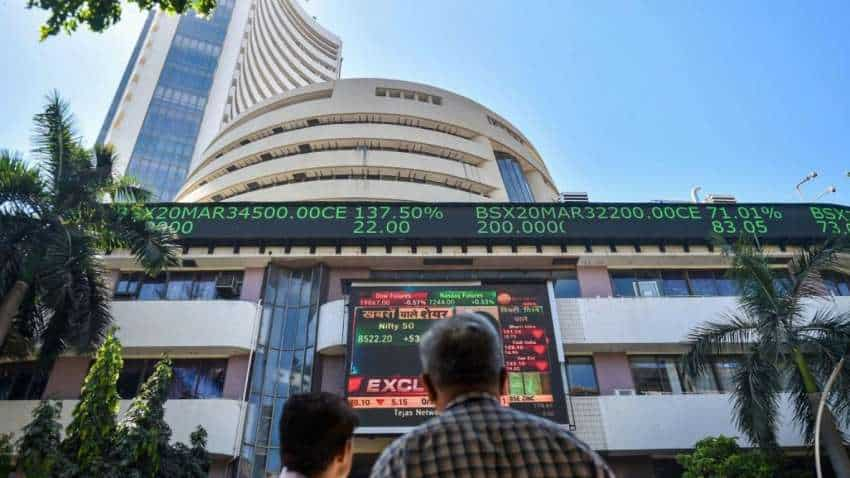

Global cues, Q4 results, Go First crisis update and more: 10 things to know before market opens today

The Nifty50 and BSE Sensex settled closer to the day’s high at 18,271 and 61,764 levels, while the broader indices – mid and smallcap – too edged higher and gained nearly a percent each.

The Indian benchmark indices – BSE Sensex and NSE Nifty50 – are expected to start Tuesday’s session on a muted note amid flat global cues. The markets on Monday started the week on a buoyant note and gained nearly a percent.

The Nifty50 and BSE Sensex settled closer to the day’s high at 18,271 and 61,764 levels, while the broader indices – mid and smallcap – too edged higher and gained nearly a percent each. Most sectors traded in sync with the move wherein auto, banking and realty ended on strong footing.

“Participants are experiencing a roller coaster ride in the index for the last 3 sessions however the overall bullish tone is somehow capping the damage,” Ajit Mishra, VP - Technical Research, Religare Broking said in his noted.

“We feel traders should continue with a cautious approach until we see some stability for a session or two. Meanwhile, stick with stock-specific trading approach and limit leveraged positions,” he said.

Stay tuned to Zeebiz.com to find out what could impact your trade today. We have collated a list of the top 10 news points which could impact markets, companies, or the economy:

Wall Street:

US stock markets paused on Monday after a strong rally in the prior session as investors shift focus to a key inflation reading later this week.

According to preliminary data, the S&P 500 (.SPX) gained 1.85 points, or 0.04%, to end at 4,137.90 points, while the Nasdaq Composite (.IXIC) gained 19.31 points, or 0.16%, to 12,254.72. The Dow Jones Industrial Average (.DJI) fell 53.96 points, or 0.16%, to 33,620.42.

Asian Markets:

Most Asian stocks were mixed tracking the flat US markets during the early morning session on Tuesday. Except for Japan’s Nikkei, which gained more than a half per cent, rest all other important indices like Hong Kong’s Hang Seng was down 0.4 per cent, South Korea’s Kospi was down 0.5 per cent and China’s Shanghai was down flat with negative bias today.

SGX Nifty:

Singapore Exchange (SGX) Nifty — an early indicator of the Nifty 50 index — was down 33 points or 0.18 per cent at 18,317 at this hour on Wednesday, suggesting a weak start ahead in the Indian share market today. It opened at 18,303 and touched the day’s high at 18,352.5 levels.

Rupee ends flat on Monday

The rupee pared initial gains to settle flat at 81.78 against the US dollar on Monday amid a recovery in crude oil prices.

Forex traders said the rupee consolidated in a narrow range as the gains from weak American currency and positive domestic equities were negated by a recovery in crude oil prices.US dollar index gains.

Dollar index gains

The dollar edged higher against a basket of its peers on Monday, shaking off earlier weakness as traders moved past an unsurprising loans survey toward other economic data that could provide fresh clues on the Federal Reserve's hiking path.

the dollar index, which measures the currency against six rivals, rose 0.08% to trade at 101.38, a better showing than the one-year low of 100.78 reached last month.

Crude oil rises

Crude oil prices rose over 2% on Monday as US recession fears eased, and some traders saw crude's three-week slide on demand worries as overdone.

Brent crude settled up $1.71, or 2.3%, at $77.01. US West Texas Intermediate (WTI) crude also gained $1.82, or 2.6%, to $73.16.

Yellen on debt ceiling

Treasury Secretary Janet Yellen said on Monday that a failure by Congress to raise the $31.4 trillion federal debt limit would cause a huge hit to the U.S. economy and weaken the dollar as the world's reserve currency.

Asked whether the U.S. Treasury could prioritize payouts to bondholders in the event of a default, Yellen told CNBC that President Joe Biden would be forced to make decisions on what to do with Treasury's resources if the debt ceiling was not raised, but declined to discuss or rank the options.

Q4 results update

Prominent companies such as Britannia, Pidilite Industries, Kansai Nerolac, Canara Bank among others announced their Q4 earnings along with some broader market firms on Monday.

The earnings momentum is expected to continue on Tuesday as auto major Lupin, Castrol India, Nazara Tech, Raymond along with others are scheduled to release their fourth-quarter earnings of the previous fiscal today.

Go First crisis update

Go Airlines on Monday called on India's company law tribunal to urgently grant its request for bankruptcy protection, as more lessors sought to repossess planes and the country's aviation regulator told the carrier to stop selling new tickets.

The airline, widely known as Go First, filed for bankruptcy protection last week, blaming "faulty" Pratt & Whitney engines for the grounding of about half its 54 Airbus (AIR.PA) A320neo. In all, it has 57 planes.

FII & DII Data:

Foreign portfolio investors (FPIs) remained net buyers for Rs 2,123.76 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 245.27 crore on Tuesday, provisional data showed on the NSE.

(With inputs from PTI, Reuters and other agencies)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

08:29 AM IST

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note