Don’t expect big fireworks from SAMVAT 2078! 10 stocks where retail investors hold maximum stakes

SAMVAT 2077 closed on a blockbuster note with gains of about 40 per cent for the benchmark indices, but experts caution retail investors for the next SAMVAT, which might not be as bright.

SAMVAT 2077 closed on a blockbuster note with gains of about 40 per cent for the benchmark indices, but experts caution retail investors for the next SAMVAT, which might not be as bright.

The broader market indices outperformed domestic equity benchmarks. The Nifty Midcap100 and the Nifty Smallcap100 yielded 70.4% and 81.5% between November 13, 2020 and November 2, 2021.

See Zee Business Live TV Streaming Below:

There are more than 8.5 crore registered investors on the BSE, while the unique investor count on the NSE crossed 50 million, according to reports as on data collated on October 25.

At the end of September, the total demat accounts with CDSL and NSDL — the country’s main depositories — stood at 70.2 million, media reports highlighted.

Retail investors have been front runners in pushing benchmark indices to fresh record highs. The S&P BSE Sensex crossed 62000, while the Nifty50 hits a record high above 18600 in SAMVAT 2077.

“SAMVAT 2077 will be remembered for a long time and will find its place in history as one of the strongest and widely participated rallies by retail investors,” Vijay Singhania, Chairman, TradeSmart, said.

“Though one would wish for a repeat performance in SAMVAT 2078, it would be asking for too much. Most tailwinds that supported the rally in SAMVAT 2077 continue to remain strong, but one needs to remember that we were operating on a low base during this time, an advantage that will not be present in the current year,” he said.

Singhania further added that SAMVAT 2078 can give positive returns but we need to keep our eyes on the two dark clouds – US Bond yields and China slowdown.

Also read: Samvat 2077 Multibaggers: These 10 stocks from Nifty Midcap100 & Nifty Smallcap100 yielded 250% to 492% returns

https://www.zeebiz.com/market-news/news-samvat-2077-multibaggers-these-1...

The bull run remains intact even though we might be trading near unchartered territories, and any dips from here on can be used to accumulate quality stocks. Benchmark indices are unlikely to give blockbuster returns but stock specific action is likely to continue, suggested experts.

“Samvat 2077 can be characterized by a broad-based recovery across the equity market segments. Benchmark Nifty index has delivered a return of over 40%, while broader market i.e. mid-caps and small-caps have outperformed the large caps with over 70% and 80% returns, respectively,” Rajnath Yadav, Research Analyst at Choice Broking, said.

“As far as the outlook for Samvat 2078 is concerned, we are not expecting returns similar to previous year. Market returns for this year will be in the range of 8-12%,” said Yadav.

Increasing clout of retail investors:

Retail holding in companies listed on the NSE went down to 7.13 per cent as of September 30, 2021 from 7.18 per cent as on June 30, 2021 on an aggregate basis by value percentage, Prime Database said in a report.

Considering only free float (non-promoter holding), retail ownership by value percentage went down to 14.39 per cent in the quarter ending September 2021 from 14.49 per cent one quarter back.

In terms of ownership by number of shares (Average of ‘Retail Holding as a % of Total Share Capital’ across all NSE listed companies), retail ownership increased to 16.29 per cent as on September 30, 2021 from 15.84 per cent on June 30, 2021.

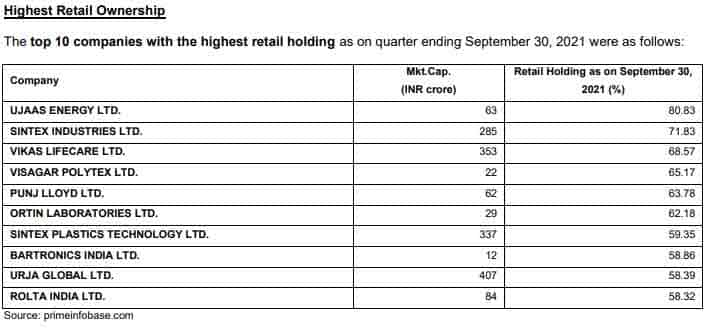

Prime Database highlighted 10 stocks, where retail investors hold maximum stakes that include names like Ujjas Energy, Sintex Industries, Vikas Lifecare, Punj Lloyd, and Rolta India etc., among others.

(Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

18x15x12 SIP Formula: In how many years, Rs 15,000 monthly investment can grow to Rs 1,14,00,000 corpus; know calculations

12:05 PM IST

BSE, NSE closed today for Christmas; trading to resume on Thursday

BSE, NSE closed today for Christmas; trading to resume on Thursday Santa Pick by Anil Singhvi for long term: Market wizard bullish on this smallcap IT services stock

Santa Pick by Anil Singhvi for long term: Market wizard bullish on this smallcap IT services stock GIFT Nifty futures hint at muted start; markets to trade cautiously

GIFT Nifty futures hint at muted start; markets to trade cautiously Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts  Indian markets will remain under pressure amid global rate cuts: Report

Indian markets will remain under pressure amid global rate cuts: Report