Multibaggers of 2021: These 10 midcap, smallcap shares surged between 139-4300%; experts decode reasons

Shares showed a rally like never before, surging up to 4300% in a year as on December 14, 2021

The year 2021 has been a roller coaster ride for retail investors as they witnessed one of the biggest surges in the Indian stock market in decades and then some corrections in fag end of the year. Barring a few sectors and shares, most of the segments and shares showed unprecedented rally. The rally was ably aided by small cap and mid cap stocks. Shares on these indices showed a rally like never before, surging up to 4300% in a year as on December 14, 2021.

"The multi-bagger returns were mostly helped by government policies and spendings, provision of liquidity in the market, lesser FD rates causing investors to park excess funds in the markets, strong balance sheet of companies and their focus on R&D, massive CAPEX drive-by companies and shifting sentiment towards India as a global hub were important reasons behind this surge," said Manoj Dalmia, Founder and Director, Proficient equities Private limited.

See Zee Business Live TV Streaming Below:

Here we will look into 10 stocks from BSE small and cap and mid cap space that surged the most this year

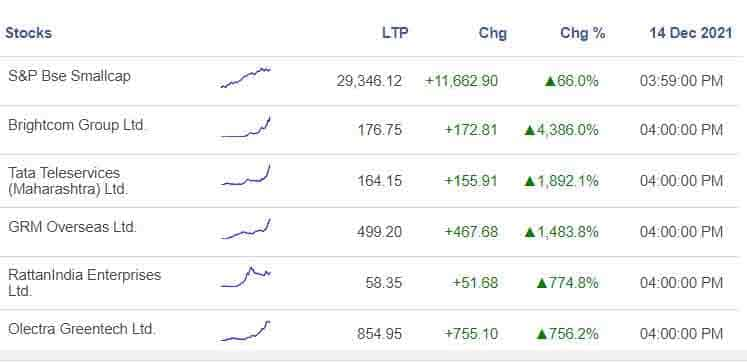

S&P BSE small cap top 5 gainers

The index surged 66% or 11,662points in a year till December 14, 2021, as per Stock Edge, an app to analyse NSE, BSE data. Top gainers from this index are Brightcom Group Ltd (BCG), Tata Teleservices (Maharashtra) Ltd, GRM Overseas Ltd, Rattan India Enterprises Ltd and Olectra Greentech Ltd.

1. Brightcom Group Ltd (BCG): Incorporated in Jan-1999, Brightcom Group is an Ad-Tech and Software Development Company, actively engaged in providing technical and economical solutions to Digital Advertisement, Marketing and Information Management sectors through tech, New Media, and IoT based businesses across the globe, primarily in the digital ecosystem. Shares of BCG soared 4386% in the last one year. From 52-week low of Rs 3.82, the shares surged over 4,000% to trade at Rs 176.75 per share on the BSE.

2. Tata Teleservices (Maharashtra) Ltd: Tata Tele (Maharashtra) Limited (TTML) is a leading player in the connectivity and communication solutions market serving enterprise customers. With services ranging from connectivity, collaboration, cloud, security, IoT and marketing solutions, it offers a comprehensive portfolio of ICT services for businesses in India under the brand name Tata Tele Business Services (TTBS). Shares of TTML surged over 1890% or Rs 155 in a year. From 52-week low of Rs 6.90 per share, the stock is trading on the BSE at 164.15 per shares as on December 14.

3. GRM Overseas Ltd: Shares of this company engaged in the production, purchase, export and sale of rice and paddy in India have zoomed to Rs 499.20 per share on the BSE on December 14 as against 52-week low of Rs 28.75, it hit on December 18, 2020. The shares jumped 1483% in one year.

4. RattanIndia Enterprises Ltd: A flagship company of Rattan India Group, the company focuses on businesses with cutting edge technologies which have the potential to transform the lives of billion plus Indians. Shares of RattanIndia Enterprises jumped from Rs 1.91 per share to Rs 9.99 on July 6, 2021. The shares of this company settled for Rs 5.65 per share on the BSE on Tuesday, December 2021. RattanIndia Enterprises shares witnessed 774% jump in the last one year.

5. Olectra Greentech Ltd: Shares of this company spurted from its 52-week low value of Rs 95.45 per share to 52week high of Rs 912. As on December 14, 2021, shares of this manufacturer of large vehicles ended at Rs 854.95 per share on the BSE on Wednesday, registering a growth of 756% .

Source: Stock Edge

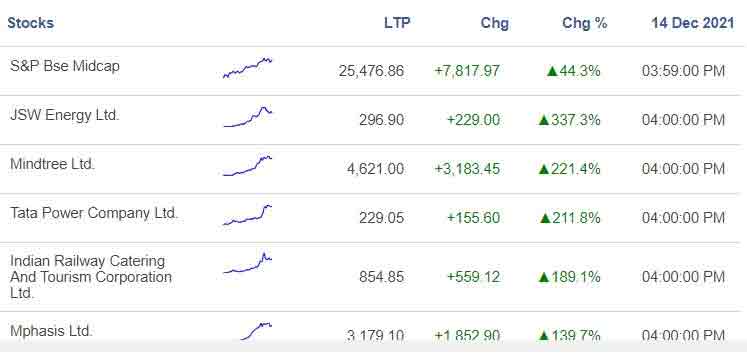

S&P BSE Midcap top 5 gainers

The index surged 44.3% or jumped by 7817 points in the last one year as on December 14, 2021, as per Stock Edge. The top 5 shares that gained the most on this index are: JSW Energy Ltd, Mindtree Ltd, Tata Power Company Ltd, IRCTC and Mphasis Ltd. Top 5 Shares on this index gained between 139 percent to 337 percent till December 14, 2021.

1. JSW Energy Ltd: From 52-week low of Rs 64 almost a year back, this energy stock touched the year's high of Rs 408.70 per share. This share zoomed 337% to trade at Rs 296.90 per share on the BSE intraday trade on Tuesday.

2. Mindtree Ltd: Shares of this IT consulting & software settled at Rs 4621.00 per share on Tuesday. Mindtree Ltd shares have grown over 221 percent in the last one year. This IT share clocked 52-week high of Rs 5,059.15 per share on the BSE on November 18.

3. Tata Power Company Ltd: Shares of this electric utilities company jumped from Rs 66.40 almost a year to Rs 269.70 per share on October 19, 2021. Tata Power stock closed Tuesday at Rs 229.05 on the BSE on Tuesday. Overall growth as on December 4, 2021, stood at 211%.

4. IRCTC: Shares of Indian Railway Catering and Tourism Corporation ltd zoomed 189% in a year. IRCTC shares which were split recently traded last at Rs 854.85 per share on the BSE. The 52-week high value after the split stands at Rs 1278.60 per share.

5. Mphasis Ltd: Another IT share on this index, Mphasis Ltd gained 139.7% in the last one year. Shares of this IT consulting and software closed at Rs 3179.10 per share on the BSE on Tuesday.

Source: Stock Edge

Here is what experts say about this unprecedented rally and outlook for midcap and small cap shares going forward

Manoj Dalmia, Founder and Director, Proficient equities Private limited

"Small-cap and mid-cap companies in the space of IT, PSU Banks and real estate are going through the PE expansion phase and have a bright future going ahead," said Manoj Dalmia.

He said several stocks like Balaji Amines, Happiest Minds, Tata Motors, Tata Steel Tata Elxsi and Indian Hotels soared between 100% to 400% in one year.

Ravi Singh, head of Research and vice president, share India

"Key factors in driving the market in 2021 were improved macro indicators, strong global liquidity, increased economic activities, significant pickup in vaccination, improvement in the consumption-related data, ease in monetary policy and sharp recovery in corporate earnings. Also, mid-caps and small caps majorly under-performed large caps since the last 3 years. Being cheaper than the large caps, mid and small caps grew much faster in an economic recovery as compared to large caps.," said Ravi Singh, head of Research and vice president, share India.

Outlook: The increased interest of FPIs and retail participation in these segments along with the monetary liquidity for an infrastructure push by the government is going to benefit the sectors in longer term. As more government structural reforms in manufacturing and infrastructure are still in pipelines, we expect the stocks in mid and small cap to outpace next year also.

Gaurav Garg, Head of Research at CapitalVia Global Research

2021 was spectacular as indices bounced sharply after COVID-19 restrictions were lifted and economy got back on track as vaccinations picked pace. There was under-performance in broader indices in pre-Covid period starting from 2017. Post-COVID-19 there were over-performance in stocks from Mid-cap & Small Caps from sectors like specialty chemicals, metals, pharmaceuticals, technology and real estate. Better than expected earnings in 1st and 2nd quarter of 2021 helped stocks to rerate these selective pockets and these might out-perform in mid to short term.

Santosh Meena, Head of Research, Swastika Investmart Ltd

Midcap and Smallcap stocks tend to outperform in a strong bull market and we are in a structural bull market that is likely to continue for at least the next 2-3 years. Therefore this outperformance may continue, but things won't be as easy as it was last year, therefore, investors should stick with quality names.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

03:48 PM IST

Markets at all-time high but its the small-caps that are booming

Markets at all-time high but its the small-caps that are booming