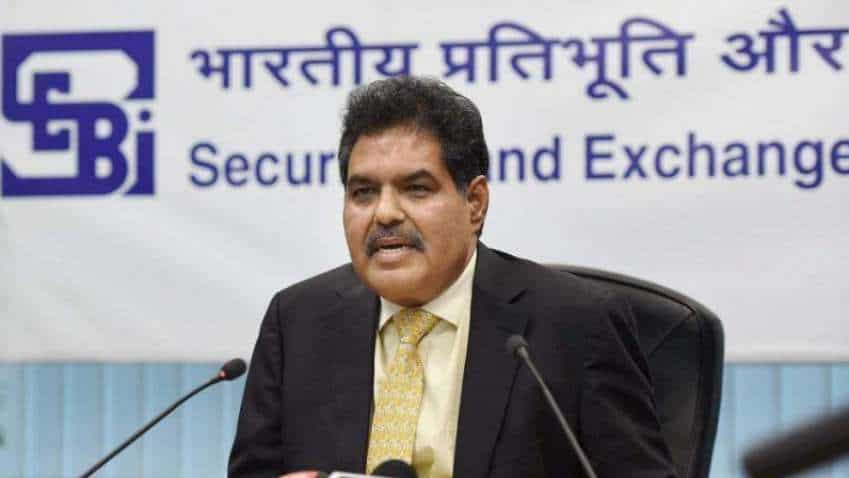

Happy with response to new age tech companies’ IPOs: SEBI Chief Ajay Tyagi

Successful IPOs of new age companies are likely to attract more funds in domestic markets, SEBI Chairman Ajay Tyagi said. Recently Zomato’s IPO was launched and this week PayTM has filed DRHP, more such new age but still loss making companies are coming to market, he added. He was delivering a speech at NISM second annual capital markets conference

Securities and Exchange Board of India (SEBI) is happy with the overwhelming response to the IPOs of the new age companies. SEBI Chairman Ajay Tyagi said “Recent filings and public offerings reflect the maturity of our market to accept the business model of new age tech companies, which aren’t amenable to valuation through conventional metrics of profitability”. He said successful IPOs of such new age companies are likely to attract more funds in domestic markets; thus creating a new ecosystem of entrepreneurs and investors. Recently Zomato’s IPO was launched and this week PayTM has filed DRHP, more such new age but still loss making companies are coming to market.

Delivering a speech at NISM second annual capital markets conference SEBI Chief said the maturity of the Indian IPO market and its resilience to the COVID-19 pandemic is reflected in the quantum of funds raised during FY21 companies raised INR 46 billion through IPOs as compared to INR 21.4 billion in FY 20. In FY 22, until June end, companies have already raised INR 12 billion and from the number of new filings with SEBI, it is expected that the figures will increase significantly going forward.

See Zee Business Live TV Streaming Below:

SEBI Chief hinted about bringing new ETF products, he said “SEBI is examining how to increase ETF liquidity on exchange platforms and feasibility of introducing new ETF products such as corporate bond ETFs to increase liquidity in corporate bond market”. Enhancing liquidity in corporate bond market has been there all along in the agenda of SEBI but outcome was not as expected.

SEBI chief spoke the increased retail investors’ interest in Indian securities market, he said the cumulative number of total demat accounts increased from 4.1 Cr at beginning of FY 21 to 5.5 Cr by the end of FY21 – an increase of 34.7 %. On an average about 12 lakh new demat accounts were opened per month in FY21 as compared to 4.2 lakh per month during the preceding year. The trend get further accentuated during the current financial year – on an average 24.5 lakh demat accounts have been opened per month during April- June 2021.

He said equity cash market turnover increased from Rs 96.6 Lakh Cr in FY20 to INR 164.4 Lakh Cr in FY21 – an increase of 70.2%. The share of individuals in turnover increased by around 5 percentage points to 51.4% in FY21 over the previous year. Larger share of trades originating from mobile devices and internet-based trading in the total turnover is another indicator of increased retail participation. The overall resource mobilization through capital markets has gone up despite being a pandemic affected year, Rs 10.12 Lakh Cr were raised in FY21, surpassing previous year’s figures of Rs 9.96 Lakh Cr.

SEBI Chief further said, low interest rates and ample liquidity availability aren’t the only reasons for increased investors interest in securities market; though one can not deny that they are major factors and any tightening of liquidity or increase in interest rates would impact the market. But it also needs to be acknowledged that by their very nature, the markets are forward looking and the present investments take into account future growth prospects. He said SEBI has made effort in terms of continuous dialogue with stakeholders to bring in required regulatory changes, rationalizing procedures and maintaining trust in the market.

He also spoke about SEBI’s policies which are work in progress like the Social Stock Exchange, Gold Spot Exchange, new products under ETF etc.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

06:49 PM IST

Sebi introduces uniform data sharing policy for research purposes

Sebi introduces uniform data sharing policy for research purposes  EXCLUSIVE: SEBI Board to discuss the toughest regulation to deal with market manipulation

EXCLUSIVE: SEBI Board to discuss the toughest regulation to deal with market manipulation  Sebi mulls facilitating participation of retail investors in algo trading

Sebi mulls facilitating participation of retail investors in algo trading  Sebi extends timeline to submit comments on proposed appointment process of key officials at MIIs

Sebi extends timeline to submit comments on proposed appointment process of key officials at MIIs  SEBI December 18 Board Meeting: Tighter regulations for SME IPOs, wider scope of UPSI, performance validation agency, other proposals for board test

SEBI December 18 Board Meeting: Tighter regulations for SME IPOs, wider scope of UPSI, performance validation agency, other proposals for board test