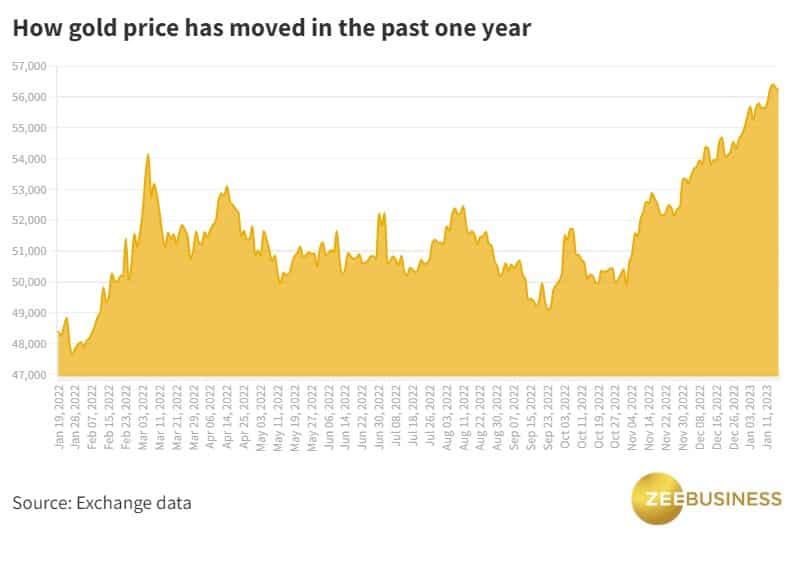

Gold soars to record high of Rs 56,850 per 10 grams. Is it an opportunity missed?

Gold, silver prices today: MCX gold futures for February 3 delivery rose by as much as Rs 304 or 0.5 per cent to a record high of Rs 56,850 per 10 grams. MCX silver futures (March 3) rose as as high as Rs 69,144 per kilogram.

Domestic gold futures rose by half a per cent to a record high on Friday tracking global benchmarks. Weakness in the US dollar — making the yellow metal more attractive for those holding other currencies — and safe-haven demand, amid weak US macroeconomic data and hawkish comments from Fed officials that fuelled concerns about a recession in the world's largest economy.

On MCX, gold futures for February 3 delivery gained by as much as Rs 304 or 0.5 per cent to Rs 56,850 per 10 grams — a record high.

The international spot gold rate was up 1.1 per cent at $1,924.1 per ounce at the last count, within $5 of a nine-month high of $1,929 touched on Monday.

US gold futures rose 0.9 per cent to finish at $1,923.9 per ounce. Silver futures were up 0.6 per cent at $24 an ounce.

The rupee was last seen quoting at 81.17 against the US dollar, higher by 19 paise or 0.2 per cent compared with its previous close.

Typically, gold shares an inverse relationship with riskier asset classes such as stocks. Indian equity benchmark Nifty50 has risen about two per cent in the last one year.

Gold & silver: Near-term outlook

In rupee terms, gold has support at Rs 56,510-56,380 per 10 grams and resistance at Rs 56,940-57,140 per 10 grams," said Rahul Kalantri-VP Commodities at Mehta Equities.

He sees support for silver at Rs 68,050-67,520 per kilogram and resistance at Rs 68,950–69,580 per kilogram.

"International gold has support at $1,912-1,898 and resistance at $1,940-1,951. Silver has support at $23.7-23.5 and resistance at $24.1-24.3," he added.

Is gold an opportunity missed for investors?

"After staging a rally in 2022, gold is poised for a rally in 2023 as well given the current market environment... One can expect gold to touch Rs 62,000 per 10 grams in 2023," Ajay Kedia, Founder and Director at Kedia Advisory, told Zeebiz.com.

"Although there might be a pullback in the short term, where those who missed the bus will be able to enter, the prospects for gold look bright for the year as a whole, given the slightly overvalued equity markets owing to fears about a recession or a slowdown or sticky inflation," said Kedia, who sees Rs 54,000 as a possible reentry level.

Silver outlook

Kedia finds silver much stronger this year driven by strong industrial consumption prospects for the white metal. "Silver is going to be the poor man's gold this year," he said.

MCX silver futures for March 3 delivery were last quoting higher by Rs 481 or 0.7 per cent at Rs 68,840 per kilogram on Friday, having jumped to as high as Rs 69,144 per kilogram earlier in the day.

Kedia expects silver to touch Rs 90,000 per kilogram in 2023, with Rs 65,000 per kilogram as a near-term entry point.

Catch latest market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Retirement Planning: How one-time investment of Rs 11,00,000 can create a Rs 3,30,00,000 retirement corpus

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 45,000, or Rs 55,000? Know what can be your total pension as per latest DR rates

SBI Senior Citizen FD Rates: Want to invest Rs 3,00,000 in SBI FD? You can get this much maturity amount in 1 year, 3 years, and 5 years

Top 7 Flexi Cap Mutual Funds With Highest Returns in 1 Year: Rs 1,50,000 one-time investment in No. 1 fund is now worth Rs 1,78,740; know how others have fared

9 Stocks to Buy for Short Term: Analysts recommend largecap, midcap stocks for 2 weeks; IndusInd Bank, Coforge, MOFSL on the list

SBI 5-Year FD vs SCSS: Which investment option can offer better returns with quarterly payments on Rs 6,00,000?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 80,000; pensionable service 25 years; what can be your monthly pension in each scheme

05:32 PM IST

Gold and Silver Rate Today (Feb 21, 2025): Precious metal futures trade under pressure; check out city-wise spot price list

Gold and Silver Rate Today (Feb 21, 2025): Precious metal futures trade under pressure; check out city-wise spot price list Precious metal prices: Gold trades near all-time high at Rs 88,443, silver up over Rs 650 today

Precious metal prices: Gold trades near all-time high at Rs 88,443, silver up over Rs 650 today Jewellery Stocks In Trouble: Falling exports, costly gold, and rising competition hit hard

Jewellery Stocks In Trouble: Falling exports, costly gold, and rising competition hit hard Gold Price Today: Yellow metal climbs as US tariff worries fuel safe-haven demand

Gold Price Today: Yellow metal climbs as US tariff worries fuel safe-haven demand Domestic gold investments surge 60 pc to Rs 1.5 lakh crore in 2024: Report

Domestic gold investments surge 60 pc to Rs 1.5 lakh crore in 2024: Report