Money Guru: What should investors look at while investing in ETFs? Swati Raina decodes with Mrin Agarwal

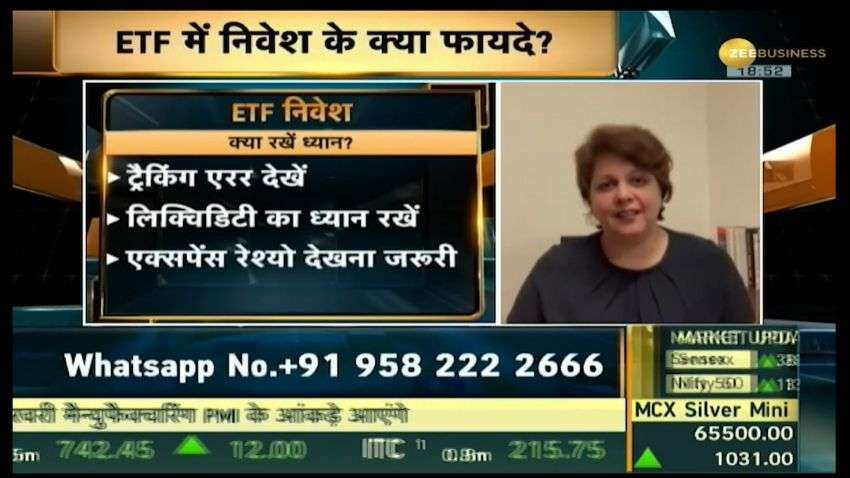

The expense ratio, tracking error, and liquidity, are the three factors that investors should look at while investing in ETFs, said expert Mrin Agarwal, Founder Director of Finsafe India Pvt Ltd.

The expense ratio, tracking error, and liquidity, are the three factors that investors should look at while investing in ETFs, said expert Mrin Agarwal, Founder Director of Finsafe India Pvt Ltd.

He said so while discussing about ETFs with Zee Business anchor Swati Raina on the popular TV show 'Money Guru' where she said shared her views on what should investors look at while investing in ETFs?

Tracking error, in simple terms, is the difference between index return and fund return, said Agarwal.

The Director of Finsafe India Pvt Ltd advised the investors to not just look at the expense ratio when it comes to investing in ETFs. People are pointing out that the ETF's expense ratio is really low, she noted. However, the most crucial thing to look for is the tracking error.

As a result, the tracking error of funds with a low expense ratio might be rather significant. This is because the tracking error is caused not just by the expense ratio, but also by transaction charges, time delays in investing the money, and currency fees for overseas funds. All of these contribute to the tracking error.

It is important to know how much time a fund has completed in order to determine the consistency of its tracking error. The second important step is to examine the fund's liquidity. It was suggested to check the traded volumes of the last 3 months. If a fund has very low liquidity, the price of the fund might fluctuate significantly during market hours.

So, overall, investors should look at the expense ratio, tracking error as well as the liquidity of the fund before investing in ETF.

For More Details Watch Full Video Here:

https://www.zeebiz.com/market-news/video-gallery-money-guru-what-are-exc...

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

11:40 AM IST

Gold’s rollercoaster ride: Key factors driving the ongoing price volatility

Gold’s rollercoaster ride: Key factors driving the ongoing price volatility Invest in gold ETFs on Dhanteras for purchasing gold jewellery later: Experts

Invest in gold ETFs on Dhanteras for purchasing gold jewellery later: Experts Silver ETFs getting investors' traction; asset bases reach Rs 1,800 crore

Silver ETFs getting investors' traction; asset bases reach Rs 1,800 crore Axis Mutual Fund aims to raise Rs 50 crore from new ETF fund of funds

Axis Mutual Fund aims to raise Rs 50 crore from new ETF fund of funds What is Exchange Traded Fund? Experts decode meaning, advantages and disadvantages of ETF

What is Exchange Traded Fund? Experts decode meaning, advantages and disadvantages of ETF