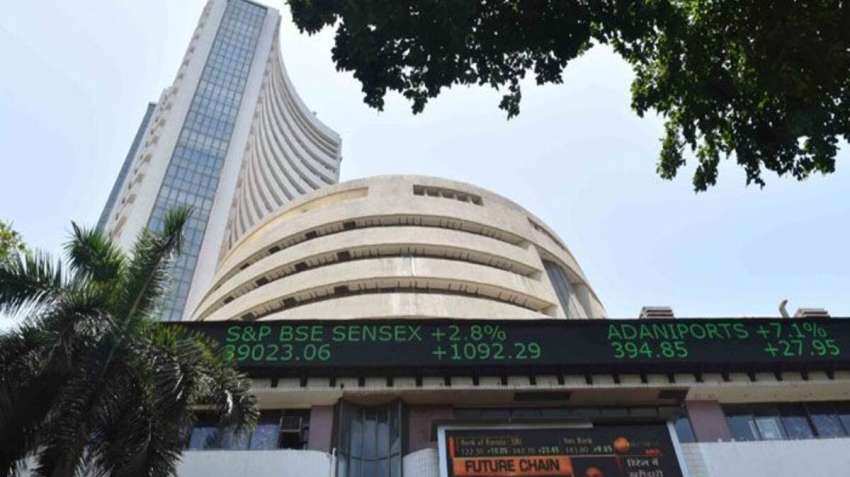

The 30-share BSE benchmark Sensex tumbled 635.05 points or 1.03 per cent to settle at 61,067.24. While the broader NSE Nifty declined 186.20 points or 1.01 per cent to end at 18,199.10.

Domestic equity benchmarks S&P BSE Sensex and NSE Nifty50 gave ended lower 1 per cent lower on Wednesday amid a largely weak trend in Asian markets and a sell-off in index majors such as ICICI Bank and HDFC twins.

The 30-share BSE benchmark Sensex tumbled 635.05 points or 1.03 per cent to settle at 61,067.24. While the broader NSE Nifty declined 186.20 points or 1.01 per cent to end at 18,199.10.

In the 50-stock Nifty50, 38 declined at the close. Healthcare stocks such as Divi’s Laboratories, Cipla, Apollo Hospital and Sun Pharma were among the top gainers, while IndusInd Bank, Bajaj Finserv, and ICIC Bank were among the top laggards on the NSE and BSE.

Analysts gave their strategy on three stocks that were among the top gainers or losers on Wednesday.

Divi’s Laboratories: Accumulate – Target: 3647; Upside: 5%

Shares of Divi’s Laboratories ended as top Nifty gainer and were up nearly 5 per cent at Rs 3,515 versus 1 per cent fall in the Nifty50 index

The long-term growth story is intact as Divi’s focus on custom synthesis segments and its ability to win repeat, high-tonnage business is clear evidence of its specialization, Dhara Patwa, Research Analyst, SMIFS Limited said, maintaining Accumulate stance with a target of Rs 3647 per share.

The company is structurally well positioned in customs synthesis and API (Active Pharmaceutical Ingredient) despite a flattish year ahead on a high base of FY22, the analyst said.

Sun Pharma: Buy – Target: 1219; Upside: 21%

Shares of Sun Pharma closed as top Sensex gainer on Wednesday. The stock closed over 1.5 per cent to Rs 1,005.55 per share on the BSE as compared to 1 per cent fall in the Sensex.

According to Vishal Manchanda, Research Analyst, Systematix Institutional Equities, “We have retained BUY rating on the stock with revised target price of Rs 1,185 from Rs 1,219 apiece earlier, valuing the company at 27x FY24E EPS.”

Manchanda said The US FDA import alert issued at Sun Pharma’s largest manufacturing facility – Halol – was unexpected, but the potential adverse impact on consolidated earnings will remain contained.

IndusInd Bank: Buy – Target: Rs 1450; Upside: 21%

Shares of IndusInd Bank closed among top Nifty and Sensex gainers on Wednesday. The stock declined over 2 per cent higher to Rs 1201.80 per share on the NSE.

Yash Agarwal, Research Analyst, Motilal Oswal estimated Profit After Tax (PAT) to report 40 per cent CAGR (Compound Annual Growth Rate) over FY22-24, leading to 16 per cent return on equity (RoE) in FY24E. It maintained a BUY rating with a target of Rs 1,450 apiece, implying 21 per cent upside.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

05:41 PM IST

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note Sensex slumps 964 pts, Nifty50 gives up 24,000 as bears dominate D-Street for 4th day

Sensex slumps 964 pts, Nifty50 gives up 24,000 as bears dominate D-Street for 4th day Nifty 50 sinks below 23,900 as Fed rate outlook disappoints global markets; Sensex slumps nearly 1,200 points

Nifty 50 sinks below 23,900 as Fed rate outlook disappoints global markets; Sensex slumps nearly 1,200 points