Economic Survey 2022: GDP growth for FY23 is estimated at 8-8.5%; experts call it conservative figures by government

India’s Gross Domestic Product (GDP) growth rate is expected to be between 8-8.5 per cent for the Financial Year 2023 according to the estimates by the government. It is down from estimated 9.2 per cent growth in the current fiscal year, the annual economic survey showed on Monday.The estimates have been given in this year’s economic survey (Economic Survey 2022). The Economic Survey 2022 was presented by Finance Minister Nirmala Sitharaman on Monday ahead of the Union Budget 2022.

Several experts on the Zee Business have said that the government has given conservative figures in its estimates and it could be higher than this.

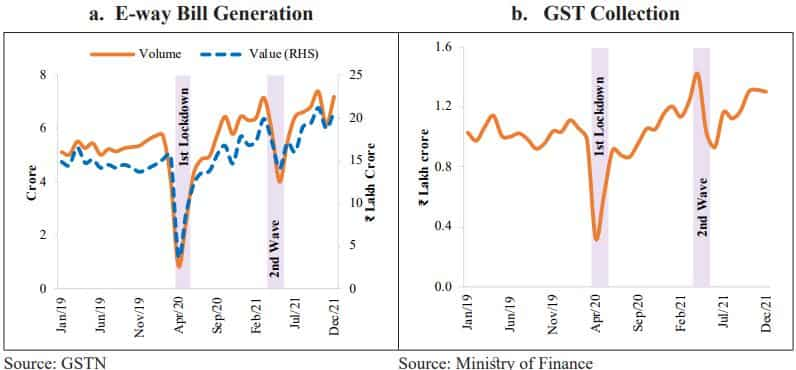

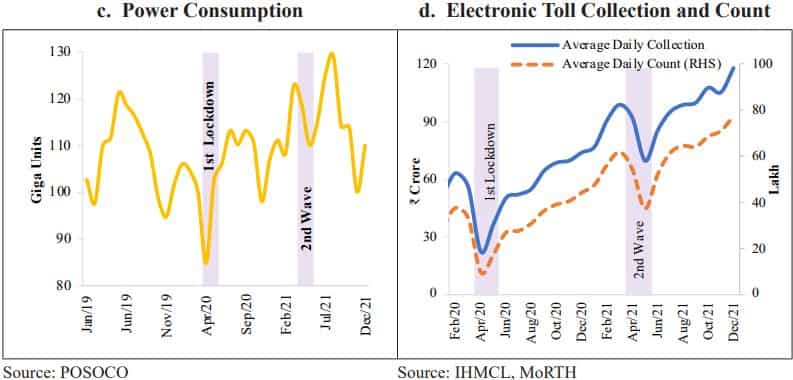

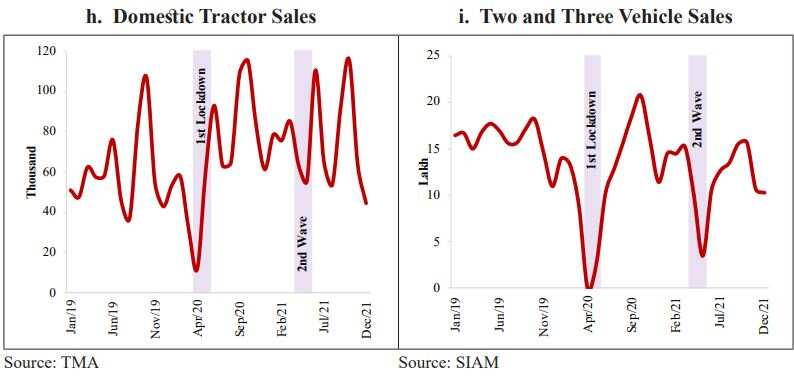

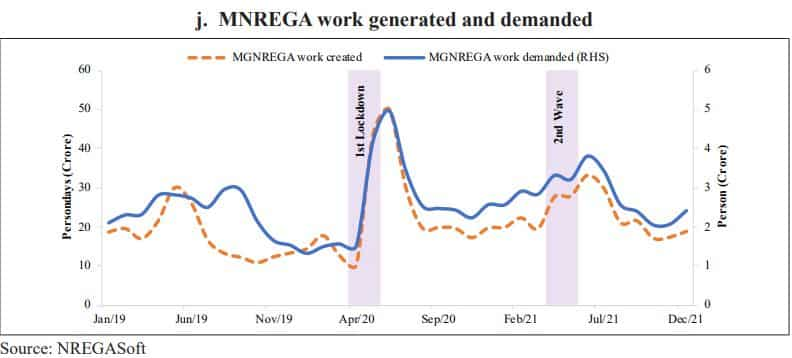

The survey suggested that India was poised well to to take on the challenges of 2022-23 citing its robust unique response strategy. "Rather than pre-commit to a rigid response, Government of India opted to use safety-nets for vulnerable sections on one hand while responding iteratively based on Bayesian-updating of information. This “barbell strategy” was discussed in last year’s Economic Survey. A key enabler of this flexible, iterative “Agile” approach is the use of eighty High Frequency Indicators (HFIs) in an environment of extreme uncertainty," the survey said.

The Economic Survey has been prepared by the new Chief Economic Adviser Dr V. Anantha Nageswaran.

LIVE AT 3:45PM

CEA Dr V. Anantha Nageswaran to address a press conference today at 3:45 PM in New Delhi

Watch on #PIB's

YouTube: https://t.co/1q0QEIcJEz

Facebook: https://t.co/ykJcYlvi5b— PIB India (@PIB_India) January 31, 2022

See Zee Business Live TV Streaming Below:

See Tweet Here:

संसद में इकोनॉमिक सर्वे पेश..

देखिए LIVE - https://t.co/rBXKs3CHn7#EconomicSurvey |#BudgetOnZee | #GrowthBoosterZee pic.twitter.com/s6RTfEIMc7

— Zee Business (@ZeeBusiness) January 31, 2022

Over the last two years, Government leveraged High Frequency Indicators (HFIs) representing industry, services, global trends, macro-stability indicators and several other activities, from both public and private sources to gauge the underlying state of the economy on a real-time basis, the documents claims. These include electricity generation, scheduled domestic flights, volume/value of financial transactions, capital flows, mobility indices, and so on. It also covers employment demanded under MGNREGA to gauge rural employment conditions, especially in the context of migrant workers. These indicators are regularly published in the Monthly Economic Report of Ministry of Finance and a full list is given in the Annex at the end of this chapter.

Pradeep Gupta, Co-Founder & Vice Chairman, Anand Rathi Group.

In terms of valuations how are we placed among the Emerging Markets?

India’s economic recovery has been stronger than initially anticipated. The IMF has retained its GDP projections of India in the current fiscal year at 9.5% and 8.5% growth for the next year, retaining the tag of one of the fastest growing economies. Globally, the economic recovery continued, but at a slower pace. Global economy is projected to grow at 5.9% in the current year and 4.9 in the next year, a downgrade from the earlier projection. This downgrade is partly due to the supply chain disruption for the advanced economies in hand with the pandemic disruptions for other nations. Coming back to the Indian equities, in the last one-year, the Indian equity market has been the best performing amongst all major markets of the world. Nifty 50 rallied 50% and mid- and small-cap indices have done much better, since April 2020, Nifty has gone up nearly 150% and the small cap indices by nearly 250%. We witnessed healthy FII inflows which resulted in strong growth in the Indian capital market. The valuation of Indian equities has grown multifolds in the last decade. According to Bloomberg data, the MSCI India index trades at 80% premium to the MSCI EM index, which represents the emerging market (EM) equities. This is much higher than the long-term average premium of 44%. Indian equities have constantly outperforming its emerging market peers and the valuation premium further improved due to the market returns. Indian equities, in term of market cap surged to 37% and is further expected to grow at a tremendous rate owing to the higher growth potential and developing technology sector.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:07 PM IST

Maharashtra will play key role in achieving India's $5 trillion economy goal: Minister Aditi Tatkare

Maharashtra will play key role in achieving India's $5 trillion economy goal: Minister Aditi Tatkare India's GDP growth to pick up in third quarter compared to first half of FY25: ICRA report

India's GDP growth to pick up in third quarter compared to first half of FY25: ICRA report GST collection grows 9% to Rs 1.87 lakh crore in October

GST collection grows 9% to Rs 1.87 lakh crore in October IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025

IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025  India poised to be third largest global economy by 2030, rising population presents challenges: S&P

India poised to be third largest global economy by 2030, rising population presents challenges: S&P