Bank stocks in focus: Nifty Bank jumps 1% ahead of RBI policy decision tomorrow; CLSA gives Buy call on these counters

The Reserve Bank of India’s (RBI) monetary policy committee meeting is currently underway, and the central bank will come out its decision on Friday, September 30, 2022. The central bank so far has increased 140 basis points in the key rate since May.

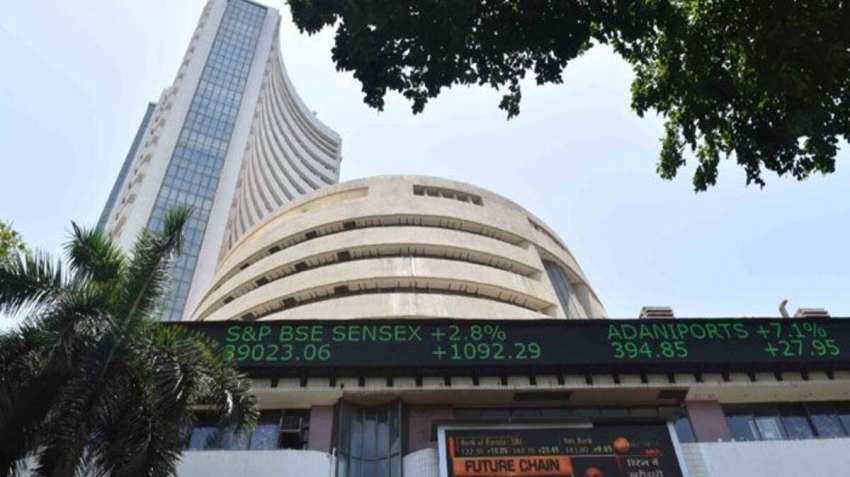

Bank stocks are on roll during Thursday’s session as the 12-share Nifty Bank jumped by over 1 per cent to 38,243 levels in the early morning trade. All stocks in Nifty Bank traded in the green, aiding most to the overall markets today.

Heavyweights such as IndusInd Bank, Axis Bank, and State Bank of India surged between 1-2 per cent, while Au Small Finance Bank, and Bank of Baroda were among the top gainers on Nifty Bank, jumping over 2 per cent each in the early morning trade today.

Stocks like Bandhan Bank, ICICI Bank, HDFC Bank, Kotak Bank, IDFC First Bank, PNB, and Federal Bank also gained between 0.5-2 per cent on the Nifty Bank index minutes after the market open today.

The Reserve Bank of India’s (RBI) monetary policy committee meeting is currently underway, and the central bank will come out its decision on Friday, September 30, 2022. The central bank so far has increased 140 basis points in the key rate since May.

Vinod Nair, Head of Research at Geojit Financial Services said that the RBI is again likely to raise repo rates by 35-50 basis points in the upcoming meeting. He, however, noted that the inflation outlook may soften in reaction to declining commodity prices.

While Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said that the MPC is likely to raise rates by 50 bps and may move to a neutral stance. But this is already discounted by the market and therefore will not have any market-moving impact, he added.

Global brokerage firm CLSA in its report on Banking stocks said, “Risk to earnings limited and the valuations are reasonable. The outlook is favourable from the Indian banking sector with benign asset quality and improving loan growth as well as margin.”

It added that the rising rates might impact growth from the high levels of currency and expects the margin to inch up by 10-20 basis points over 2-3 quarters as a risk to asset quality is low.

CLSA gives a Buy call on Axis Bank, ICICI Bank, SBI, BoB and PNB for target of Rs 1050, Rs 1010, Rs 680, Rs 145 and Rs 40 per share, respectively.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

01:28 PM IST

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Final Trade: Sensex closes flat; Nifty below 24,600; Bajaj Finance, Britannia gain 2%

Final Trade: Sensex closes flat; Nifty below 24,600; Bajaj Finance, Britannia gain 2%