BPCL falls after poor Q2 performance, brokerages cut stock price targets

BPCL Share Price: The oil marketing company in the Q2FY23 posted a second consecutive quarterly loss.

BPCL Share Price: Bharat Petroleum Corporations Limited (BPCL) stocks traded under pressure on Wednesday, November 9, as investors' sentiment turned negative following the release of the July-September quarter results. According to an exchange filing, the oil marketing company in the Q2FY23 posted a second consecutive quarterly loss.

Earlier on Monday, BPCL had released its Q2 earnings wherein the company revealed that it posted a loss of Rs 304.17 crore. In the first quarter, it posted a loss of Rs 6,263.05 crore. This was the highest ever loss reported by BPCL for any six-month period, including the era when petrol and diesel prices were regulated and the government used to give subsidies to the three retailers.

The stock opened at Rs 311.10 apiece on the NSE. At 11:20, it quoted Rs 306, falling more than 1 per cent.

The combined loss for the first half of the current fiscal year that began on April 1 now stands at Rs 21,201.18 crore.

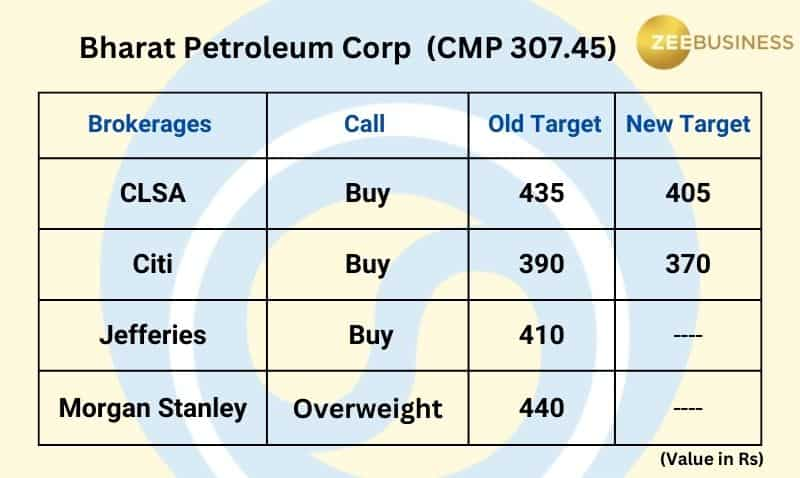

Following the poor Q2 results, brokerages have reduced their target on the counter:

BPCL recorded a total income of Rs 1,28, 702.42 crore as compared to last year which was Rs 1,02,596.50 crore. The Net Profit after tax stood at Rs 3,149.28 crore as compared to Rs 6,147.94 crore last year. The company recorded a Net Revenue from Operations of Rs 1,28,355. 72 crore in Q2FY23 up from Rs 1,01,938. 72 crore in the same quarter last year. Q2 revenue, however, was lower than Rs 1,38,424.50 crore recorded in Q1FY23.

Company’s total asset standing was at Rs 1,87,060.45 crore and total liabilities was at Rs 1,38,295.17 crore.

The market sales of the Corporation for the half year ended 30th September 2022 was 23.20 MMT as compared to 19.54 MMT for the half year ended 30th September 2021.

The Average Gross Refining Margin (GRM) of the Corporation for half year ended 30t h September 2022 is $22.30 per barrel (April-Sept 2021: $ 5.23 per barrel). This is before factoring the impact of Special Additional Excise Duty and Road & Infrastructure Cess, levied w.e.f 01st July 2022. However, the suppressed marketing margins of certain petroleum products have offset the benefit of higher GRM.

The company in the regulatory filing said that the Corporation had suffered under recoveries on sale of domestic LPG in the Financial Year 2021-22 and in six months ended on September 30, 2022. To compensate the Corporation for these under recoveries, Government of India has recently approved a one-time grant of Rs 5,582 Crores. This receivable grant has been recorded under Revenue from Operations in Financial Results for the quarter and half year ended September 30, 2022.

Impairment loss amounting to, 10.66 Crores (Previous period:, 6.84 Crores) has been recognized after intra group elimination, as per exchange filing.

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:49 AM IST

HPCL, BPCL, IOCL gain as Citi remains bullish on OMCs; Mahanagar Gas also rises

HPCL, BPCL, IOCL gain as Citi remains bullish on OMCs; Mahanagar Gas also rises De-rating of BPCL, HPCL, IOC on the cards as dominance in petroleum pipelines gets challenged

De-rating of BPCL, HPCL, IOC on the cards as dominance in petroleum pipelines gets challenged BPCL Q4 Results: Consolidated PAT skyrockets 168.46%; declares a dividend of 40%

BPCL Q4 Results: Consolidated PAT skyrockets 168.46%; declares a dividend of 40% BPCL to invest Rs 1.4 lakh crore in petrochemicals, gas business in next 5 years

BPCL to invest Rs 1.4 lakh crore in petrochemicals, gas business in next 5 years Q1 results: IOC, HPCL, BPCL post Rs 18,480 cr loss in quarter 1 on holding petrol, diesel prices

Q1 results: IOC, HPCL, BPCL post Rs 18,480 cr loss in quarter 1 on holding petrol, diesel prices