Mulitbagger Stock: Analysts see PepsiCo bottler's shares surging by Rs 300 apiece

Varun Beverages' margins — a key measure of profitability for businesses — expanded by 190 basis points to 13.9 per cent compared with the year-ago period.

Varun Beverages shares surged on Tuesday, extending gains to a third straight session on Dalal Street. The stock of Varun Beverages – which bottles PepsiCo drinks – jumped by as much as Rs 84.2 or 6.9 per cent to Rs 1,305 apiece on BSE, as the Street continued to cheer the company's strong set of earnings.

The stock of New Delhi-based Varun Beverages has rewarded investors with multibagger returns in the recent past. In the last one year, a period in which the Sensex headline index has risen about five per cent, Varun Beverages shares have more than doubled.

Varun Beverages Q3 results

This week, the beverage bottler company reported a multifold jump in net profit to Rs 74.7 crore for the quarter ended December 2022 aided by sustained demand for packaged beverages, from Rs 16.4 crore for the year-ago period.

The company’s revenue grew almost 28 per cent on a year-on-year basis to Rs 2,214 crore.

Varun Beverages' margins — a key measure of profitability for businesses — expanded by 190 basis points to 13.9 per cent compared with the year-ago period.

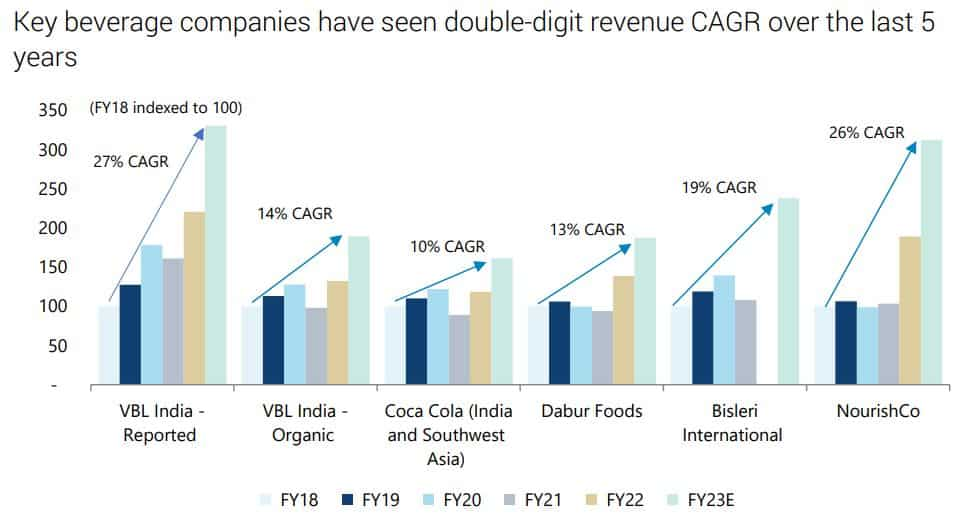

Image Source: Jefferies

What brokerages recommend on Varun Beverages shares

Varun Beverages is available at an attractive valuation with a price-to-earnings multiple of 40 times its estimated earnings for 2023.

Jefferies has a ‘buy’ rating on Varun Beverages with a target of Rs 1,540 apiece, implying upside potential of 25 per cent from its closing price on Monday.

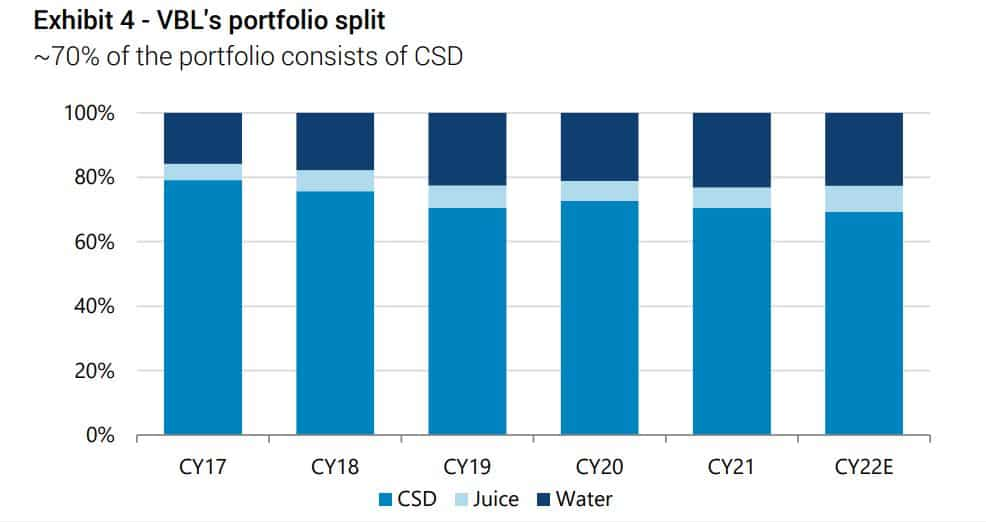

Image Source: Jefferies

The success of Varun Beverages' energy drink, Sting, and share gain in underpenetrated markets aided its stellar earnings, according to Kotak Institutional Equities.

The company will continue its growth trajectory led by the continued success of Sting, significant capacity expansion, the pan-India rollout of its new products, distribution expansion and share gains in underpenetrated markets, according to Jaykumar Doshi of Kotak Institutional Equities.

The brokerage has upgraded the stock to 'buy' from 'add' with a target price of Rs 1,500 per share.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:31 PM IST

Varun Beverages board gives nod to Rs 7,500 crore QIP

Varun Beverages board gives nod to Rs 7,500 crore QIP PepsiCo bottler announces stock split for second consecutive year: Check details

PepsiCo bottler announces stock split for second consecutive year: Check details  Varun Beverages stock just 2% shy of its all-time high; here’s what is the news

Varun Beverages stock just 2% shy of its all-time high; here’s what is the news Varun Beverages share price target: What should investors do with PepsiCo bottler stock after it beats quarterly profit?

Varun Beverages share price target: What should investors do with PepsiCo bottler stock after it beats quarterly profit? Varun Beverages reports Q1 results; stock slips over 3%

Varun Beverages reports Q1 results; stock slips over 3%