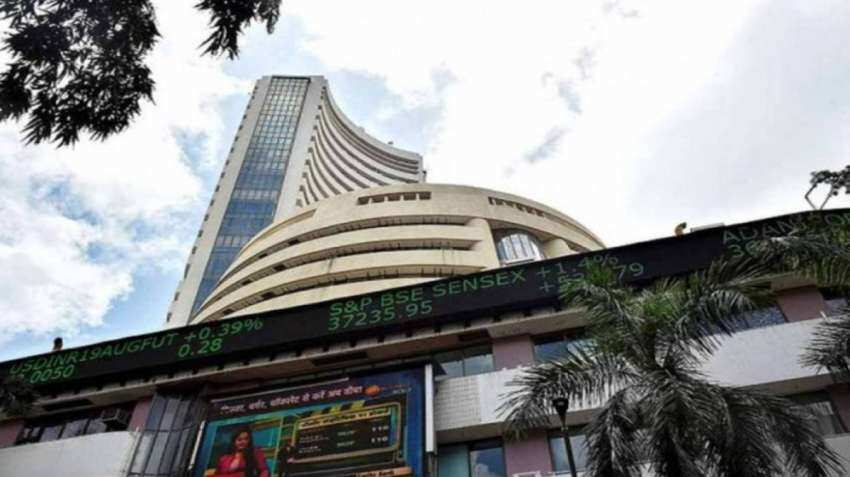

Brokerage Views: ICICI Lombard, ICICI Prudential, Paytm, metal stocks in focus today

Several global brokerages are upbeat on ICICI Lombard, ICICI Pru Life and Bank of India. Goldman Sachs believes the shares of Paytm may double from the current market price.

Brokerage Views: Global brokerages are upbeat on ICICI Lombard, ICICI Prudential Life and Bank of India a day after the companies reported their financial results for the October-December period. Macquarie is bullish on Siemens after the company bagged one of the largest orders from Indian Railways. CLSA has Hindalco as its top pick from the metals space.

Here are some key stocks under the brokerages' radar:

ICICI Lombard

The general insurance company reported a set of results on Tuesday that fell short of analysts' estimates.

CLSA and Jefferies each maintained a 'buy' rating on the stock with target prices of Rs 1,500 and Rs 1,620 per share respectively.

| Brokerage | Rating | Target Price |

| Morgan Stanley | Overweight | Rs 1,495 |

| CLSA | Buy | Rs 1,500 |

| Jefferies | Buy | Rs 1620 |

| Credit Suisse | Outperform | Rs 1,500 |

Credit Suisse has an 'outperform' call on the stock with a target price of Rs 1,500. Morgan Stanley has an 'overweight' with a target of Rs 1,495.

ICICI Prudential Life

The life insurance company's earnings also fell short of analysts' estimates. CLSA and Citi are positive on the stock, with a 'buy' call each.

CLSA has a target price of Rs 620 for the stock and Citi's target is Rs 695.

| Brokerage | Rating | Price Target |

| Morgan Stanley | Overweight | Rs 630 |

| CLSA | Buy | Rs 620 |

| Jefferies | Buy | Rs 580 |

| CITI | Buy | Rs 695 |

Morgan Stanley has maintained 'overweight' on the stock with a target of Rs 630 apiece. The value of the new business (VNB) beat is attributable to higher product-level margins and the persistence trend of the insurance company is strong, according to the brokerage.

Bank of India

Morgan Stanley maintained an 'overweight' on the lender's stock with a target price of Rs 125. Credit Suisse has given an 'outperform' call on the PSU Bank with a target of Rs 110 per share.

| Brokerage | Rating | Price Target |

| Morgan Stanley | Overweight | Rs 125 |

| Credit Suisse | Outperform | Rs 110 |

Paytm

Goldman Sachs believes Paytm operator One-97 Communications shares may double (112% upside) as it maintained a Buy rating on the digital company stock with a revised target price of Rs 1120 per share from Rs 1100 apiece earlier.

Siemens

Macquarie has maintained 'outperform' on Siemens with a target price of Rs 3,330 per share on the back of strong order momentum.

CLSA on metal stocks

CLSA believes a faster reopening in China and stimulus have provided a new lease of life for the metal sector.

Hindalco: Maintain Buy, Target raised to Rs 580 from Rs 515

Tata Steel: Upgrade to Outperform from Sell, Target raised to Rs 135 from Rs 90

JSW Steel: Maintain Sell, Target raised to Rs 640 from Rs 480

Vedanta: Maintain Reduce, Target raised to Rs 295 from Rs 275

Jindal Steel & Power: Upgrade to Reduce from Sell, Target raised to Rs 610 from Rs 430

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

02:17 PM IST

ICICI Lombard Q2 profit rises 20% to Rs 694 crore

ICICI Lombard Q2 profit rises 20% to Rs 694 crore LIC, SBI Life, HDFC Life, ICICI Pru, ICICI Lombard: Should you buy, sell or hold these insurance stocks?

LIC, SBI Life, HDFC Life, ICICI Pru, ICICI Lombard: Should you buy, sell or hold these insurance stocks? ICICI Lombard & other general insurance stocks in focus after May premium data

ICICI Lombard & other general insurance stocks in focus after May premium data Bharti Enterprises sells shares of ICICI Lombard for Rs 663 crore

Bharti Enterprises sells shares of ICICI Lombard for Rs 663 crore ICICI Lombard shares gain 6% after-Q4 results; what should investors do?

ICICI Lombard shares gain 6% after-Q4 results; what should investors do?