Market mayhem: Sensex slips 1688 points, Nifty tests 17,000-level—Factors that spooked markets on Friday

Indian stock markets witnessed a massive selloff on Friday amid multiple global factors.

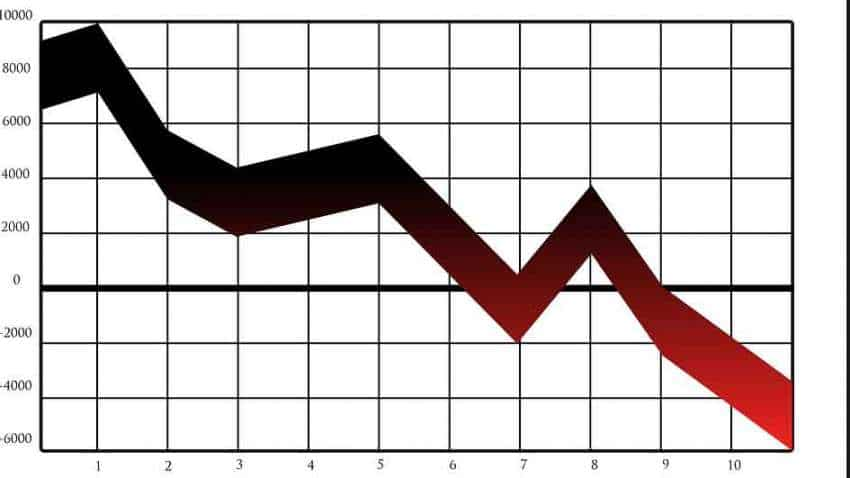

Indian stock markets witnessed a massive selloff on Friday amid multiple global factors. Domestic equity benchmarks Nifty50 and S&P BSE Sensex tanked nearly 3 % each weighed down by metal, auto, realty and power stocks. The Sensex fell by nearly 1700 points, while Nifty slipped touched 17,000 at the closing hours on Friday. The only positive from the today's session was pharma shares. Cipla, Dr Reddy and Divis Lab gained between 2 to 7 per cent on Nifty in the afternoon trade on Friday. JSW steel, Hindalco, BPCL, Tata Motors and Tata Steel corrected between 5 to 8 per cent. Nifty Realty and Nifty metal slid the most as the indices corrected 6.72% and 5.40% on the last trading day of the week..

See Zee Business Live TV Streaming Below:

Asian market and new Covid variant in South Africa

The triggers largely came from Asian markets which opened in the negative on Friday. Japanese index Nikkei 225 was trading lower by 660 points to 28, 838, Hang Seng index was also down nearly 1 per cent (0.96%) or 237 points to 24,502, while China's Shanghai Composite were down 0.23% to 3,576 around 7.10 am on Friday.

In the afternoon trade around 1.45 pm, Nikkei 225 corrected over 2.5%, Hang Seng Index 2.34%, Shanghai Composite was down 0.56% and Asia Dow was trading 1.92% lower over fears of a new Covid variant detected in South Africa that could be could be more infectious than Delta.

Oil prices

Stocks and oil prices fell even on Friday amid concerns of global investors in view of new Covid variant. Brent slid nearly 4% to below $80 a barrel on Friday as a new COVID-19 variant spooked investors, adding to concerns that a global supply surplus could swell in the first quarter following the release of crude reserves by the United States and others, said Reuters. Earlier, Oil prices dipped in thin trading on Thursday amid the U.S. Thanksgiving holiday.

Lockdown situation

A rise in Covid cases in Europe and a new variant, detected in South Africa, has prompted Britain to introduce travel restrictions on South Africa and capped downside in bullion. Austria imposed a nationwide 10-day lockdown after its daily virus deaths tripled, while Italy imposed curbs on activity by unvaccinated people. The US government advised Americans to avoid Germany and Denmark. Morocco too suspended flights from France after its daily new cases spiked above 30,000, said a Reuters report.

Thanksgiving holiday

The US Markets remained closed on Thursday, November 25, on account of Thanksgiving 2021 and will close early on discounted shopping bonanza Black Friday. Lack of triggers from the US markets also did not augur well for the Indian markets.

FIIs selling pressure & inflation

Amid looming Covid risks, FIIs remained net seller to the of Rs 2,300 crore in the Indian equity cash market on November 25. Also, the annual rate of inflation in the US hit 6.2% in October. It is the highest figure in more than three decades.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

Retirement Planning: Investment Rs 20 lakh, retirement corpus goal Rs 3.40 crore; know how you can achieve it

03:47 PM IST

Indian markets will remain under pressure amid global rate cuts: Report

Indian markets will remain under pressure amid global rate cuts: Report FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows

FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts

Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts  FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%

FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4% Tata Steel, Zomato, Mahanagar Gas, IEX, Bajaj Finance, Honasa Consumer and other stocks to track today

Tata Steel, Zomato, Mahanagar Gas, IEX, Bajaj Finance, Honasa Consumer and other stocks to track today