Hot Stock: Sharekhan recommends Buy on pizza-maker Jubilant FoodWorks, check price target

Jubilant Foodworks share price: The brokerage house in its report dated December 30, 2022, said that it likes the company's strategy of investing in the core and new ventures to scale up business growth and revenue without comprising on profitability in the medium term

Jubilant Foodworks share price: Domestic brokerage firm Sharekhan is bullish on Domino's pizza-maker Jubilant FoodWorks and has recommended buy rating on the stock. It said that the company’s brand-wise differentiated strategy, aggressive store additions, improving customer experience on the delivery platform, sustained innovation and customer-centric offerings will drive growth in the medium-long term.

The brokerage house in its report dated December 30, 2022, said that it likes the company's strategy of investing in the core and new ventures to scale up business growth and revenue without comprising on profitability in the medium term.

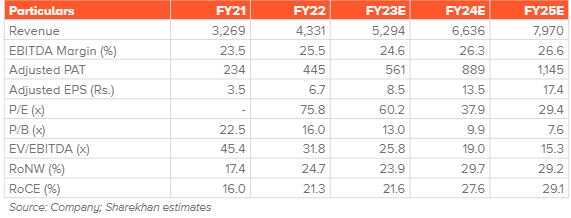

With the right strategies in place, Sharekhan expects the company’s revenue and PAT to report a 22.5 per cent and 37.1 per cent CAGR, respectively, over FY2022-FY2025E.

Jubilant FoodWorks Share Price Target 2023

The stock has corrected by 18 per cent from its recent high, it said, adding that "we maintain our Buy rating on the stock with an unchanged price target of Rs 770."

The report also said that the food service company witnessed strong demand traction till Diwali. However, post the festive season, the momentum weakened in November with a decline in footfalls, which continued till mid-December. It said that the decline in demand can be majorly attributed to a general decline in the high street and mall footfalls and higher eating out at social functions (vs. Quick Service Restaurants chains).

Even though demand has shown some signs of recovery in the latter half of December, on an overall basis, it will be muted for the quarter ending December, it said.

On the other hand, the report said that raw-material inflation which continued to remain elevated during the quarter with cheese and wheat prices up by 30 per cent year on year (y-o-y) would also adversely impact JFL’s profitability in the near term.

According to the report, JFL has multiple drivers in place to achieve consistent double-digit growth in the coming years. It said that a few of the company’s strategies will aid in achieving strong growth which includes regional menu innovation, enhanced digital focus, scaling up of new ventures, sustained new store addition, and introduction of the loyalty program in the long run.

Shares of Jubilant FoodWorks quoted Rs 508 apiece on NSE, up nearly 0.80 per cent the previous close of Rs 505.05. On BSE, the scrip traded at Rs 507 per share.

Valuation

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

10:49 AM IST

Domino's aims to double store count to 4,000 in India in 5-6 years

Domino's aims to double store count to 4,000 in India in 5-6 years Jubilant Foodworks Q1 results preview: Weak demand to impact earnings; PAT may decline 28% YoY

Jubilant Foodworks Q1 results preview: Weak demand to impact earnings; PAT may decline 28% YoY Q4 results preview: Domino’s pizza maker may post weak results on raw material inflation, weak demand

Q4 results preview: Domino’s pizza maker may post weak results on raw material inflation, weak demand Domino’s Pizza-maker Jubilant Foods gains as Street cheers QSR's expansion plans, 20-min delivery service

Domino’s Pizza-maker Jubilant Foods gains as Street cheers QSR's expansion plans, 20-min delivery service