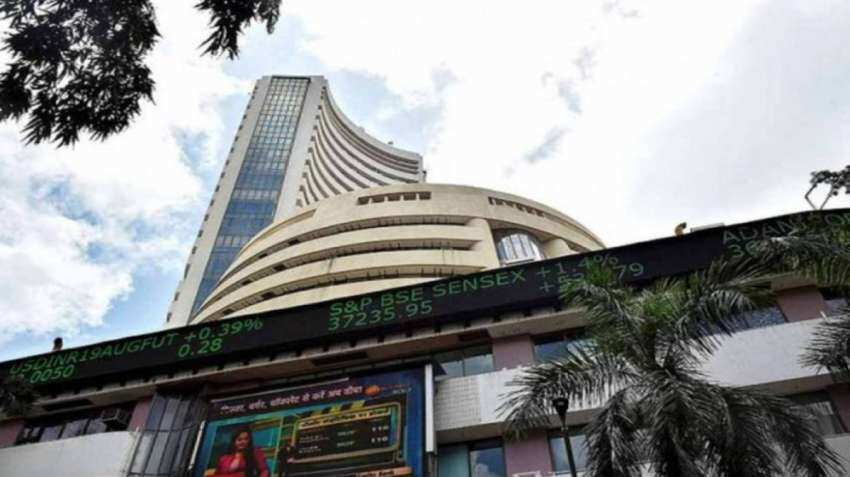

Market Next Week: Inflation data, global cues, FII flows among other top factors for Dalal Street

The analysts believe that triggers like foreign investors flow, the Indian rupee (INR) versus the US dollar (USD) movement and brent crude oil trends may also impact the benchmark equities in the next week.

The Indian markets shall mainly be influenced by multiple factors including macroeconomic data, Indian and US inflation data, and global cues among others in the coming week, according to analysts.

They also believe that triggers like foreign investors flow, Indian rupee (INR) versus the US dollar (USD) movement and crude oil trends may also impact the benchmark equities in the next week.

Amid the prevailing scenario, participants will be eyeing crucial macroeconomics for cues next week, Ajit Mishra, VP - Technical Research, Religare Broking said in his market next week expectations.

“On the domestic front, CPI and WPI Inflation will be unveiled on March 13 and 14 respectively. Besides, the US Inflation data, scheduled on March 14, will also be in focus,” Mishra said in his quote.

Similarly, Santosh Meena, Head of Research, Swastika Investmart said that the market will respond to US job data on Monday, but the most important data points will be domestic inflation data on Monday and US inflation data on Tuesday.

In addition to this, Chinese IIP (industry production) numbers will also play a significant role, Meena said, adding that it will also be crucial to monitor changes in the dollar index and US bond yields.

According to the Swastika Investmart analyst, “If block deals aren't included, FIIs are still in a selling mode. But, given that it is the final month of FY23, we can anticipate a cushion from domestic investors. Institutional flows will therefore be crucial.”

Last week, Nifty Bank concluded with a cut of around 2 per cent, dragging the Nifty index, which ended with a cut of about 1 per cent as the bears regained control of the market. Both the benchmark indices, Nifty and Sensex, ended closer to the week’s low at 17,412.90 and 59,135.10 levels.

Poor global cues were major contributors to the weakness in the Indian equity markets the previous week, and it may continue to be significant next week, as per the Swastika Investmart research head.

The bias was positive in the market during the initial sessions however weak global cues viz. lingering fear of sharp rate hikes by the US Fed and fresh turmoil in the US banking space turned the tone completely in the final sessions.

Most of the sectoral indices ended lower wherein banking, financials and IT majors faced tremendous pressure. Meanwhile, the resilience in the broader indices helped the traders to some extent.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:00 PM IST

Market next week: Auto sales, last leg of Q4 results, global cues, and other key factors for Dalal Street

Market next week: Auto sales, last leg of Q4 results, global cues, and other key factors for Dalal Street Market Next Week: Inflation data, Q4 earnings, Karnataka assembly polls among other factors for Street

Market Next Week: Inflation data, Q4 earnings, Karnataka assembly polls among other factors for Street US Fed meeting, auto sales, Q4 results among other key factors for Street in holiday-shortened next week

US Fed meeting, auto sales, Q4 results among other key factors for Street in holiday-shortened next week Dalal Street Week Ahead: Q4 earnings, monthly expiry, macro number and other things to watch

Dalal Street Week Ahead: Q4 earnings, monthly expiry, macro number and other things to watch Infosys, HDFC Bank results impact, global cues, FII flows among other factors for Dalal Street next week

Infosys, HDFC Bank results impact, global cues, FII flows among other factors for Dalal Street next week