Just Dial shares locked in 10% upper circuit. Here's what's driving the stock

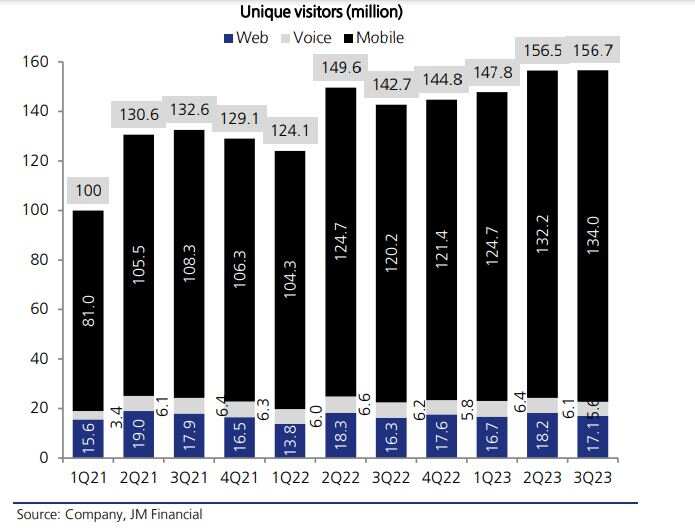

The Mumbai-based company saw an increase of 9.8 per cent in its total traffic of unique visitors to 15.7 crore, out of which, 85.5 per cent originated on mobile platforms.

Just Dial shares got locked in the 10 per cent upper circuit on Monday, after the local search engine company reported a nearly four-fold jump in its quarterly net profit. At 12:40, the Just Dial stock was frozen with a gain of Rs 58.5 or 10 per cent at Rs 643.7 apiece on BSE.

Just Dial's net profit came in at Rs 75.3 crore for the October-December period, as against a net profit of Rs 19.4 crore for the corresponding period a year ago, according to a regulatory filing.

Also Read: Radhakishan Damani Stock: DMart shares drop 6% as retail chain's Q3 results fail to excite Street

Its revenue expanded 39.3 per cent on year to Rs 221.4 crore for the three-month period.

Just Dial's EBITDA margin -- a measure of profitability -- expanded by 900 basis points (bps) on a year-on-year basis.

The Mumbai-based company saw an increase of 9.8 per cent in its total traffic of unique visitors to 15.7 crore, out of which, 85.5 per cent originated on mobile platforms, 10.9 per cent on desktops and PCs, and 3.6 per cent on its voice platform, according to the company.

JM Financial Research Analyst Swapnil Potdukhe said the company's earnings beat estimates on the profit front owing to better-than-expected operating profit and treasury gains.

He highlighted that the company's cash collections rose to a 15-quarter high led by a strong ramp-up in its sales team.

Just Dial's cash collections increased 63 per cent on a year-on-year basis to Rs 245 crore.

Also Read: Wipro shares in focus after IT major posts mixed results. Here's what to do with the stock

The margin expansion was aided by the company's strong operating leverage, Potdukhe pointed out.

JM Financial retained a 'hold' call on the stock with a target price of Rs 660 apiece, citing uncertainties related to investments in new initiatives such as JD Mart, JD Xperts, JD Shopping and JD Real Estate. It suggests investors to play the stock for the near term on strong results and inexpensive valuations.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

02:26 PM IST

Just Dial shares erase gains after hitting fresh 52-week high; JM Financial maintains ‘buy’ on compelling valuations

Just Dial shares erase gains after hitting fresh 52-week high; JM Financial maintains ‘buy’ on compelling valuations Just Dial stock hits 52-week high, shares jump over 13% after Q4FY24 results

Just Dial stock hits 52-week high, shares jump over 13% after Q4FY24 results Just Dial stock zooms as Street cheers strong Q4 show

Just Dial stock zooms as Street cheers strong Q4 show