Mastermind of estimated Rs 1,500 crore SMS stock tip scam Hanif Shekh likely absconding from India

Shekh enjoying high life in Dubai after evading multiple SEBI summons. Adjudication pending in many matters, he used hundreds of front entities for the operation. Zee Business had highlighted stock rigging through sending of bulk SMSes.

)

Hanif Shekh, a little known resident of Gujarat, is among the most wanted market manipulators on the list of the Securities and Exchange Board of India (SEBI). Under the regulatory scanner for one of the largest 'pump-and-dump' stock market operations in the last four years, Shekh is absconding from India and currently believed to be ensconced in Dubai.

SEBI has been tracking Shekh since 2019 but he has evaded all the summons and notices of the regulator, and is not traceable in the country. However, his social media account reveals that Shekh has been enjoying high life in Dubai, sources close to the SEBI probe told Zee Business.

Investigators believe that Shekh's market manipulation is likely to have generated illegal wealth to the tune of around Rs 1,000 crore to Rs 1,500 crore, and he is alleged to be the kingpin behind hundreds of entities that were involved in rigging share prices of 50-70 company stocks. According to the sources, these are estimates of the gains based on SEBI's ongoing probe, past orders and the pending adjudication proceedings against Shekh and hundreds of entities connected to him. Investigators also believe that Shekh has managed to transfer the bulk of his wealth to Dubai through hawala channels (money mules). SEBI's investigations into Shekh's operations are still ongoing and interim orders have been passed in a few matters where the regulator was able to reach some conclusion, sources said.

Shekh's racket involved sending bulk SMSes and circulation of stock tips through websites to attract gullible investors and dump his holdings through multiple front entities later when the scrips caught the fancy of the investors. SEBI's investigations have found that Shekh created fake SMS IDs closely resembling prominent equity broking companies like Zerodha and ICICI Securities and used them to send bulk phone messages with 'buy' recommendations to entice small investors while entities connected to him dumped shares in the market.

In the view of SEBI whole-time member SK Mohanty, "Entire operation was run by the kingpin Hanif Shekh with best of care to deceitfully hoodwink and delude the normal eyes. As a consequence of which Mr. Hanif Shekh along with his connected entities and promoters of some companies generated wrongful gains."

In 2019, Zee Business had first highlighted how few small company shares were being manipulated by sending bulk SMSes to retail investors.

Shenanigans of Shekh

His racket first came to light a few years ago when SEBI started receiving several investor complaints against high operator activity in some of the small company stocks on its online grievance platform SCOREs. SEBI's initial probe suggested that the operation involved stock tips through bulk SMSes. After examining the prima facie evidence, SEBI started its detailed investigations.

SEBI's recent probe order against Shekh shows there were 226 entities under his network. The regulator has also recovered multiple bank accounts and fund transfers in Ahmedabad, Mumbai and Kolkata. This apart, SEBI has tumbled up on SMS compilations, forex bills, trading logs, Gmail links, call data record (CDR) and also his links to few promoters of the small companies.

Kasambhai Shekh, Hasina Kasambhai Shekh, Robert Resources, Econo Trade India, Econo Broking (Erstwhile Bansal Finstock) and Sai Metaltech LLP are a few key entities directly linked to Shekh and his family, as per SEBI investigations.

Experts say Shekh's market operation could easily be among the few large illegal schemes to have been unearthed by SEBI since it passed orders in the infamous Global Depository Receipt (GDR) scam.

"Shekh is another of the big fraudsters like the infamous Arun Pancharia of the GDR fraud worth thousands of crore where share price was inflated first and then operator holding was dumped in the market, all in the name of issuing fancy instruments. Although SEBI passed orders in the GDR scam after months and years of painstaking investigations, major recovery from the scamsters is lacking," a source close to the regulator's office said.

Flamboyant lifestyle

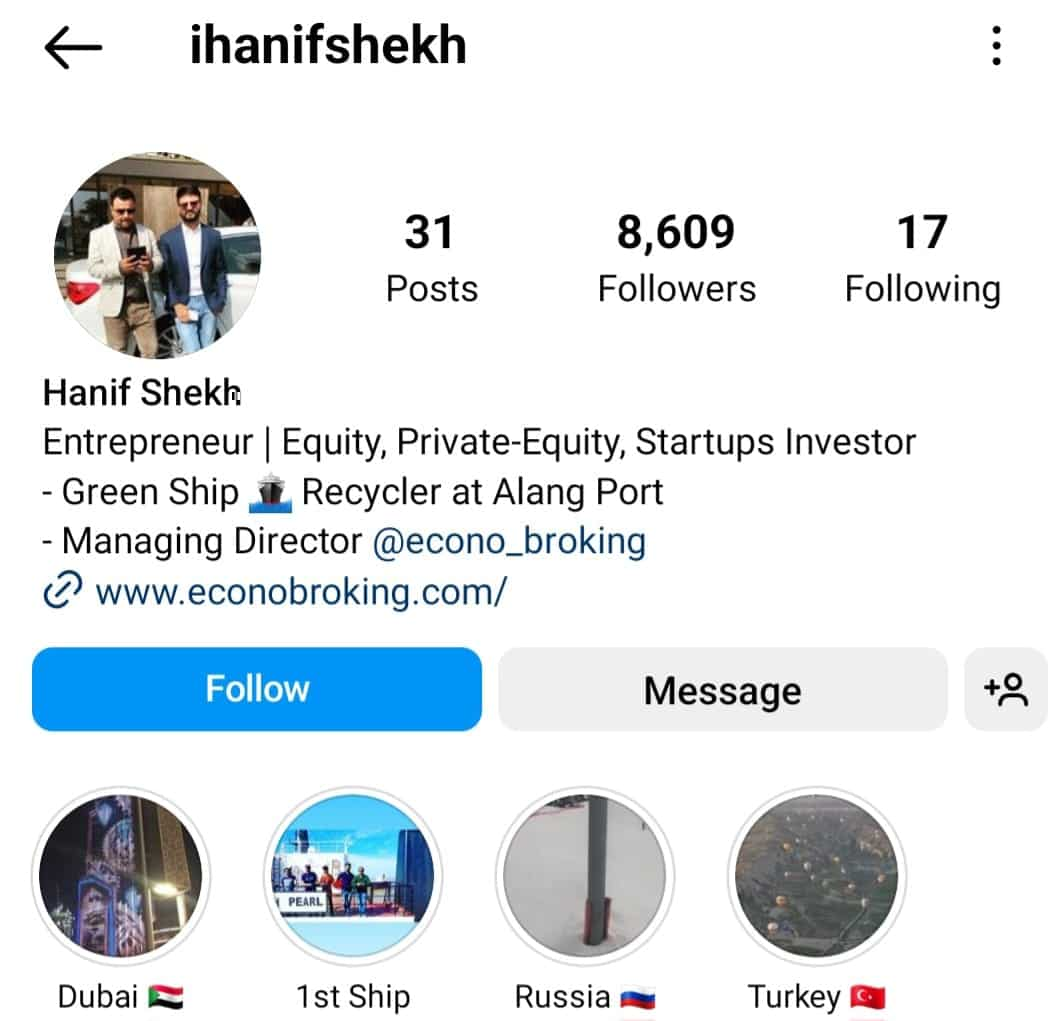

Sources say that Sheikh is currently believed to be in Dubai. His instagram handle "ihanifshekh" gives a peek into his extravagant, high life. To attract eyeballs, Shekh has splashed his picture with Urvashi Rautela, Miss Diva Universe 2015, and actress and model Sana Shaikh on his social media handles that display his profile as the head of a broking firm.

On the Instagram handle, Shekh calls himself an entrepreneur, private equity and start-up investor, green-ship recycler at Alang Port and Managing Director of Econo Broking. He has shared the web address of his brokerage firm "econobroking.com" that is under SEBI scanner.

But investigators say Shekh and his family are from Gujarat's Bhavnagar district where they stayed at Flat No 102, Royal Rehamani Complex, Sir Pattni Road, Bhavnagar-364002. Econo Broking, registered at 9/12 Lal Bazar Street, 3rd Floor, Block -B, Room No.3103, Kolkata – 700001, which was acquired by Shekh and his family in 2018 through an open offer.

How the fraud operated

Shekh's dealings are among the few instances where SEBI has managed to zero in on the 'ultimate beneficiary' of the stock tip scam through mobile phones and Internet. Otherwise, the difficulties that investigators face in probing the source of mobile phone messages and the internet are commonly known.

An order passed by SEBI official Mohanty on June 19 has estimated the illegal gains made by Shekh to the tune of Rs 144 crore by his operations in just five stocks that they looked at in the particular order. Besides, there are multiple investigations, recovery notices, adjudication and summons pending against Shekh and his connected entities, which suggests to the investigators that his illegal gains could be way higher.

SEBI's June 19 order Shekh and entities connected to him were dabbling in stocks including Mauria Udyog, 7NR Retail, GBL Industries and Darjeeling Ropeway Co. He has also been named in manipulating scrips including Leading Leasing Finance and Investment, Agrophos India Pvt Ltd, VB Industries Pvt Ltd among few others.

Although Shekh may have conveniently evaded SEBI summons, his lawyers have filed appeals in some matters at the Securities and Appellate Tribunal. In November 2022, SEBI had fined Shekh Rs 7 lakh for evading their summons multiple times. Sources say the recovery of some penalties levied against Shekh is still pending.

Play of Bulk SMSes

SEBI investigations show that Shekh used three types of entities for his operations.

First was instrumental in artificially influencing price and volume in stocks a few days prior to sending of the SMSes with 'buy' recommendations. SEBI has labeled such entities as price/volume (PV) influencers and found that all were connected to each other.

Another type was the “off loaders". These entities would make substantial gains by dumping the shares previously acquired by them. After the initial buying into the shares prior to the sending of the bulk SMS tips, these entities would turn massive sellers.

Last was the ‘kingpin’ - Shekh

"He was the source of the bulk SMSes who had not only orchestrated the entire scheme but shared direct links to the entities from which the SMEs with buy recommendations originated. He used certain websites too for luring small investors," said the SEBI order. Profits were transferred to the ultimate beneficiary Shekh through several conduits.

The trail

SEBI's lead started with the SCOREs complaints and soon the regulator discovered that two government-owned telecom operators BSNL and MTNL were being used to send bulk SMSes with 'buy' recommendations.

Shekh's SMS IDs mimicked the names of top stock brokers like Zerodha and ICICI Securities. SMS senders were registered as BT-ZROHDA, BT-MGAINS, BH-MGAINS and BT-ICISEC. Another government telecom company MTNL was the service provider for Shekh-linked IDs MB-STOCK and MD-MULTIB.

SMS aggregators and resellers Awadh Info Pvt Ltd, Spark TG Pvt Ltd and Newrise Technosys Pvt Ltd were the resellers who dealt with the clients on behalf of the telecom company for sending SMSes. HFCL Infotel was a service provider for QP-BGAINS and its reseller was One Popular Softtech, SEBI investigations show.

To reach the source of these SMSes, SEBI focused on mobile numbers provided to the resellers. When the certificate users of these mobile numbers were probed, the links led SEBI to the one point -- Shekh. Suspicion that Shekh was the kingpin of the entire racket was confirmed by the CDR of mobile numbers 9537570268 and details of exchange of calls between Shekh and Awadh Info having mobile numbers (9838585569 and 7311111641) and SparkTG (97179397366).

Shekh and connected entities were also financing the owners and managers of two websites: "www.midcapgains.in" and "www.mbstocks.in". The payments for development and maintenance of these were all linked to Shekh controlled entities. and a HDFC Bank account number 50200027909681, as per SEBI's order.

Catch latest minute-by-minute stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

07:02 PM IST

Sebi introduces uniform data sharing policy for research purposes

Sebi introduces uniform data sharing policy for research purposes  EXCLUSIVE: SEBI Board to discuss the toughest regulation to deal with market manipulation

EXCLUSIVE: SEBI Board to discuss the toughest regulation to deal with market manipulation  Sebi mulls facilitating participation of retail investors in algo trading

Sebi mulls facilitating participation of retail investors in algo trading  Sebi extends timeline to submit comments on proposed appointment process of key officials at MIIs

Sebi extends timeline to submit comments on proposed appointment process of key officials at MIIs  SEBI December 18 Board Meeting: Tighter regulations for SME IPOs, wider scope of UPSI, performance validation agency, other proposals for board test

SEBI December 18 Board Meeting: Tighter regulations for SME IPOs, wider scope of UPSI, performance validation agency, other proposals for board test