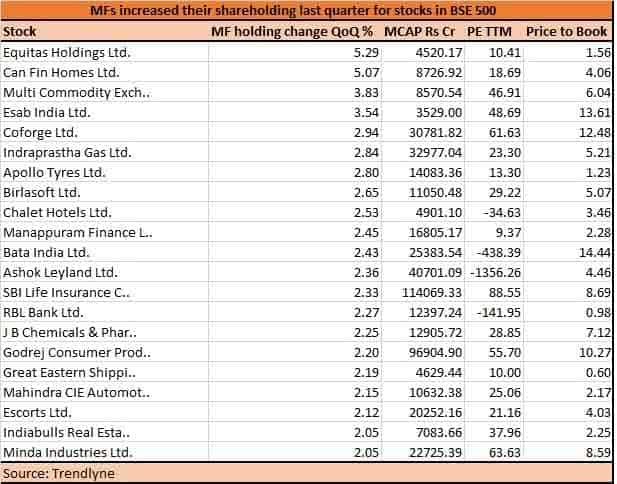

Fund managers raise 2-5% stake in 21 companies in BSE 500 index; do you own any?

The Average Assets Under Management (AAUM) of the Indian Mutual Fund Industry rose from Rs 33 lakh crore for the month of June 2021 to over Rs 37 lakh crore at the end of September.

The Average Assets Under Management (AAUM) of the Indian Mutual Fund Industry rose from Rs 33 lakh crore for the month of June 2021 to over Rs 37 lakh crore at the end of September.

Fund managers mobilized nearly Rs 40,000 crore from the July-September period under the growth and equity-oriented schemes, in which they raised stake in more than 200 companies in the S&P 500 index.

See Zee Business Live TV Streaming Below:

Out of 200 companies, in which fund managers raised stake sequentially, 21 of those saw a quarter-on-quarter change of 2-5 per cent.

The companies that remained fund managers' favourite included Minda Industries, Escorts, RBL Bank, Bata India, MCX, Can Fin Homes, and Equitas Holdings.

Most of the companies are in the small and midcap space from cyclicals, auto, consumption as well as specialty chemical space, suggested experts. Most fund managers are increasing exposure to companies that are likely to benefit the most from the domestic economic revival theme.

"We feel sectors geared to domestic economic revival should do well in the coming years. Thus, we are bullish on early and mid-cyclical such as financials, auto and auto ancillaries, consumer discretionary, construction and capital goods/industrials," George Heber Joseph, CEO-CIO, ITI Mutual Fund, said.

"Within the defensive sectors, we are bullish on pharmaceuticals as compared to consumer staples. We are underweighting on the metals, IT and speciality chemicals sectors as we feel valuations discount most of the positives and leave little room for error," he said.

There are more than 33 stocks in which fund managers increased stake by 1-2 per cent on a QoQ basis that include names like Equitas, NMDC, Tata Chemicals, WABCO, Lupin, Amber Enterprises, SBI Cards, M&M, Oberoi Realty, and Adani Ports.

(Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

Top 7 Mid Cap Mutual Funds With up to 41% SIP Returns in 5 Years: No 1 fund has converted Rs 15,000 monthly investment into Rs 23,84,990

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

10:53 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence