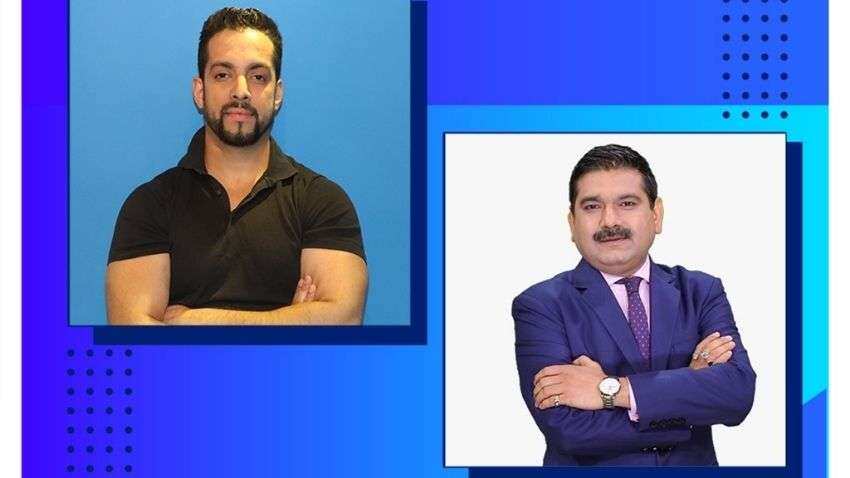

Market Guru exclusive chat with RJ Salil Acharya of Radio City: People can buy Bank, NBFC, Auto and Real Estate stocks after a correction

Anil Singhvi, Managing Editor, Zee Business, says the markets are falling because the global markets are weak and FIIs have started selling again.

Anil Singhvi, Managing Editor, Zee Business, says the markets are falling because the global markets are weak and FIIs have started selling again. During a candid radio podcast, 'Kadak Currency’, with RJ Salil Acharya, Radio City, 91.1 FM, Mumbai, Mr Singhvi said people should focus on four sectors, banks, NBFCs, auto and real estate, for buying purposes when they feel that the correction has stopped and the market may go up from here.

See Zee Business Live TV Streaming Below:

RJ Salil started the podcast, 'Kadak Currency' by saying that the markets witnessed a slight fall in early December but it has seen a big fall of around 1,500 to 2,000 points in the last few days, however, the percentage-wise it is not so big compared to other falls but people are nervous? To which Mr Singhvi said, the market is turning a bit volatile, ups and downs are more. It has fallen sharply and has seen a sharp and smart recovery. Again slight weakness is visible. There are two reasons:

(i) Generally, when the foreign markets like the US among others are a little weak then we get stronger with a thought that it hardly impacts us and our economy is good, companies are earning well and our retail investors have money in their pockets. So, we survive on the basis of our liquidity.

(ii) At times, when the FIIs are selling then we think that how much you can sell, we also have money, we will buy as everything is fine here.

So, if one of the two comes then we deal with it but we are not heroes of a Bollywood film that all the villains will come together, yet we can beat and drive them away. So, both things are in front of us and it is that the global market is weak and the American markets have been under tremendous pressure for the last five to seven days and there is a huge selling there and on top of it, the FIIs are have started selling again. So, it is becoming a bit difficult to handle both of them. In addition, there is a big event - the Budget - is around the corner. Prior to that, there has been a non-stop rally of 2000 points in Nifty, so, there is an environment of profit booking and people are a bit cautious as after a good rally when the global markets are weak, FIIs are in a selling mood, then we should also turn bit cautious.

In his next question, RJ Salil said, we have seen a lot of fall in the Bank Nifty, although, during our last chat we were talking that the banks might be one of the big movers before the budget. So, is it so and I have also seen many times that a lot of sell-off occurs and the market falls a low before a big event and then it starts increasing? So, do you think that the banks were overbought which led to sell-off or something else? Mr Singhvi in his reply said, banks are looking good from here and I believe that it will perform a little better than the market. If there will be a recovery in the market before and after the budget then it will come from the banking shares. What will happen now is that IT and pharma shares will be less good and strong.

Apart from it, the banking shares can lead the bullishness. At the same time, real estate and auto shares can also lead the buzz. So, I believe, there should be some buzz on the front. Even in this recovery, the banking sectors have shown a better recovery. In correction of the market, whenever, you feel that the fall has stopped, the market will not fall further from here and there is a possibility of rising, in that case, you should focus on four sectors, namely banks, NBFCs, auto and real estate, with the perspective of buying.

Continuing the chat further, RJ Salil said, last time, you said that the Budget has turned into a paper event. Does the Finance Minister have a look at these factors and then make last-minute additions to the budget that has already been written - similar to what we make last-minute changes while preparing some reports? Is there something last minute in the budget or whatever has been made in the final budget paper? Mr Singhvi said, it used to happen but not now. What used to happen earlier was that when the budget was presented then every budget talked about the items on which the tax has been reduced and on which it has increased and similar things were there. Now, these things are out of the budget.

Earlier, the Railway Budget and the Union Budget were presented separately but now, they have been clubbed. Earlier, Railway Budget used to talk about the new trains that will run, the meter-gauge and broad-gauge, two lines will turn into four-line and so on. Now, the government presents the budget as a policy document that we want to give you a direction as to what is happening in the economy, what is the focus of the government, where will the growth come from, where will the expenditure be, where earnings will happen and how much. So, those shocks are not felt in the budget now. Besides, the other good thing that has happened in the last two years is that earlier when you used to listen the budget then it seems something else while the fine prints would come something else, things were quite jumbled and things were different.

Now, gradually, the government is making sure that you do not get any shock in the fine prints. So, I feel, the same will happen in this budget where you will get a complete direction in terms of policy but if you think that this will turn costlier or cheaper then it is not going to happen. But you will get a clear cut direction about the economy and the country and you will get to know about the thought process of the government and the finance minister. Accordingly, you can make your mood for the market.

After this, RJ Salil asked, do you think that there can be any change in the tax slab as a lot of discussions has been held on an option of an alternate tax slab was provided and many people have not accepted it and are moving ahead with the same old tax structure. Do you think that amid the increasing expenses the government may bring some changes which may give a shock? Mr Singhvi in his reply to this question said, tax slabs should be there - tax slabs mean, it should be reduced or increase the limits where the tax slabs start. Because the purchasing power of Rupee is declining, for instance, you used to have a limit of Rs 5 lakhs but today nothing happens in Rs 5 lakh compared to the past. So, the government has two options and they are either increase the exemption limit or reduce the tax rates. Reducing the rates is a bit difficult although the corporate tax has been reduced to 25% then it doesn't have an option on that front but the tax rates for individuals is quite high and if it shows a big heart then it is a good thing. If the tax slabs are reduced then consumption will go up.

The other thing it can do is that it can increase the limit of our investment, like the interest we pay on the housing loans or on principal repayment, you can increase the limit here. You can also increase the limit in Section 88. So, those, who save more money will save more taxes and the money will be used in the growth of the country. I stand along with you on this issue either the tax slabs be changed or exemption limits should be changed or the finance minister should increase the relaxations in tax on investment so that the general public like us are benefitted from it.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

03:16 PM IST

Market Guru in talk with RJ Salil Acharya of Radio City: People can invest in Capital Goods, Defence, Paper And Sugar stocks when the market falls

Market Guru in talk with RJ Salil Acharya of Radio City: People can invest in Capital Goods, Defence, Paper And Sugar stocks when the market falls Market Guru in talk with RJ Salil Acharya of Radio City: People should invest in Bank, Auto and Real Estate stocks

Market Guru in talk with RJ Salil Acharya of Radio City: People should invest in Bank, Auto and Real Estate stocks Market Guru in talk with RJ Salil Acharya of Radio City: People can invest in companies doing India specific business

Market Guru in talk with RJ Salil Acharya of Radio City: People can invest in companies doing India specific business Market Guru in talk with RJ Salil Acharya of Radio City: Buy TCS shares in retail and tender them in the buyback

Market Guru in talk with RJ Salil Acharya of Radio City: Buy TCS shares in retail and tender them in the buyback Market Guru in talks with RJ Salil Acharya of Radio City: People can buy real estate shares as upside expected in it, says Anil Singhvi

Market Guru in talks with RJ Salil Acharya of Radio City: People can buy real estate shares as upside expected in it, says Anil Singhvi