Dolly Khanna Portfolio Stock: This mulitbagger counter to trade ex-dividend on Thursday; scrip up 150% in 2 years – Should you Buy?

Multibagger Stock, Dolly Khanna Portfolio, Polyplex Corporation, Ex-Dividend Date, Record Date: Earlier on November 14, 2022, the company while announcing its Q2 earnings for FY23, also declared 550 per cent at Rs 55 per share Interim/Special Dividend.

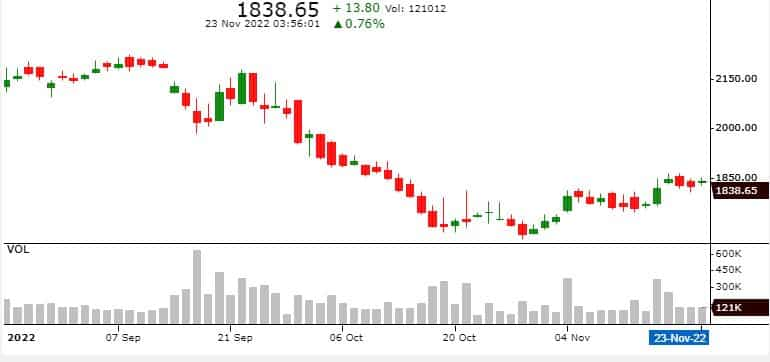

Multibagger Stock, Dolly Khanna Portfolio, Polyplex Corporation, Ex-Dividend Date, Record Date: Ace investor Dolly Khanna-backed packaging stock – Polyplex Corporation to trade ex-dividend on Thursday, November 24, 2022. Shares of this small-cap company have given multibagger returns in the last two years, it surged around 150 per cent from Rs 735 to Rs 1839 per share (today’s closing).

Polyplex Corporation Interim/Special Dividend

Earlier on November 14, 2022, the packaging company while announcing its second-quarter earnings for the financial year 2022-23 (Q2FY23), also declared 550 per cent at Rs 55 per share Interim/Special Dividend.

“The Board of Directors in its meeting held on November 14, 2022 have approved the declaration and payment of Interim/Special Dividend for the Financial Year 2022-23 at Rs 55/- per share (including special dividend at Rs. 35/- per share) of the face value of Rs. 10/- each,” the company said in a filing.

“Record Date for the purpose of payment of aforesaid Dividend has been fixed as November 25, 2022, and is proposed to be paid within the time prescribed under the law,” Polyplex Corporation further said.

This means the stock would trade ex-dividend tomorrow, November 24, 2022 - a day prior to the Record Date. An ex-dividend date is a day on which a stock trades without the benefit of the next scheduled dividend payment. While the record date finalises the transfer of the stock's ownership.

Polyplex Corporation: Ace Investor’s Favourite

Chennai-based celebrity investor Dolly Khanna has marginally reduced her stakes in Polyplex Corporation from 1.2 to 1.3 per cent in September 2022 quarter. As per the latest shareholding pattern available on the BSE, the ace investor has 3,68,170 equity shares in the company.

Dolly Khanna publicly holds 22 stocks with a net worth of over Rs 399.6 crore as of November 23, 2022, according to the stock analysis website trendlyne.com. Her portfolio typically leans more towards traditional stocks in manufacturing, textile, chemicals, and sugar stocks from the small-cap category.

Polyplex Corporation: Fundamental View

The company is trading at a single-digit PE of 8.75, with profit growth of 23.6 per cent CAGR over the last 5 years and it has a solid dividend track record and an improving ROE over the last two years, Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd said in its comment.

According to Pravesh Gour, “We are seeing a rise in interest from foreign institutional investors in this stock; however, mutual funds have cut their stake. The recent correction provides a favourable opportunity for long-term investors.”

Polyplex Corporation: Technical Charts

Technically, it is in a long-term uptrend where it is creating a base around the 1650 mark after a meaningful correction, Gour said. “On the upside, 2000 is a psychological barrier that may coincide with falling 100 and 200-day moving averages; above this, we can expect new bullish momentum towards 2500 and 3000 levels.”

Similarly, Mehul Kothari, AVP - Technical Research at AnandRathi Shares said, Since October 2021; the 1700 – 1600 level had been a strong demand zone for the POLYPLEX. On the upside, 1900 seems to be an immediate hurdle since that has been a breakdown point during Sept 2022, he added.

Image Source: Stockedge

“Traders holding longs can book their positions once the stock starts trading near this zone while Investors should continue to hold the stock till the time it stays above the 1600 mark. Below 1600 we might see a fresh downtrend in the stock,” the analyst further said.

Polyplex Corporation: Share Price History

On Wednesday, the counter closed around 1 per cent to Rs 1839 per share on the BSE as compared to 0.15 per cent rise in the S&P BSE Sensex. With the ex-dividend and record date approaching, the shares in the last five sessions have reported growth of nearly 4 per cent on the BSE.

Shares of Polyplex Corporation are trading more than 35 per cent below its 52-week high of Rs 2870. The scrip in the last one year has produced marginal gains of over 5 per cent, while it has corrected over 17 per cent in the last six months on the exchanges.

About Polyplex Corporation

Polyplex Corporation Ltd. (Polyplex) is one of the leading PET (polyethylene terephthalate) Film Manufacturers and the seventh-largest capacity of polyester (PET) film globally. The company’s business portfolio also includes BOPP, Blown PP/PE, and CPP films produced in state-of-the-art plants.

The company has a global presence, supplying about 2650+ customers in 75 countries across Europe, the US and the Indian sub-continent, the Far East, Asia Pacific, and the Middle East with subsidiaries in Thailand and Turkey, where it owns a 70 per cent stake.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

10:10 PM IST

This smallcap textile stock zooms to new 52-week high: Do you own it?

This smallcap textile stock zooms to new 52-week high: Do you own it? Multibagger infra stock zooms 6% in trade today: Check details

Multibagger infra stock zooms 6% in trade today: Check details Textile stocks a mixed bag; what analysts make of political instability in Bangladesh for Indian exporters

Textile stocks a mixed bag; what analysts make of political instability in Bangladesh for Indian exporters This multibagger Navratna PSU stock gains today: Here's why

This multibagger Navratna PSU stock gains today: Here's why Up a significant 460% in one year; this smallcap jeweller stock zooms 5%

Up a significant 460% in one year; this smallcap jeweller stock zooms 5%